Declining Investor Sentiment in Global Crypto Investment Products

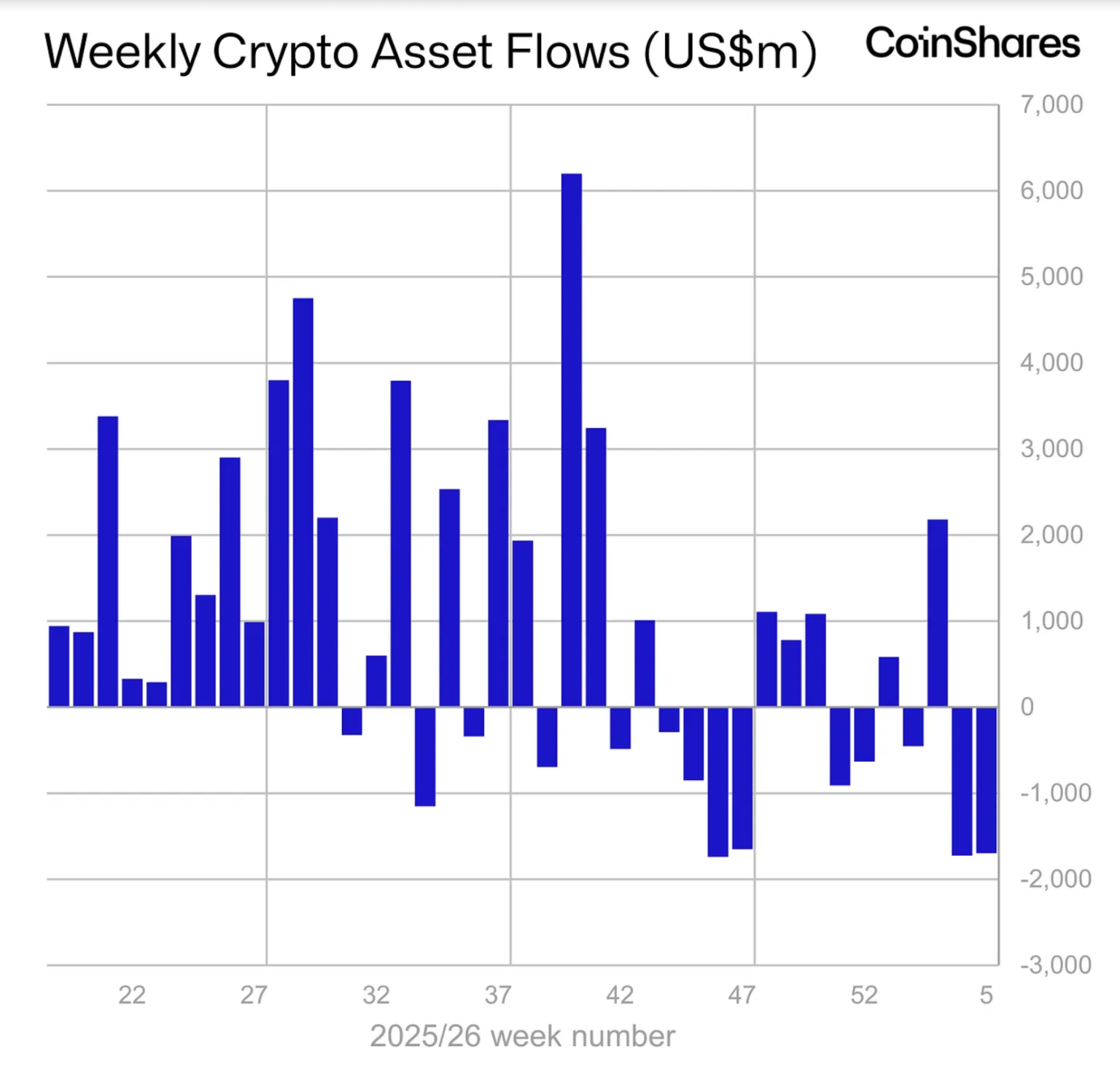

In recent weeks, the allure of global crypto investment products offered by major asset managers such as BlackRock, Grayscale, Fidelity, and Bitwise has sharply waned. According to a recent report from CoinShares, these funds experienced significant investor outflows, totaling $1.7 billion last week alone, marking a second consecutive week of increasing withdrawals. This shift in sentiment appears to be rooted in a complex mix of macroeconomic factors, market dynamics, and investor behavior.

The Current Landscape of Crypto Outflows

As detailed in CoinShares’ latest weekly report, the cumulative net outflows for the year now stand at an alarming $1 billion. This recent trend comes on the heels of a similar $1.7 billion in outflows reported the week prior. These withdrawals have also contributed to a notable decline in assets under management, which have dropped by an astonishing $73 billion since reaching their peak in October 2025. James Butterfill, head of research at CoinShares, highlighted that various forces, including a more hawkish stance from the U.S. Federal Reserve, persistent whale selling as part of crypto’s four-year cycle, and rising geopolitical tensions, have collectively influenced this downturn in investor confidence.

Geographic Distribution of Crypto Withdrawals

Notably, the outflows are concentrated primarily in the United States, accounting for $1.65 billion of last week’s total withdrawals. Canada and Sweden also faced net outflows, with $37.3 million and $18.9 million, respectively. Interestingly, some European markets exhibited a contrasting scenario, as funds in Switzerland and Germany attracted modest inflows of $11 million and $4.3 million, providing a glimmer of hope amid the broader market sell-off.

Bitcoin Takes a Hit

Among the various assets impacted, Bitcoin (BTC) has faced the harshest consequences, leading to massive redemptions. Bitcoin-based funds, especially BlackRock’s iBIT product, suffered a staggering $1.32 billion in outflows. Ethereum (ETH) investment products were not spared either, incurring losses of $308 million, while other popular assets such as XRP and Solana faced net withdrawals of $43.7 million and $31.7 million, respectively, signaling a widespread retreat from major digital assets.

Defensive Positioning Gains Popularity

Despite the overall downturn, certain investment strategies have begun to attract attention from investors. For example, short Bitcoin investment products managed to secure $14.5 million in inflows, suggesting that some market participants are opting for defensive positions during this price decline. Additionally, hype-linked products garnered $15.5 million in inflows, as increased on-chain activity associated with tokenized precious metals seemed to resonate with a niche segment of investors. This reflects a growing trend where opportunistic and defensive investments are preferred amid falling prices.

The Impact of Price Declines

The wave of withdrawals coincides with significant price decreases in the cryptocurrency market, with Bitcoin’s value plummeting by approximately 12% over the past week and Ethereum falling nearly 22%. Such steep declines tend to exacerbate fear among investors, further accelerating the trend of withdrawals. This volatility, coupled with broader economic challenges, has led many to reassess their investments in digital assets.

A Cautious Outlook for Crypto Investments

As the crypto landscape continues to evolve, the increase in outflows raises concerns about long-term investor confidence and market stability. While some investors may be positioning themselves to take advantage of future recoveries, the prevailing sentiment appears to be one of caution. For potential investors, understanding market dynamics and the various forces at play will be crucial in navigating this complex environment. In conclusion, while the situation is undeniably challenging, those in the crypto market should remain informed, flexible, and prepared for the potential opportunities that may arise during these turbulent times.