Gemini’s Executive Shakeup: What It Means for the Crypto Exchange’s Future

Gemini, a prominent name in the cryptocurrency exchange landscape, has announced a significant restructuring of its leadership team, as detailed in a recent Form 8-K filing. The company revealed that Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen, and Chief Legal Officer Tyler Meade are set to depart effective February 17. This leadership reshuffle is not simply a routine managerial change; it signals a critical juncture for Gemini as it strives to regain investor confidence amid a challenging market landscape.

The announcement highlighted that Beard’s resignation from both his executive role and the board was not related to any disagreements regarding company operations or policies. In a strategic move, Gemini has decided not to directly replace the COO position. Instead, co-founder Cameron Winklevoss will absorb many responsibilities previously held by Beard, particularly those involving revenue generation. This shift suggests a commitment to streamline operations while attempting to harness Winklevoss’s vision for the company and maintain continuity during this uncertain period.

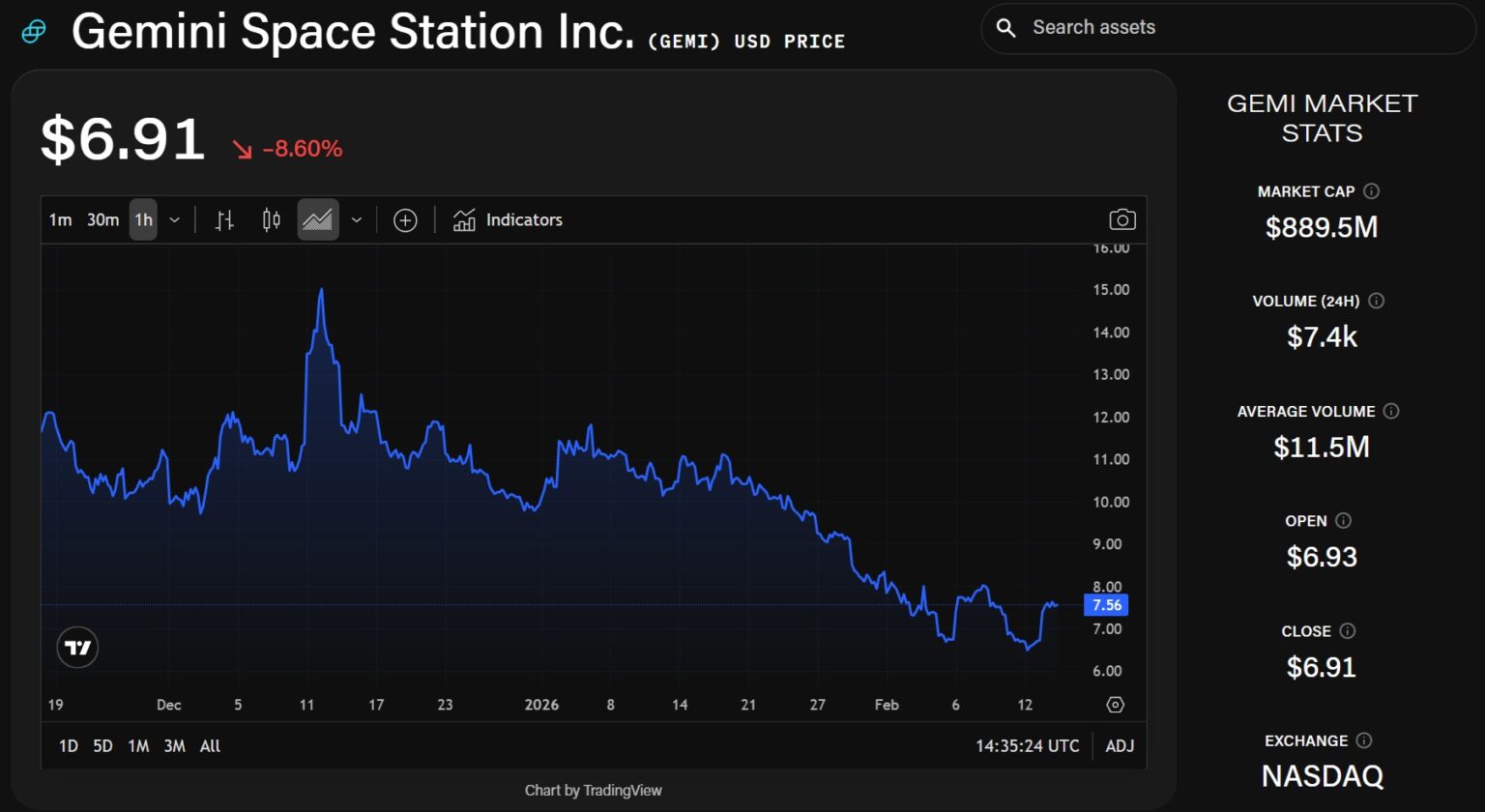

As part of the executive overhaul, Chief Accounting Officer Danijela Stojanovic has been appointed as the interim CFO, while Kate Freedman, serving as associate general counsel and corporate secretary, will take on the role of interim general counsel. ETF analyst James Seyffart characterized this transition as a “big shakeup” for Gemini, underscoring the potential impact of these changes on investor perception and market performance. Shortly after the announcement, Gemini Space Station’s stock (NASDAQ: GEMI) experienced a notable drop of nearly 9% in premarket trading, dropping to approximately $6.90.

Adding to the concerns of investors, the recent leadership changes coincide with a challenging financial landscape for Gemini. The exchange recently released preliminary unaudited results that, while indicating some growth in user engagement, also highlighted escalating losses driven by rising operational costs. Monthly transacting users saw an increase of about 17% year-over-year, totaling around 600,000. Yet, the anticipated net revenue is expected to rise only to between $165 million and $175 million, a modest increase from $141 million in 2024.

However, operational expenses are projected to skyrocket, potentially exceeding $530 million. This sharp increase in expenses is leading to an adjusted EBITDA loss in the vicinity of $260 million and net losses nearing $600 million for the year. The disparity between the positive growth metrics and the looming financial losses paints a complex picture of the company’s current standing and its strategies moving forward. The ramifications of these financial dynamics and leadership changes are likely to resonate across Gemini’s operations and influence its recovery trajectory as it endeavours to return to profitability.

While Gemini’s executive shakeup represents a bold move toward reimagining leadership, it also raises pressing questions regarding the company’s direction and viability in the increasingly competitive crypto exchange market. Market analysts and investors will be watching closely to see how the new leadership will navigate these turbulent waters and whether the company can successfully implement strategies that balance user growth with sustainable profitability.

In conclusion, Gemini’s recent leadership reshuffling sends ripples through the cryptocurrency industry, underlining the challenges many exchanges face. The dual focus on bolstering user growth amidst rising losses presents both risks and opportunities. Gemini’s ability to adapt to this rapidly changing landscape will be pivotal in determining its future success and restoring investor confidence in an uncertain financial climate. As the crypto market continues to evolve, how Gemini manages these transitions will undoubtedly shape its reputation and market standing in the years to come.