Bitcoin’s Volatility Decline: A New Era of Value and Corporate Interest

As of late 2023, analysts from JPMorgan have identified that Bitcoin’s current price lacks alignment with its intrinsic value, particularly in comparison to gold. According to their findings, Bitcoin’s volatility has dramatically decreased from nearly 60% at the start of the year to approximately 30%, marking historical lows for the cryptocurrency. This significant reduction has prompted experts to suggest that Bitcoin’s fair market value could be as high as $126,000, given the present dynamics in the market.

Factors Driving Bitcoin’s Valuation

The analysts from JPMorgan, including managing director Nikolaos Panigirtzoglou, have pointed to several factors contributing to this optimistic outlook. One of the primary drivers has been the marked increase in corporate treasury purchases, which have now made up over 6% of Bitcoin’s total supply. This trend resembles the effects of quantitative easing observed post-2008, where a significant acquisition of assets led to diminished variations in market performance. When corporations integrate Bitcoin into their asset reserves, it effectively stabilizes its price, reducing volatility further.

Corporate Competition and Treasury Strategies

A noteworthy surge in interest among corporate entities has been evident. Companies like Nasdaq-listed KindlyMD are positioning themselves to utilize Bitcoin as a reserve asset, eyeing to raise as much as $5 billion in investments. Furthermore, rivalries are emerging among various firms as Adam Back’s BSTR aims to dethrone Marathon Digital as the largest corporate holder of Bitcoin, just behind MicroStrategy. This escalated competition adds rigidity to Bitcoin’s bottom line, much like movements seen in traditional financial markets.

Impact of Index Inclusion

Adding to the momentum, Bitcoin’s increasing presence in global equity indices has been pivotal in attracting passive investments. The reallocation of assets in corporations like Strategy (formerly MicroStrategy) to major benchmarks has opened doors for new investment inflows. Additionally, the upgrade of Metaplanet to mid-cap status within FTSE Russell indices has seen it included in the FTSE All-World Index, further extending Bitcoin’s reach into mainstream markets. This positive exposure is leading to a growing consensus regarding Bitcoin’s stature as a legitimate financial asset.

Implications of Falling Volatility

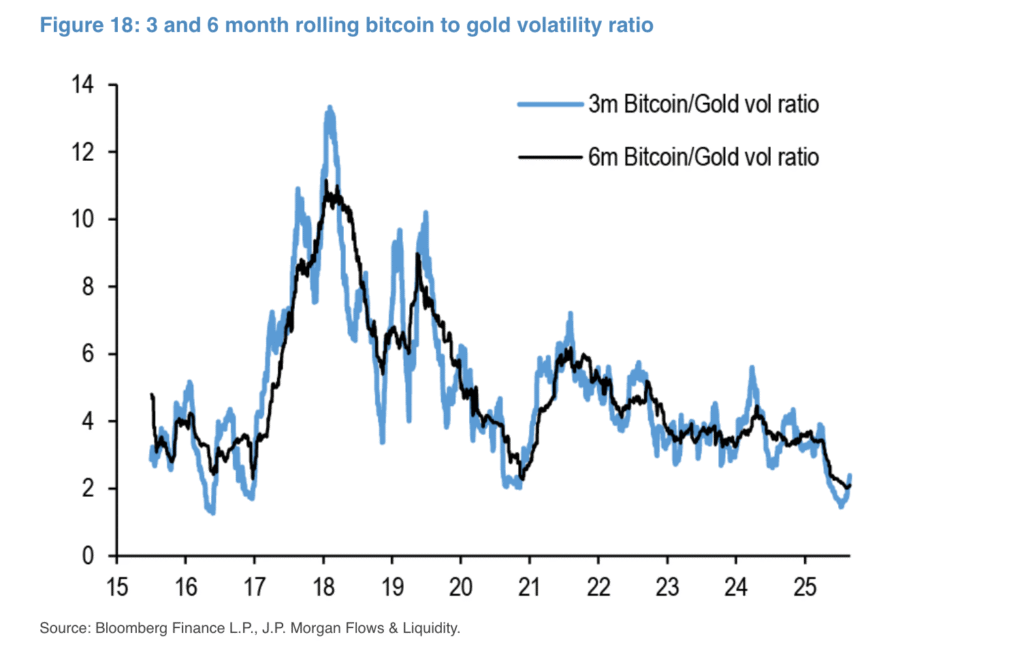

With Bitcoin’s volatility ratio relative to gold experiencing a historical dip to 2.0, the cryptocurrency now requires twice as much risk capital as gold in investment portfolios. This new metric indicates that institutional investors may find it more feasible to allocate funds to Bitcoin, especially given the prevailing economic climate. The shift indicates that Bitcoin’s risk-adjusted profiles are becoming increasingly competitive with gold, further justifying its place in portfolios traditionally dominated by precious metals.

The Potential for Price Growth

As Bitcoin’s market capitalization currently stands around $2.2 trillion, achieving a valuation that aligns more closely with gold—estimated to be around $5 trillion—would suggest a necessary price increase of approximately 13%. This brings Bitcoin’s theoretical price to the predicted $126,000. Analysts have observed significant shifts, noting a transition from a situation where Bitcoin was trading around $36,000 above this fair value at the end of 2024 to its current scenario where it is about $13,000 below. This sets the stage for possible upside potential in the near future.

Conclusion: A Bright Future for Bitcoin?

In summary, the current landscape suggests that Bitcoin is becoming a more viable investment alternative, especially in light of its recent decrease in volatility and the surge in corporate treasury interest. With institutional investors observing a narrowing gap in risk-adjusted terms relative to gold, the prospects for Bitcoin could be more promising than ever. The analyses predict that, given the right market conditions and continued corporate interest, Bitcoin’s price may realistically aim for that potentially lucrative $126,000 milestone by the year’s end. With these developments, Bitcoin appears poised to solidify its position as a fundamental asset in the modern investment landscape, transcending its previous limitations as a speculative vehicle.