Wintermute Expands into Tokenized Commodities: A New Era for Gold Trading

The crypto landscape is evolving, with significant developments occurring even amidst a broader downturn in the cryptocurrency market. Recently, crypto market maker Wintermute announced its ambitious plans to venture into tokenized commodities. By launching an institutional over-the-counter (OTC) trading desk for gold-backed digital tokens, Wintermute aims to capitalize on the rising demand for decentralized and robust trading solutions. This move is particularly timely, as trading volumes for tokenized gold have recently outpaced traditional gold ETFs, signaling a significant shift in the investment landscape.

A Shift to Gold-Backed Digital Tokens

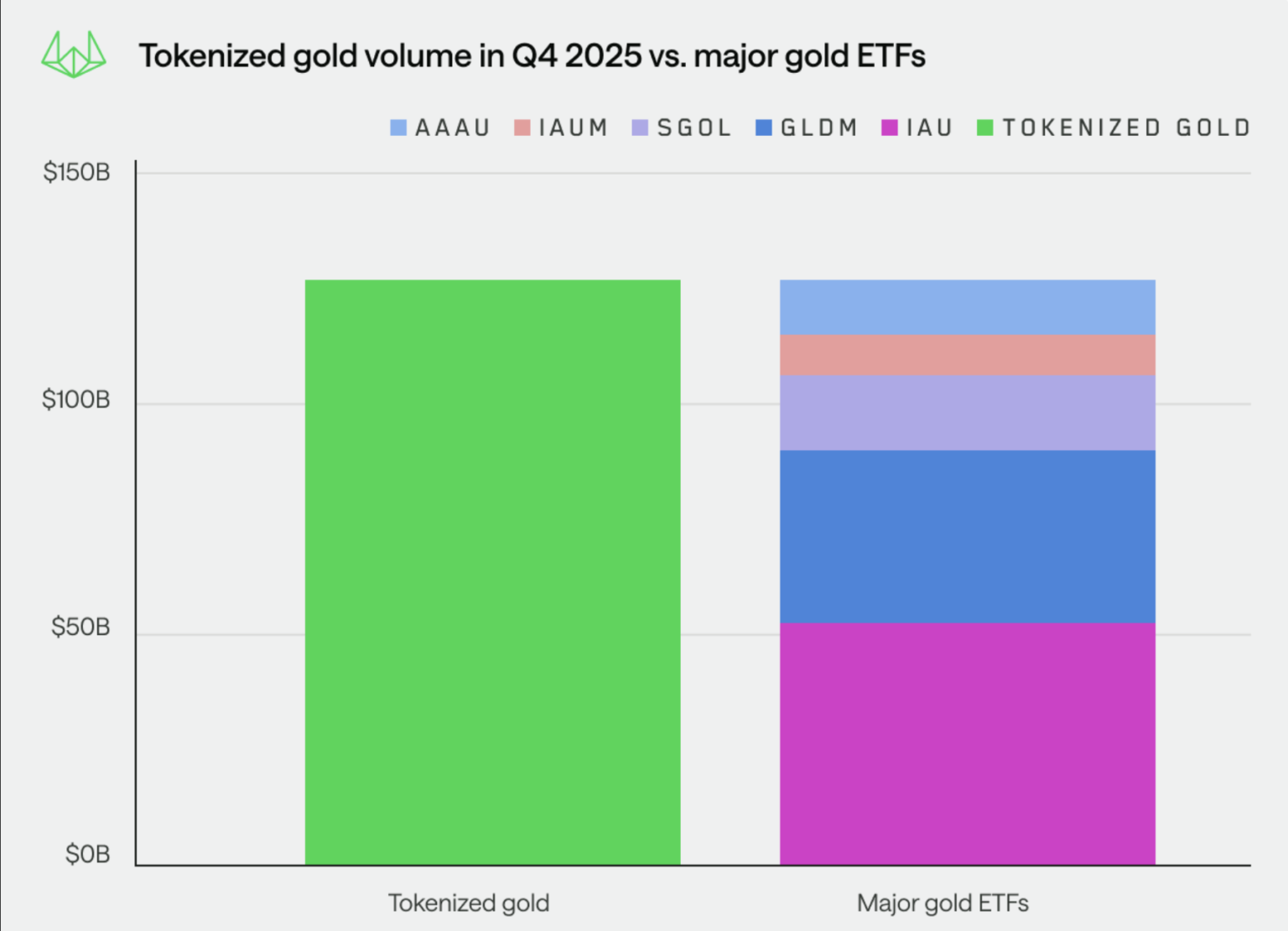

On Monday, Wintermute unveiled its OTC desk’s new offerings, which will include trading in the two leading gold-backed tokens: Pax Gold (PAXG) and Tether Gold (XAUT). This strategic expansion caters to institutional investors looking for exposure to gold via blockchain-based settlements. The momentum for tokenized gold is evident, with trading volumes reaching $126 billion in the fourth quarter of 2025, surpassing that of five major gold ETFs for the first time. This trend underscores a growing preference for the advantages that tokenization brings, such as enhanced liquidity and instant settlement capabilities.

Furthermore, on-chain gold’s market capitalization has surged by over 80% within just three months, climbing from $2.99 billion to $5.4 billion. With these developments, it’s clear that investors are increasingly gravitating towards digital gold options, prioritizing flexibility and 24/7 trading over conventional gold storage or ETF mechanisms.

The Evolution of Gold Trading Infrastructure

Evgeny Gaevoy, CEO of Wintermute, emphasizes that gold is following a similar transformational path as foreign exchange did in the past. He posits that the tokenized gold market could reach an impressive $15 billion by 2026, driven by accelerated institutional adoption. Tokenized gold assets, which represent fractionalized ownership of physical gold reserves, allow traders to engage with the commodity around the clock without the constraints of traditional market hours. Unlike ETFs, which rely on outdated settlement processes, tokenized assets leverage blockchain technology for immediate on-chain settlement, paving the way for novel applications within decentralized finance (DeFi).

With Wintermute’s new trading desk, institutions will have the flexibility to trade PAXG and XAUT against popular cryptocurrencies like USDT and USDC, as well as fiat currencies. This real-time capability enables effective hedging and collateral mobility, making it an attractive option for investors, especially as gold prices hover near all-time highs amid ongoing macroeconomic uncertainty.

Tokenized Real-World Assets on the Rise

The surge in tokenized gold is just one component of a broader movement toward the tokenization of real-world assets (RWAs). A recent report from ARK Invest suggests that tokenized assets could surpass $11 trillion by 2030, while Standard Chartered projects that tokenized RWAs could reach $2 trillion by 2028. Notably, analysts at BlackRock have described tokenization as a structural evolution for capital markets, signifying a paradigm shift in how assets are traded and exchanged.

In fact, data reveals that tokenized public-market RWAs tripled in 2025, reaching approximately $16.7 billion. With analysts predicting on-chain RWA trading volumes could one day reach a trillion-dollar scale, the importance of integrating real-world assets with blockchain technology cannot be overstated.

Advantages of Tokenized Gold

Tokenized gold offers several distinct advantages compared to traditional gold investment vehicles. The primary benefits include increased liquidity, reduced transaction costs, and enhanced trading flexibility. Investors can easily buy or sell gold-backed tokens without dealing with physical storage issues, transport risks, or the complexities associated with traditional gold ETFs. Moreover, the ability to use these tokens as collateral in DeFi platforms further enhances their utility, opening new avenues for investors to leverage their holdings.

Wintermute’s OTC desk is expected to play a critical role in supporting this growing interest. By providing algorithmically optimized spot trading for institutional clients, Wintermute aims to facilitate seamless entry into the tokenized gold space. As demand for gold-backed digital assets surges, Wintermute is positioning itself as a leader in facilitating access to this burgeoning market.

Looking Forward: The Future of Tokenized Assets

As we gaze into the future of the crypto and asset trading landscape, tokenization emerges as a pivotal driver of change. The increasing institutional interest in tokenized commodities, specifically gold, is reflective of a broader recognition of the benefits that blockchain technology offers. With Wintermute’s latest expansion into tokenized gold trading, we can expect significant milestones in the sector that could redefine trading standards and practices.

As institutions become more acquainted with and begin to adopt these technologies, it’s likely that the market for tokenized RWAs will expand exponentially, fostering a new era of capital market operations. The forecast for tokenized assets highlights a promising trajectory for innovation, creating unique opportunities for investors and reshaping how we perceive value in the modern economy.

In conclusion, Wintermute’s entry into the tokenized commodities space signals a key moment for both the crypto and gold markets. By bridging the gap between traditional commodities and blockchain technology, Wintermute is set to drive change that not only enhances liquidity and trading efficiency but also elevates the status of tokenized assets in the eyes of investors. The future looks bright for this intersection of technology, finance, and commodity trading.