Declining Crypto Ownership in the UK: Insights from Recent Research

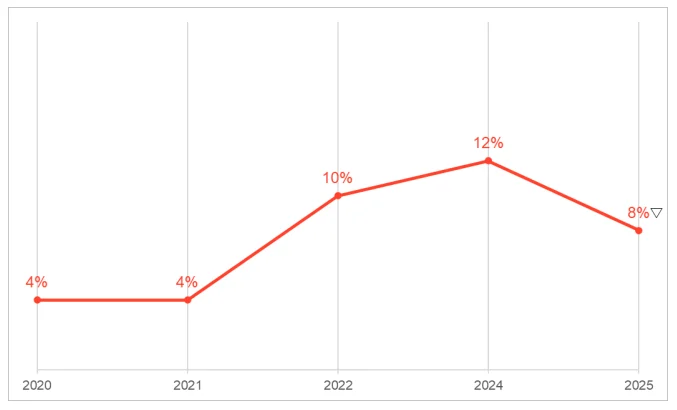

The cryptocurrency landscape in the UK has witnessed a notable shift, with a recent YouGov survey conducted for the Financial Conduct Authority revealing a decline in the proportion of adults owning crypto assets. As of 2025, only 8% of UK adults are reported to have crypto holdings, a decrease from 12% in 2024. This downturn indicates a pullback from the peak ownership levels observed in previous years, but it’s important to note that this figure remains approximately double what was recorded in 2021. Despite this decline, public awareness of cryptocurrencies continues to be robust, with 91% of respondents indicating familiarity with the concept.

Trends in Crypto Ownership Values

While the overall number of crypto holders has declined, the value of the assets held by investors has actually seen an upsurge. The recent findings show a significant drop in the proportion of individuals maintaining small holdings of £100 ($134) or less, in contrast to an increased ownership of more substantial portfolios. Specifically, the share of users holding crypto assets worth between £1,001 ($1,314) and £5,000 ($6,714) escalated by four percentage points to 21%, while those with holdings in the range of £5,001 ($6,715) to £10,000 ($14,430) rose by three percentage points to 11%. This shift underscores a growing trend towards investing greater amounts among the remaining crypto holders in the UK.

The Dominance of Centralized Exchanges

The research highlights that centralized exchanges remain the primary gateway for individuals looking to acquire cryptocurrency. Approximately 73% of respondents reported using popular platforms such as Coinbase, Binance, or Kraken to purchase their digital assets, marking an increase of four percentage points since 2024. Following these exchanges, 15% of respondents indicated using payment firms that offer crypto services. The main factors influencing their choice of exchange included ease of use, reputation, and safety and security, illustrating that investors prioritize reliability and convenience in their trading behaviors.

Risk Tolerance and Investment Behavior

The study further delineated a stark contrast in the risk tolerance levels between crypto holders and the wider public. Around 63% of crypto users expressed their willingness to undertake higher risks for potentially higher returns, in comparison to only 24% of those aware of cryptocurrencies but without holdings. Despite this evident risk appetite, the public’s engagement in activities like crypto lending and borrowing has remained largely stagnant, similar to the previous year. Additionally, participation in crypto staking has seen a decline, with only 22% of holders indicating involvement, down five points from 2024. Notably, reliance on credit for purchasing crypto assets has also decreased, from 14% in 2024 to just 9% in 2025.

Perspectives on Regulation

Responses regarding the regulation of cryptocurrencies revealed mixed feelings among users. A quarter of crypto holders expressed increased willingness to invest should more regulation be enacted in the UK. Meanwhile, an additional 26% stated that regulatory measures would only prompt their investment if they included financial protection against potential platform failures. In contrast, 11% felt that increased regulation would deter them from investing, and 25% remained indifferent to regulatory changes. This ambiguity indicates a nuanced understanding of the implications regulation may have on market dynamics and personal investment strategies.

The Future of Crypto Regulation in the UK

As the UK government progresses towards implementing new crypto regulations, these findings come at a pivotal moment for the industry. Recently, the government introduced legislation aimed at establishing a structured regulatory framework, which would place cryptocurrencies under the existing financial regulatory umbrella. The proposed framework would empower HM Treasury to set overarching regulatory guidelines, overseen by both the Financial Conduct Authority and the Bank of England. In line with this, the FCA is consulting on rules surrounding various aspects of the crypto market, including admissions, platform disclosures, and decentralized finance activities, with final regulations anticipated by 2026.

As the landscape continues to evolve, the overarching goal remains clear: to foster innovation while simultaneously enhancing consumer protection and maintaining market integrity. The transition towards effective regulation is expected to commence by 2027, aiming to create a more secure environment for crypto investments in the UK. The research findings could serve as useful indicators for policymakers working to strike the right balance between innovation and accountability in this fast-paced financial sector.

In conclusion, while UK crypto ownership may have dipped, the increasing value of assets held presents a complex picture of an evolving market. As the regulatory environment develops, stakeholders will closely monitor these trends, particularly regarding the intersection of user behavior, risk appetite, and the overall public perception of digital currencies.