The Rise and Future of Digital Asset Treasury Firms: A Comprehensive Overview

Digital Asset Treasury (DAT) firms have emerged as a force in the venture capital landscape in 2025, amassing over $20 billion in funding this year alone. This shift has transformed the startup ecosystem, particularly within the crypto industry, where traditional fundraising has appeared subdued in comparison. The question arises: will DATs continue to lead fundraising efforts through 2025 and into 2026, and what does the future hold for this innovative category?

Current State of DAT Fundraising

As indicated by recent analyses, many investors believe the peak of DAT fundraising activities may have been reached. Experts predict a compressing of premiums as more prominent tokens are already covered. While new DAT launches are expected to continue into early next year, it’s anticipated that these rounds will garner smaller sums with only a select few demonstrating strong performance. As Cosmo Jiang, General Partner at Pantera Capital, suggests, we are transitioning into a phase focused on execution, scalability, and potentially consolidation.

Challenges Facing DATs

Despite their impressive growth, DATs face pressing concerns, particularly around Net Asset Value (NAV) compression. Many trading below their net asset value indicates a looming threat, as articulated by Ray Hindi, co-founder of L1D AG. Consolidation seems inevitable, with the stronger firms likely absorbing weaker ones. The structural dynamics suggest that if firms can leverage favorable acquisition ratios, they can enhance their asset values substantially. Michael Bucella from Neoclassic Capital highlights the necessity of liquidity in the tokens of these firms. If the underlying assets lack liquidity, efforts to bridge NAV gaps could ultimately cause destabilization.

The Liquidity Puzzle

Liquidity has emerged as a critical stress point for DAT firms, limiting their ability to raise equity through market offerings. Brian Rudick, Chief Strategy Officer at Upexi, emphasizes that firms can only issue a small percentage of their trading volume without negatively impacting their stock price. Nevertheless, there are alternative avenues to generate value, such as staking and acquiring locked tokens at discounted rates. Upexi’s strategy involves purchasing locked Solana at a discount, which not only helps manage NAV but also stabilizes yields over time.

Shifting Focus to Other Investment Avenues

As dynamics continue to evolve within the DAT landscape, the venture capital market appears to be gradually redirecting its focus toward various other domains, prominently decentralized finance (DeFi). According to Quynh Ho from GSR, anticipated rate cuts could reinvigorate demand for attractive DeFi yields, paving the way for more real-world asset (RWA) products. This shift indicates a more discerning approach among VCs, favoring applications that exhibit a clear product-market fit and substantial potential.

The Dominance of Bitcoin and Altcoins

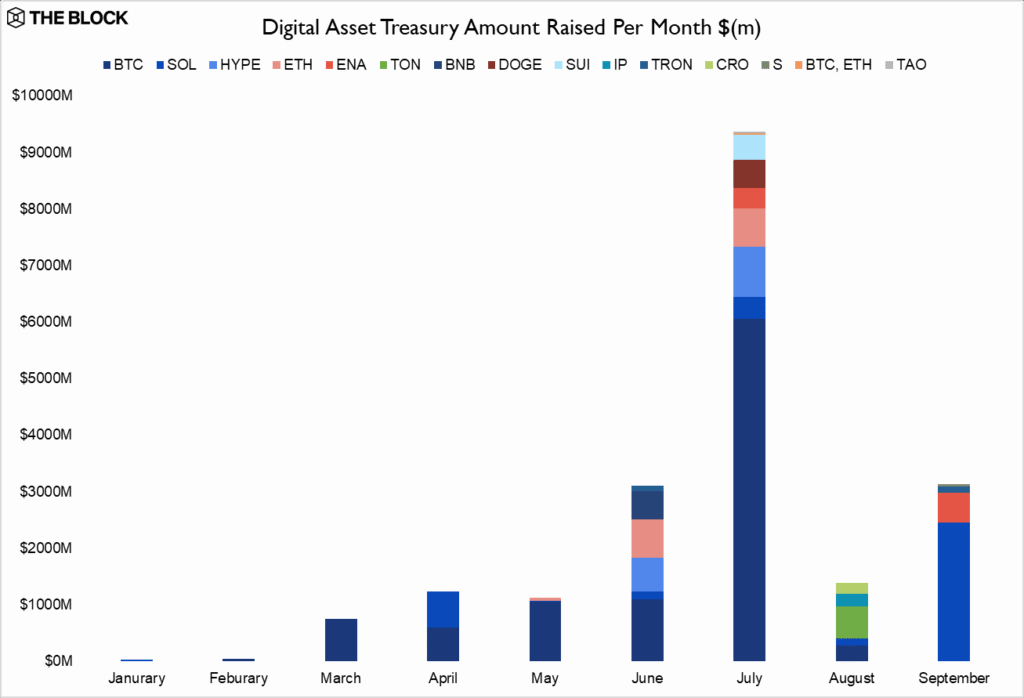

This year, Bitcoin has led the DAT funding totals, yet an increasing share is being allocated to diverse altcoins, including Solana, Ethereum, and others. Remarkably, July alone accounted for nearly half of the $20 billion raised, marking a significant surge in activity. Following a slow August, funding has bounced back in September, showcasing resilience in investor interest across the crypto spectrum.

Looking Ahead: The Road for DAT Firms

As the landscape of digital asset treasury firms continues to be shaped by fluctuating market dynamics, opportunities and challenges lie ahead. The emphasis will likely shift to strategies that prioritize execution and market adaptation. Analysts predict that while fundraising might stabilize, the consolidation of firms could lead to stronger, more resilient entities poised for future growth.

In conclusion, while digital asset treasury firms have made remarkable strides this year, navigating the complexities of the evolving crypto landscape will be crucial for sustained success. Investors and firms alike must adapt to changing dynamics to play a strategic role in the future of this burgeoning sector.