Janover’s Strategic Acquisition of Solana: A Game Changer for the Crypto Sector

In an impressive move within the cryptocurrency landscape, Janover, now transitioning to be known as DeFi Development Corporation, has acquired an additional 80,567 SOL tokens for approximately $10.5 million. This latest acquisition brings Janover’s total holdings to 163,651.7 SOL, valued at around $21.2 million. This considerable purchase demonstrates Janover’s commitment to building a substantial presence in the cryptocurrency market, specifically through the Solana network, which is recognized for its high-performance blockchain capabilities.

Janover’s strategic focus on acquiring SOL tokens is not a standalone endeavor. It follows two previous acquisitions made earlier in April, amounting to $4.6 million and $5 million respectively. These purchases are part of Janover’s broader strategy to leverage the advantages of staking, allowing the firm not only to generate revenue but also to play a vital role in maintaining and supporting the Solana network’s infrastructure. By staking these tokens, Janover underscores its intent to establish a stronghold in the immensely lucrative staking market inherent to Solana.

The firm’s latest acquisition marks its implementation of a playbook similar to that pioneered by former Microstrategy CEO Michael Saylor, who has famously led a campaign to accumulate Bitcoin as a long-term investment. Notably, Janover’s aggressive strategy reflects a growing trend among market participants, as many firms now look to capitalize on emerging digital asset platforms. Additionally, the company aligns its goals with those of fellow crypto holding firm Sol Strategies, which entered a similar realm by acquiring Solana assets in October.

Further strengthening its position in the crypto ecosystem, Janover has also announced a non-binding letter of intent for a strategic partnership with cryptocurrency exchange Kraken. This agreement involves the delegation of part of Kraken’s significant SOL holdings—over 4.5 million SOL, worth approximately $500 million—to validators operated by Janover. This collaboration highlights the trust and foundational relationship between the two entities and opens pathways for mutual growth in staking efforts, which is a critical aspect of the Solana network’s operations.

As part of its ongoing evolution, Janover has appointed former Kraken executives to key leadership roles following the acquisition of a majority stake in the company. Joseph Onorati now takes the roles of Chairman and CEO, while Parker White serves as CIO and COO. This new leadership team is not just a reflection of the internal transformation but also a strategic initiative to enhance the company’s focus on digital asset management. With the backing of significant financial investments from well-known entities such as Pantera Capital and Kraken, Janover aims to expand its digital assets portfolio further while transitioning to a Software as a Service (SaaS) model.

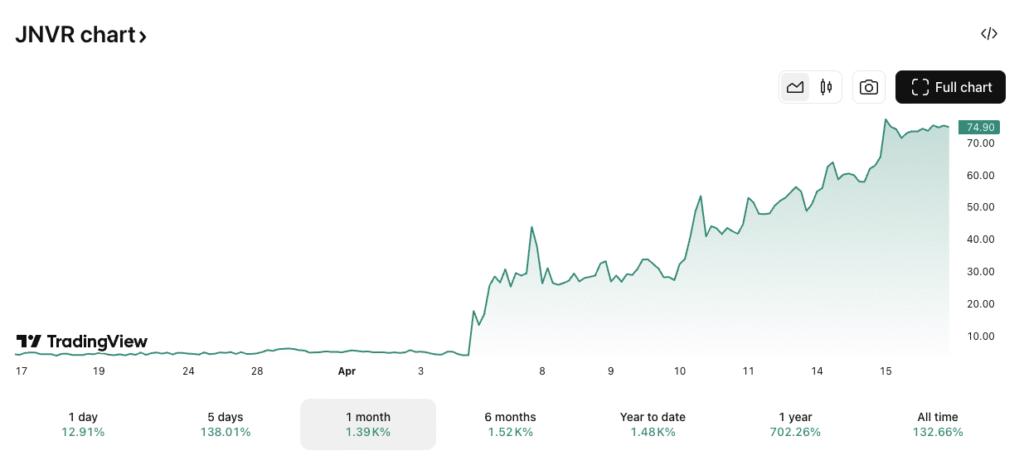

In a remarkable turnaround, shares of Janover have skyrocketed by 1,732% since the inception of its Solana acquisition strategy. As of recent market reports, Janover (ticker symbol JNVR) closed up 12.9% at $74.45, marking a total market capitalization of $106.4 million. This dramatic rise in market value not only reflects investor confidence in Janover’s strategic direction but also points to the growing interest and investment opportunities within the cryptocurrency sector.

The story of Janover’s acquisition strategy is a compelling narrative within the evolving world of crypto investment and development. As it transitions to DeFi Development Corporation, the company is well-positioned to explore new horizons within the blockchain ecosystem and foster innovation in larger digital finance initiatives. The implications of such moves resonate throughout the industry, attracting attention from both investors and strategists seeking to navigate the complexities of the crypto landscape and digital asset ownership.

Disclaimer: This article is for informational purposes only and is not intended as legal, tax, investment, or financial advice. For more insights on developments in the crypto and blockchain space, stay updated with reliable sources.