The Evolving Landscape of Cryptocurrency Liquidity: Insights from Wintermute’s 2025 Report

In 2025, the dynamics of the cryptocurrency market took a significant turn as outlined in a report from market maker Wintermute. The firm highlighted that liquidity, which had previously been dispersed across a broader range of altcoins, sharply concentrated into Bitcoin (BTC), Ethereum (ETH), and a select few large-cap tokens. This shift indicates a departure from traditional market behavior and influences how capital flows throughout the crypto ecosystem.

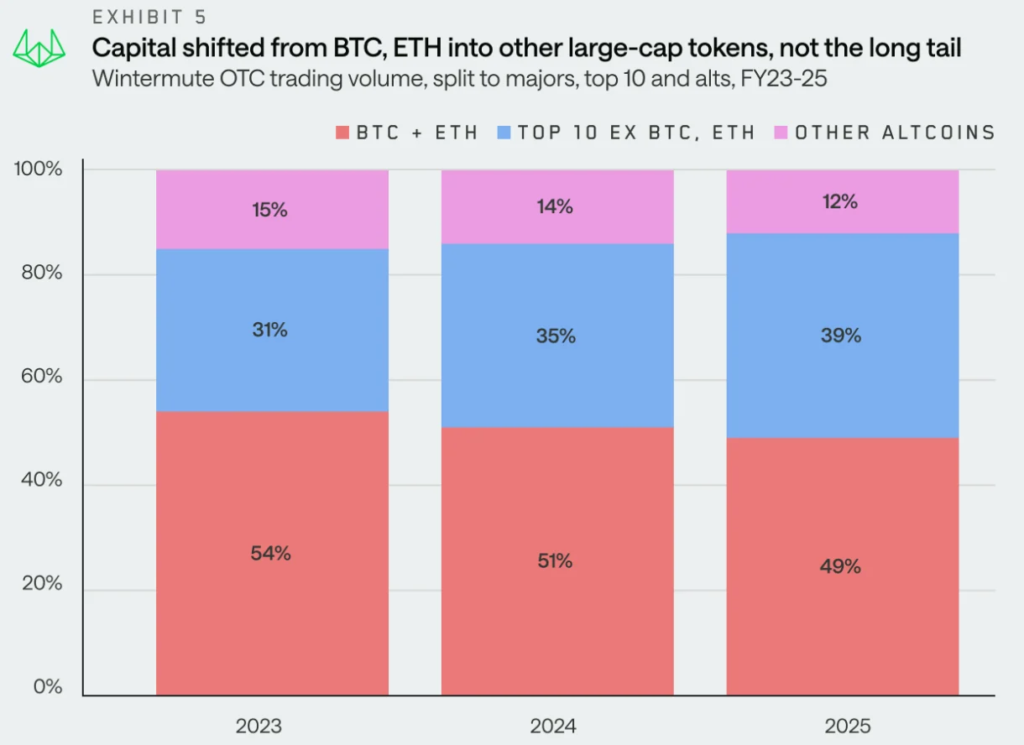

Concentration of Liquidity in Major Tokens

According to Wintermute’s analysis, the ongoing concentration of liquidity in major cryptocurrencies is a fundamental shift in the market’s architecture. Historical patterns observed in prior cycles, where capital was allocated across various digital assets, have become obsolete. Instead, we’re witnessing a new paradigm where significant amounts of liquidity are confined to a handful of leading tokens. The report emphasizes that exchange-traded funds (ETFs) and digital asset treasury companies have played influential roles by directing capital flow primarily into these major assets. As a result, the dynamics governing trading activity in 2025 have become increasingly focused on larger, well-established cryptocurrencies.

Shortened Rally Durations for Altcoins

One of the most notable consequences of this liquidity concentration is the abbreviated nature of altcoin rallies. The report found that the median rally duration for altcoins has significantly decreased from 61 days in 2024 to just 19 days in 2025. This drastic reduction in timeframes not only reflects heightened volatility but also indicates that market interest has narrowed primarily to major cryptos. Furthermore, earlier observed cycles, such as the memecoin phenomenon, have diminished, leading to a lack of sustained rallies for less prominent tokens. Such shifts point to a market environment where opportunities for quick gains may exist, but their viability is quickly undermined by the absence of long-term support.

Tactical Positioning and Evolution of Trading Strategies

The report also unearthed changes in how institutional investors are navigating the crypto markets. Wintermute’s analysis revealed that large counterparties are displaying less directional conviction, leaning instead towards more tactical trading approaches influenced by market headlines. Unlike previous cycles known for pronounced seasonal trading patterns, 2025 has observed a decline in such trends, suggesting that sophisticated investment strategies are replacing simpler methods. The increasing deliberation in executions indicates an evolving mindset among institutional participants, underlining the necessity to adapt to rapidly changing market conditions.

Maturation of Derivatives and Trading Mechanisms

In terms of derivatives, Wintermute noted a marked evolution in trading mechanisms. Specifically, off-exchange structures are gaining traction, as institutions are increasingly turning to Contracts for Difference (CFDs) as a capital-efficient means of exposure to various underlying assets. Additionally, options trading has matured substantially, moving beyond the previously dominant directional strategies to embrace more systematic and yield-generating approaches. This maturation speaks to a broader understanding of risk management and portfolio diversification within a sector historically characterized by speculative trading.

The Importance of Liquidity Pathways

The critical finding from Wintermute’s report is that liquidity pathways are becoming just as vital as overall market sentiment. The capital moving through structured channels—such as ETFs and digital asset treasury companies—shapes the viability of trading across different assets. Consequently, while major cryptocurrencies benefit from sustained liquidity, smaller tokens often struggle to attract attention and investment. This bifurcation creates a market environment that is increasingly range-bound, with significant implications for long-term asset performance.

Future Outlook: Possibilities for Market Expansion in 2026

Looking ahead to 2026, Wintermute projects that the trends observed in 2025 could mark the transition towards a fundamentally different market structure. For a reversal of this pronounced concentration in major assets to occur, several conditions must be met. Corporate buyers, particularly those operating through ETFs and treasury companies, would need to broaden their investment mandates to include a wider array of assets. Furthermore, substantial performance upgrades in major tokens might trigger capital rotation across the broader cryptocurrency market. Lastly, a revival of retail interest could play a critical role in introducing new capital and stimulating demand, although Wintermute’s report expresses skepticism about the likelihood of such a scenario materializing.

In conclusion, as the cryptocurrency landscape continues to evolve, the concentration of liquidity into fewer assets will significantly shape market dynamics. Stakeholders will need to adapt to these new realities to navigate the unique challenges and opportunities presented by an increasingly selective liquidity environment.

These insights illuminate the challenges faced by smaller altcoins and emphasize the importance of institutional players in shaping crypto market dynamics. Understanding these trends is crucial for anyone looking to invest in or navigate the ever-changing landscape of cryptocurrencies.