BlackRock’s IBIT Bitcoin ETF: Pioneering Investment in Digital Assets

BlackRock’s IBIT spot Bitcoin exchange-traded fund (ETF) recently surpassed 800,000 BTC, representing approximately $97 billion in assets under management. This remarkable achievement has occurred in less than two years since the fund began trading in January 2024. The ETF has gained significant traction among investors, accumulating over 798,000 BTC as of October 7, according to the latest fund disclosures. The recent inflow of $426.2 million, equivalent to around 3,510 BTC, was pivotal in pushing the total above the 800,000 BTC milestone—about 3.8% of Bitcoin’s total supply.

The scale of BlackRock’s investments is particularly striking when compared to leading Bitcoin treasury firms. For instance, Michael Saylor’s Strategy, a prominent Bitcoin holding entity, owns 640,031 BTC, translating to roughly $78 billion, which comprises 3.1% of Bitcoin’s overall supply. This indicates that BlackRock’s holdings for its clients far exceed those of any single Bitcoin treasury, establishing the IBIT as a leading choice for institutional investors eager to capitalize on the digital currency’s potential.

Growing Demand for Bitcoin ETFs

The enthusiasm for Bitcoin ETFs is palpable, with all U.S. spot Bitcoin ETFs collectively attracting $440.7 million on the same day IBIT crossed the significant milestone. This surge contributes to an impressive eight-day inflow tally exceeding $5.7 billion, highlighting a growing appetite for Bitcoin investments among institutional and retail investors alike. Notably, IBIT itself has brought in a staggering $4.1 billion worth of net inflows in just a week, showcasing the strong demand and investor confidence in Bitcoin as a strategic asset.

Timothy Misir, Head of Research at BRN, remarked on the enduring structural demand for Bitcoin, echoing sentiments about corporate treasury participation enhancing Bitcoin’s narrative as a strategic reserve asset. This ongoing momentum can be partly attributed to diminished geopolitical risks, which have led to reduced market volatility, making the current trading environment more appealing for entering the fourth quarter of the year.

Investor Sentiment and ETF Performance

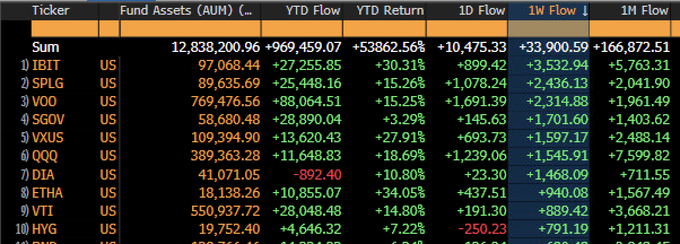

IBIT has captured the title of the #1 ETF in weekly flows, drawing in an impressive $3.5 billion, making up 10% of all net ETF flows. Bloomberg Senior ETF Analyst Eric Balchunas pointed out the intensified interest in Bitcoin ETFs, noting that all 11 original spot Bitcoin ETFs experienced cash inflows recently, underscoring the substantial interest among investors. This wave of inflows can be viewed as a bullish signal for Bitcoin and its future in the market.

In a remarkable turn of events, Monday marked the largest daily inflow for Bitcoin ETFs since a pro-crypto candidate won the U.S. presidential election last November. The U.S. spot Bitcoin ETFs have now recorded nearly $63 billion in inflows since their inception, with BlackRock’s IBIT alone boasting $65 billion. This robust performance is further bolstered by net outflows from Grayscale’s converted fund, which have offset the total inflow figures.

Market Trends and Projections

As the demand for Bitcoin ETFs continues to rise, market experts have noted that recent flows into Bitcoin ETFs are at an all-time high. NovaDius Wealth Management President Nate Geraci emphasized the astonishing $5.3 billion inflow over just seven trading days, with $2 billion coming in the last two days alone. This momentum showcases the market’s evolution, surprising many who previously doubted that the ETF category could reach similar heights.

Furthermore, BlackRock’s IBIT crossed the 500,000 BTC threshold last December, affirming its position as a formidable contender in the ETF market. not just in terms of Bitcoin investments but also in general trading dynamics. BlackRock’s CEO, Larry Fink, previously remarked on the fund’s rapid growth rate after IBIT surpassed the 250,000 BTC mark in March 2024, calling it the fastest-growing ETF in the history of the asset class. This assertion underscores the striking rise in Bitcoin’s valuation, which at one point stood at around $69,000 and has since risen markedly to approximately $121,500 per Bitcoin.

Conclusion: The Future of Bitcoin and ETFs

The trajectory of BlackRock’s IBIT is not just reshaping the ETF landscape but also the broader narrative surrounding Bitcoin as a legitimate investment vehicle. As institutional participation expands, the notion of Bitcoin as a strategic reserve asset becomes more firmly entrenched. The current market dynamics indicate that investors are increasingly viewing Bitcoin not just as a speculative asset but as an essential component of a diversified investment portfolio.

In summary, BlackRock’s pioneering efforts with its IBIT Bitcoin ETF exemplify the growing institutional interest in digital assets. As trends continue to evolve, these ETFs represent a significant shift in how both retail and institutional investors approach Bitcoin, suggesting a promising future for the asset class. The convergence of assets into Bitcoin ETFs opens new avenues for growth and strengthens Bitcoin’s position in the financial landscape, reinforcing its status as a key strategically important asset in the modern investment ecosystem.