Strategy’s Bold Bitcoin Acquisition: Insights and Implications

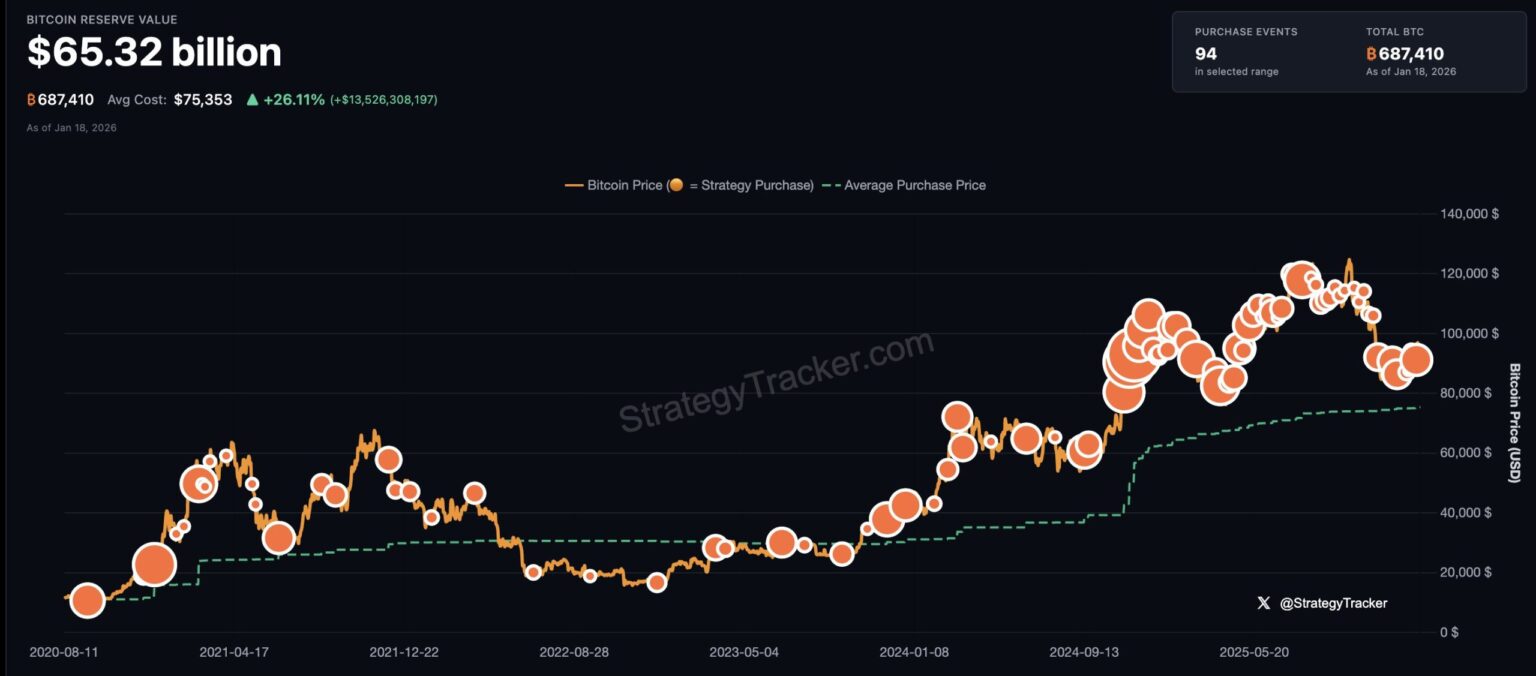

In a significant move that underscores its commitment to Bitcoin, the treasury company Strategy has acquired an additional 22,205 BTC for approximately $2.13 billion from January 2 to January 19. This acquisition was disclosed through an 8-K filing with the Securities and Exchange Commission (SEC). With this recent purchase, Strategy now holds a staggering total of 709,715 BTC, valued around $64.5 billion, purchased at an average price that remains undisclosed. This represents a remarkable 3% of Bitcoin’s capped supply of 21 million and reflects an impressive $10.6 billion in paper gains based on current market valuations.

Strategy has effectively leveraged proceeds from its Class A common stock, along with various preferred stock programs, to fund these acquisitions. Notably, their perpetual preferred stock programs—specifically STRK, STRC, STRF, and STRD—contribute to a broader financial strategy that aims to raise a total of $84 billion in capital through equity offerings and convertible notes aimed predominantly at Bitcoin acquisitions by 2027. This ambitious venture was an expansion from an earlier target of $42 billion, and indicates the firm’s compatibility with the ongoing fluctuations and opportunities within cryptocurrency markets.

The preferred stock offerings are designed for various risk appetites. For instance, STRD is a high-risk option featuring a 10% non-cumulative dividend, while STRK offers a more balanced risk-reward with equity upside potential through its 8% non-cumulative dividend. STRF is the most conservative choice with a 10% cumulative dividend, effectively minimizing risk. On the other hand, STRC’s variable-rate offering seeks to provide consistent returns by adjusting rates monthly, maintaining alignment with market conditions. This tailored array of options showcases Strategy’s innovative financial engineering geared toward maximizing profitability from Bitcoin investments.

In addition to Bitcoin, Strategy’s recent filings reveal an expansion of its USD Reserve. This reserve, designed to facilitate the payment of dividends on its preferred stock and interest on existing debts, was bolstered significantly, showcasing an approach focused on financial prudence. This move follows a previous cash infusion of $748 million into the reserve, ensuring the company retains the liquidity necessary to navigate the complex financial landscape associated with cryptocurrency investments.

However, despite impressive acquisition numbers, many companies within this sector, including Strategy itself, have seen substantial decreases in their stock value from summer peaks. Currently, Strategy’s market capitalization closely mirrors its net asset value, sitting at approximately 0.85, suggesting that it is valued less than the Bitcoin it holds. Michael Saylor, the co-founder and executive chairman, acknowledged that his company’s capital structure is resilient enough to withstand a severe downturn in Bitcoin values, though shareholders would still “suffer” in such scenarios of sustained decline.

Amidst the backdrop of these strategies, Saylor hinted at the recent acquisitions with a playful reference to "Bigger Orange" prior to their official announcement. This enthusiasm is reflected in Strategy’s purchasing activity, where a notable acquisition of 13,627 BTC for $1.25 billion marked the largest buying spree in half a year. Market analysts are adjusting their expectations, with investment bank TD Cowen reducing their one-year price targets for Strategy amid rising dilution from ongoing equity issuances. The revamped estimate now anticipates the firm will acquire around 155,000 BTC in fiscal year 2026, an increase from the earlier estimate of 90,000 BTC.

In the fluctuating market, Strategy’s stock recently showed a positive trajectory, climbing 4.2% by the end of the previous week to close at $173.71. Meanwhile, Bitcoin itself experienced a 5.1% gain in the same timeframe, before concerns regarding potential tariff conflicts dampened sentiment. As market conditions continue to evolve, Strategy’s ambitious plans and calculated financial decisions position it as a formidable player in the ever-expanding cryptocurrency landscape.

As a final note, it’s critical to emphasize that all financial maneuvers in the crypto-exchange space come with inherent risks. While Strategy’s approach appears to be proactive and robust, interested investors should remain vigilant and informed about market movements and regulatory changes. The cryptocurrency market remains complex and volatile, and decisions should be made with care and thorough research.

This article is intended for informational purposes and does not serve as legal or financial advice.