Bitcoin Treasury Company Stratégie’s Recent BTC Acquisition: An Overview

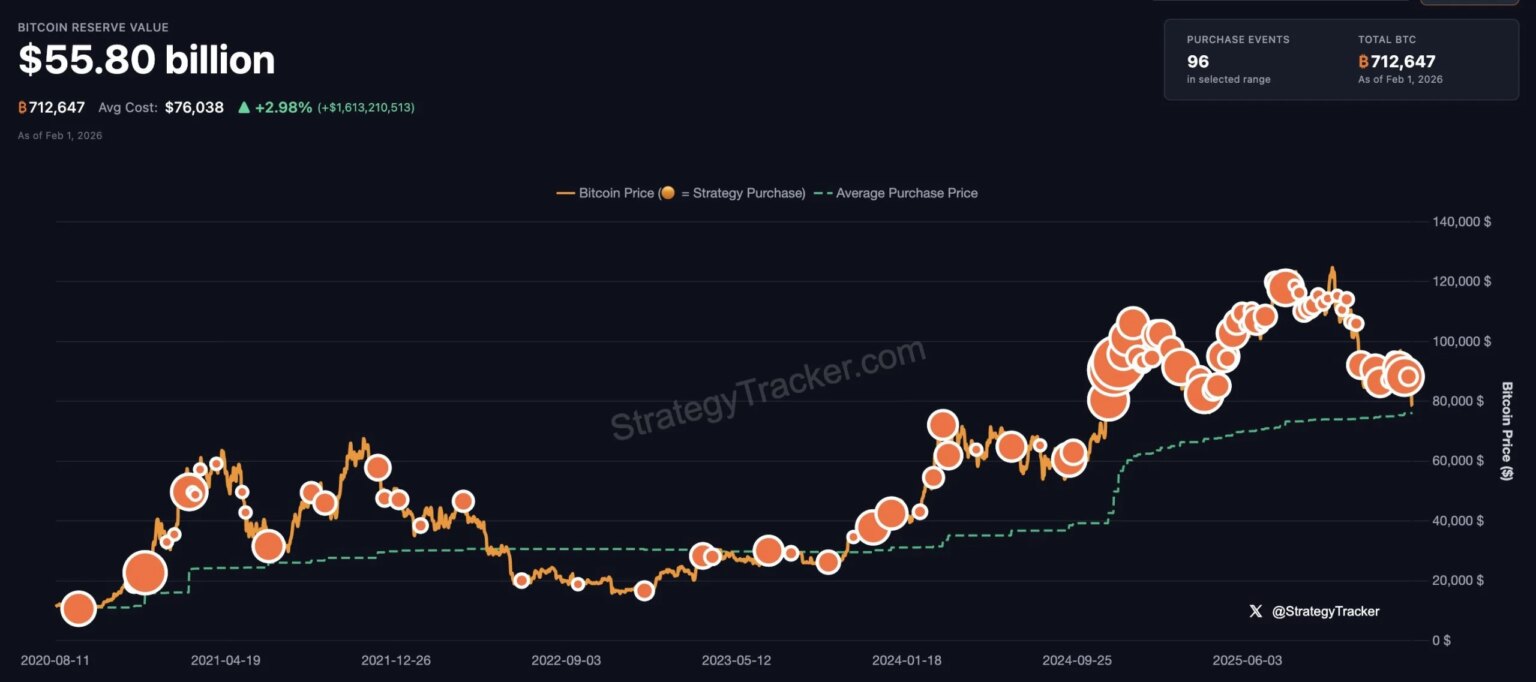

Bitcoin has long been a focal point for innovation and investment strategies among organizations and individuals alike. One major player, Strategy, recently made headlines by acquiring an additional 855 BTC for approximately $75.3 million. This acquisition, reported in a recent 8-K filing with the Securities and Exchange Commission, took place between January 26 and February 1. With this latest purchase, Strategy now holds a staggering total of 713,502 BTC, which is currently valued at around $56 billion. The average cost of their Bitcoin holdings sits at $76,052 per BTC, accumulating to a total expenditure of about $54.3 billion, including all fees and expenses.

The Financial Landscape of Strategy

To put the size of Strategy’s Bitcoin holdings into perspective, they now control more than 3.4% of Bitcoin’s total supply of 21 million coins. However, amidst this acquisition spree, the scale of unrealized gains has been affected by recent market conditions. With Bitcoin’s price dipping below $76,000, it was reported that Strategy faced an unrealized loss for the first time since October 2023. At current market conditions, their paper gains stand at approximately $1.2 billion.

The recent acquisitions were financed through at-the-market sales of Strategy’s Class A common stock, MSTR. Just last week, the company sold 673,527 shares for around $106.1 million. Looking ahead, Strategy disclosed that there remains around $8.06 billion worth of MSTR shares available for future issuance. This approach allows the company to reinforce its Bitcoin holdings while providing the liquidity needed for its operations.

Insights from Co-founder Michael Saylor

Michael Saylor, the co-founder and executive chairman of Strategy, continues to inform stakeholders of the firm’s acquisition strategies. In a social media update, he hinted at the latest Bitcoin buy with the phrase "More Orange," indicating an ongoing commitment to Bitcoin accumulation. Such communications not only keep investors engaged but also enhance strategy visibility within the crypto community.

On January 29, Strategy had previously disclosed the purchase of 2,932 BTC for around $264 million at an average price of $90,061, increasing their total BTC holdings to 712,647. This proactive approach has positioned Strategy as a leading institutional player in Bitcoin investment, particularly as many portfolios seek alternative asset classes amid market fluctuations.

Institutional Interest and Broader Market Trends

Strategically, Strategy’s stock has emerged as a favored indirect Bitcoin exposure vehicle for institutional players, including Norway’s sovereign wealth fund. Reports indicate that 81% of NBIM’s indirect Bitcoin exposure is derived from the company’s shares, valued at 7,801 BTC, which translates to roughly 1.16% ownership of Strategy. This trend underscores the growing institutional interest in Bitcoin as an asset class, as public sentiment shifts towards cryptocurrencies as viable investment alternatives.

Data from Bitcoin Treasuries highlights that a total of 194 public companies have adopted various Bitcoin acquisition models. Among these, major players include Marathon Digital Holdings (MARA) and Tether-backed Twenty One. While these companies hold varying quantities of BTC, they collectively indicate a robust and increasing institutional interest in Bitcoin investment strategies.

Challenges Faced by Investment Firms

Despite the enthusiasm surrounding Bitcoin investments, many firms have experienced significant downturns from their summer 2025 peaks. For Strategy, this has translated into a staggering 67% decrease, reflected in their market cap-to-net asset value ratios. The firm’s mNAV currently stands at around 0.81, meaning it holds less market value than the worth of the Bitcoin assets it possesses. The implications are clear: the current market volatility poses challenges not just for individual investors but for institutions as well.

Michael Saylor has previously mentioned that Strategy’s capital structure is tailored to withstand a 90% drop in Bitcoin over extended periods. This approach includes a strategic mix of equity, convertible debt, and preferred instruments. However, Saylor also emphasized that shareholders would still experience adverse effects in such scenarios, illustrating the inherent risks associated with investing in volatile assets like cryptocurrency.

Recent Market Performance

In the wake of these developments, Strategy’s stock demonstrated volatility, falling by 7% last week to close at $149.71. The correlation between Bitcoin’s market performance and Strategy’s share price remains evident, as the cryptocurrency also experienced a 7% decline over the same period. Pre-market trading on Monday further reflected bearish sentiments, with MSTR down by 8%. This recent performance underscores the continued uncertainty in the cryptocurrency market, which is characterized by rapid price fluctuations.

As investors and institutions look forward to the future, the operational strategies employed by firms like Strategy provide a lens through which the evolving dynamics of Bitcoin investments can be better understood. Despite the current hardships, the bitcoins acquired will likely play a pivotal role in shaping Strategy’s long-term financial strategy.

In summary, Strategy’s acquisitions reflect both aggressive market positioning and response to the volatility inherent in cryptocurrency investments. With significant holdings and ongoing financial maneuvers, the firm stands at a critical junction in the broader narrative of institutional Bitcoin investment. As the market continues to fluctuate, stakeholders will be closely monitoring how Strategy navigates these challenges and seizes potential opportunities moving forward.