Bitcoin Treasury Strategy: A Closer Look at MicroStrategy’s Recent Moves

Introduction to Bitcoin Acquisitions by MicroStrategy

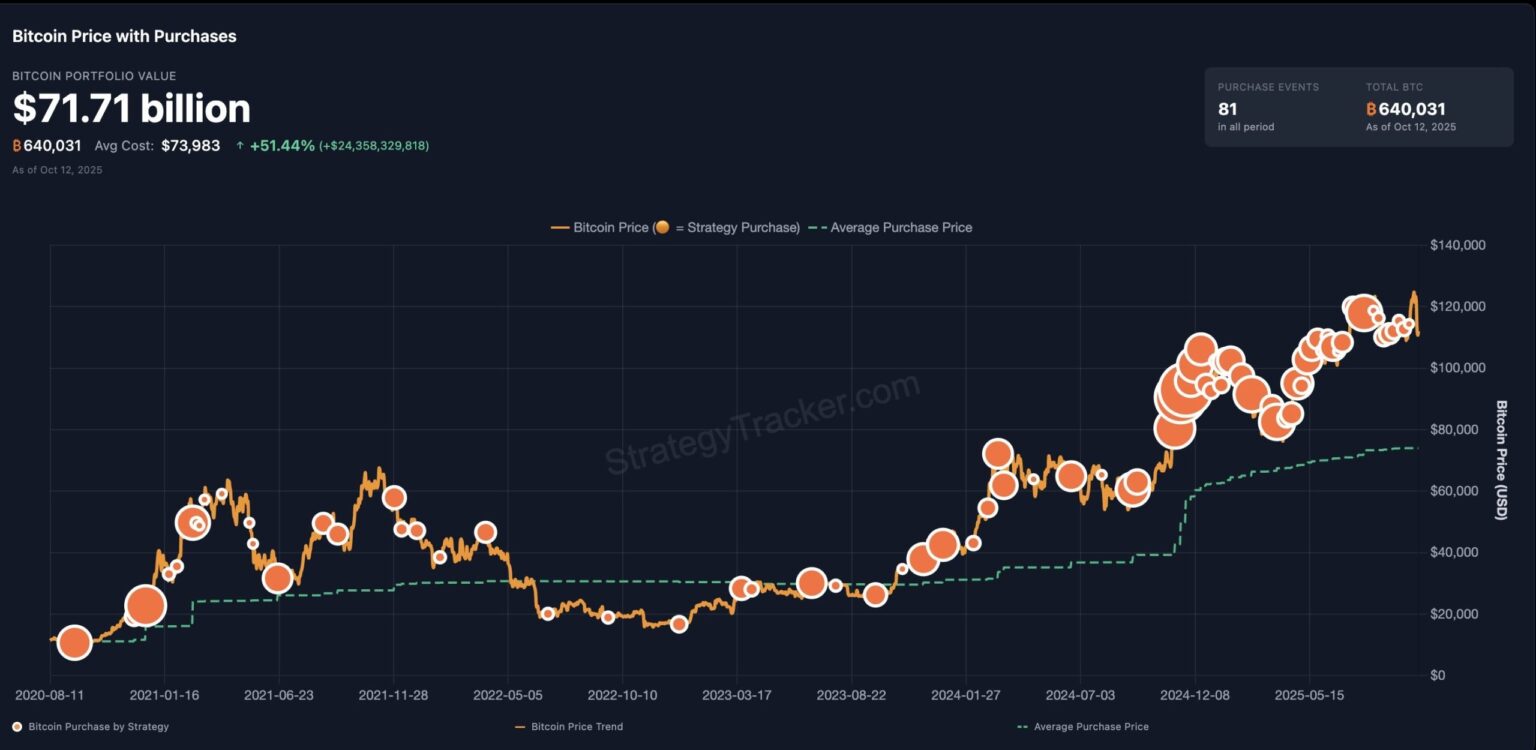

In a significant move reflecting its bullish sentiment on Bitcoin, MicroStrategy, now known as Bitcoin Treasury Strategy, recently acquired an additional 220 BTC for approximately $27.2 million. This acquisition, which took place between October 6 and October 12, underscores the company’s unwavering commitment to Bitcoin as a primary reserve asset. Co-founder and Executive Chairman Michael Saylor revealed that the firm now holds a staggering total of 640,250 BTC, valued at roughly $73 billion. With an average purchase price of $74,000 per Bitcoin, this translates to a total investment of approximately $47.4 billion, inclusive of fees and expenses.

Reinforcing Bitcoin Holdings and Financial Strategy

Bitcoin Treasury Strategy’s latest acquisition amounts to more than 3% of Bitcoin’s capped supply of 21 million coins, highlighting its substantial market presence. Notably, the firm’s paper gains are estimated at around $25.6 billion based on current market prices. These recent purchases were financed through the company’s innovative at-the-market (ATM) sales of various perpetual preferred stocks: STRK, STRF, STRD, and STRC. Each stock variant bears a different risk-reward profile, providing flexible avenues for acquiring Bitcoin while appealing to diverse investor appetites.

The "42/42" Capital Raise Initiative

Bitcoin Treasury Strategy’s growth is also propelled by its ambitious "42/42" capital raise initiative. This enhanced strategy aims to collect $84 billion through equity offerings and convertible notes specifically for Bitcoin acquisitions by 2027. This plan marks an upsizing from its initial "21/21" campaign as the equity side was rapidly consumed. The offerings range from non-convertible stocks with significant dividends to more flexible variable-rate options, providing the company with the liquidity necessary for its aggressive accumulation of Bitcoin.

Public Adoption of Bitcoin Holdings by Companies

The landscape of corporate Bitcoin adoption is expanding exponentially, with 188 public companies now utilizing Bitcoin acquisition models. Among the leading firms, notable players include Marathon Digital, Tether-backed Twenty One, and Riot Platforms. The collective Bitcoin holdings of these companies reflect a growing trend toward integrating cryptocurrency into institutional portfolios, thereby reducing reliance on traditional fiat systems.

Quarterly Financial Health and Unrealized Gains

According to Bitcoin Treasuries data, Bitcoin Treasury Strategy reported an unrealized gain of $3.89 billion for the quarter ending September 30. Although the company is required to account for a deferred tax expense of $1.12 billion, its total digital asset carrying value stands at an impressive $73.21 billion. This robust financial position reinforces the company’s strategic advantage in an increasingly volatile crypto market. However, normal market fluctuations were evident, as seen when the firm paused its weekly acquisitions at the end of the quarter, maintaining its holdings at 640,031 BTC.

Market Environment and Challenges Ahead

Despite the impressive gains, market volatility continues to challenge Bitcoin’s stability. The broader cryptocurrency sector recently witnessed a tumultuous period, seeing over $20 billion wiped from positions amid cascading liquidations, marking a historic fallout. This turbulence was partly attributed to traders using less liquid altcoins as collateral for over-leveraged positions, illustrating the intricacies of market risk management. As such, Bitcoin Treasury Strategy remains vigilant, adapting its strategies to not only weather the storm but also seize opportunities for continued growth in the digital asset space.

In summary, Bitcoin Treasury Strategy’s acquisitions and strategic initiatives underscore its long-term vision for Bitcoin as a foundational asset. As more public entities ally with Bitcoin, the potential for wider mainstream acceptance grows, fostering a more resilient financial ecosystem. The path ahead may be fraught with challenges, but the commitment to Bitcoin positions Bitcoin Treasury Strategy favorably within the evolving landscape of digital finance.