Bitcoin Miners Find New Opportunities in the AI Infrastructure Boom

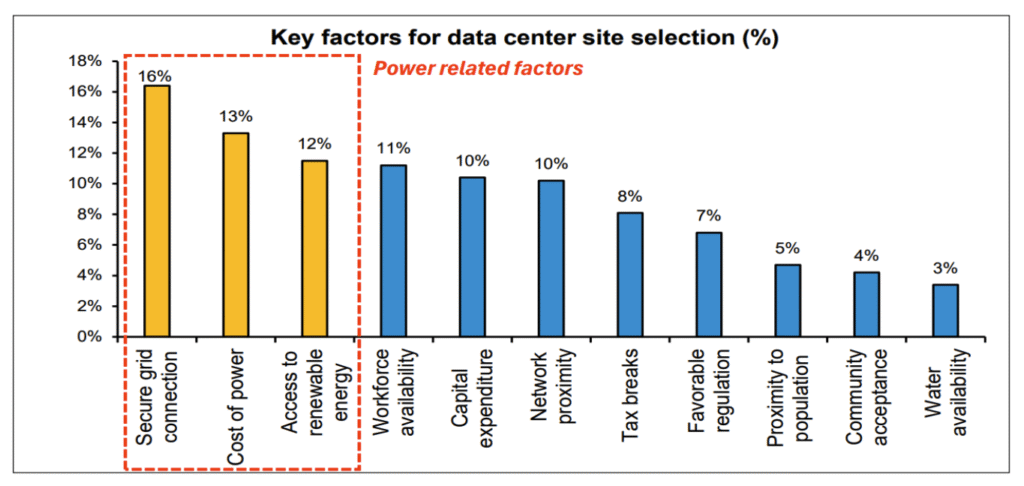

As artificial intelligence (AI) continues to reshape various sectors, bitcoin miners have emerged as unlikely beneficiaries of this transformation. According to analysts at Bernstein, these miners possess valuable assets—specifically pre-secured, high-density power capacity—that make them crucial allies for AI cloud providers. In a recent report, analysts led by Gautam Chhugani emphasized that bitcoin miners’ access to significant grid-connected power places them ahead of traditional data center developers, particularly in a landscape where the demand for energy is rapidly increasing, and interconnection delays are common.

The study highlighted that bitcoin miners have secured access to over 14 gigawatts of grid-connected power, much of which utilizes surplus renewable energy. This ready-made infrastructure can shorten deployment timelines for AI data centers by as much as 75%. By contrast, new developers often find themselves tangled in extensive interconnection queues, making the pre-established capabilities of miners highly attractive. "Access to the grid has become a very scarce resource in the U.S.," the analysts noted, underscoring the strategic advantage that miners have cultivated through early infrastructure investments.

Among the multitude of bitcoin miners, Iren North America (IREN) stands out as a leading player. This miner controls around 3 gigawatts of operational and developmental power capacity across North America. Analysts have identified IREN as their top pick, rating the stock as "outperform" with a raised price target of $75. With over 23,300 GPUs, including advanced NVIDIA Blackwell models, IREN aims to surpass an annualized revenue run-rate of $500 million in AI cloud operations by Q1 2026. Its future-focused projects, including a 50-megawatt liquid-cooled data center and a 2-gigawatt hub in Texas, are also integral to capitalizing on the AI infrastructure boom.

IREN’s stock has seen remarkable growth recently, climbing 123% in a month and up 519% year-to-date. Following Bernstein’s price target revision in September, the stock has increased more than 50%, approaching the revised target. Despite its rapid expansion into AI, IREN remains one of the largest self-operated bitcoin miners in the U.S., generating around $1.1 billion in annualized revenue and approximately $650 million in EBITDA based on current bitcoin prices. This stable cash-generating mining operation provides essential funding for the company’s AI-focused initiatives.

Bernstein forecasts a striking increase in IREN’s overall revenue, predicting an escalation from $286 million in 2024 to an astounding $2.1 billion by 2027. They expect that IREN’s AI cloud segment will contribute more than half of that figure, showcasing a potential boom in profit margins, projected to reach around 83% EBITDA. The shift from bitcoin mining towards AI infrastructure represents a broader transition where miners can bridge two contrasting compute economies—volatile bitcoin mining and stable AI cloud hosting. By 2027, Bernstein estimates that a staggering 87% of IREN’s enterprise value will arise from its AI and power resources, leaving just 13% attributable to its bitcoin mining operations.

One of the primary reasons behind bitcoin miners’ ability to pivot towards AI is their early investment in secured power infrastructure during 2019–2021. By establishing systems designed for compute-intensive operations, miners can now offer scalable power solutions that are particularly advantageous in an industry that is quickly evolving. As the AI sector becomes increasingly reliant on robust data center capacity, bitcoin miners can leverage their existing resources and strategic foresight to meet this burgeoning demand effectively.

In summary, bitcoin miners, and IREN in particular, are harnessing an unexpected opportunity amidst the rise of AI infrastructure. Their early investments in power capacity not only provide them with a competitive edge in the energy-scarce U.S. landscape but position them as essential partners for AI cloud providers. As they continue to bridge the gap between the rapidly evolving AI and traditional cryptocurrency markets, bitcoin miners stand to redefine their roles in the tech landscape, heralding a new phase of development that merges both industries.