Bitcoin Price Surge Predictions Amid Fed Independence Concerns

In the ever-evolving landscape of cryptocurrencies, Bitcoin remains a focal point for investors and analysts. Recently, Geoffrey Kendrick, the global head of digital assets research at Standard Chartered, highlighted that Bitcoin’s price could keep climbing in light of ongoing concerns regarding the Federal Reserve’s independence. These concerns position Bitcoin favorably as a decentralized hedge against issues associated with traditional financial systems, which further strengthens its role in an investment portfolio. This overview will delve into Kendrick’s insights and explore the implications of Federal Reserve operations on Bitcoin’s trajectory.

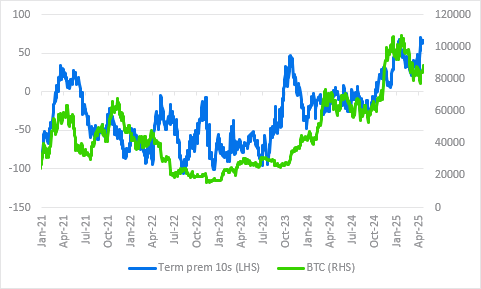

Kendrick identifies the perceived risks to the Federal Reserve as a crucial driver of Bitcoin’s performance. He categorizes such risks under "government-sector risks," which include factors like the potential replacement of Fed Chairman Jerome Powell impacting the central bank’s independence. He notes that investor sentiment is already reflecting these concerns, as the U.S. Treasury term premium has surged to its highest levels in 12 years. The increase in this premium indicates investors’ growing apprehension about the long-term economic outlook and the functioning of the Federal Reserve.

Analyzing Bitcoin’s historical behavior, Kendrick observes that Bitcoin has a notable correlation with the U.S. Treasury term premium, especially since the start of 2024. However, in recent weeks, Bitcoin has not kept pace with this increase. Instead, it has been influenced more by macroeconomic headlines and has been trading similarly to high-growth tech stocks. He highlights that if the apprehensions surrounding the Federal Reserve continue, Bitcoin might regain its strength and could potentially reflect a price resurgence that leads towards new all-time highs.

Currently, Bitcoin’s trading price hovers around $91,200, marking a 4% increase within the last day. The way Bitcoin responds to varying degrees of risk, including both governmental and private sector risks, often dictates its market movements. Kendrick emphasizes that when these risks are subdued, Bitcoin behaves more like a high-growth tech stock—drawing parallels to the Magnificent Seven, a group of high-performing tech companies.

Looking to the future, Kendrick maintains an optimistic outlook for Bitcoin, setting ambitious price targets of $200,000 by the end of 2025 and $500,000 by the end of 2028. This bullish stance echoes with the broader expectation of Bitcoin being a formidable asset, particularly amidst prevailing economic uncertainties. Alongside Bitcoin, Kendrick has made bold predictions for other cryptocurrencies, including a tenfold surge in Avalanche’s AVAX token and significant gains for XRP, while adjusting his projections for Ethereum.

Standard Chartered’s cryptocurrency team, as Kendrick clarifies, is not personally invested in digital assets, aiming to provide research and analysis from an objective standpoint. This neutrality allows them to deliver insights that reflect broader market trends without the influence of vested interests. Despite his bullish sentiments, Kendrick advises that external factors, particularly regarding U.S. regulations and overall economic health, will play pivotal roles in the cryptocurrency market’s evolution in the upcoming years.

In conclusion, the interplay between Bitcoin and macroeconomic indicators, especially concerns over Federal Reserve independence, reveals a critical narrative for investors. As Bitcoin continues to present itself as a hedge against traditional financial vulnerabilities, its potential for growth remains particularly compelling. Given Kendrick’s predictions and the evolving landscape of cryptocurrencies, it seems that Bitcoin has the capacity not only to recover but to exceed previous highs as the market responds to ongoing financial uncertainties. This places Bitcoin in a unique position as both a digital asset and a litmus test for the resilience of the broader financial system.