Understanding the Current Crypto Winter: Insights from Bitwise’s Matt Hougan

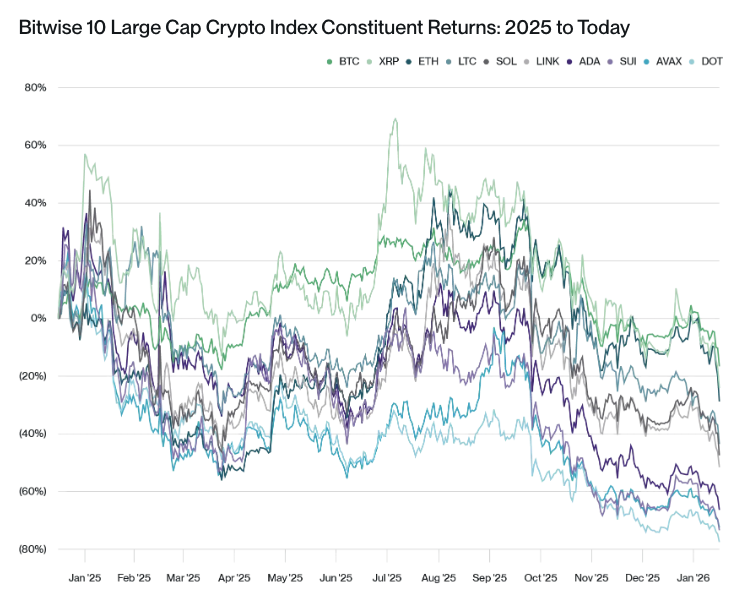

The cryptocurrency market has entered a significant downturn that many analysts are likening to a "crypto winter," similar to past declines seen in 2018 and 2022. As noted by Bitwise Chief Investment Officer Matt Hougan, this downturn is characterized by severe adjustments across major digital assets, with Bitcoin (BTC) down nearly 39% since its peak in October 2025, and Ethereum (ETH) experiencing an even steeper decline of approximately 53%. The widespread drop in prices across multiple digital assets points to a challenging environment for investors who were hoping for short-term corrections rather than a prolonged downturn.

Understanding the Current Crypto Environment

Hougan emphasizes that framing this situation as a crypto winter is crucial for investors. During previous crypto winters, even positive developments regarding adoption or regulation managed to fail to boost prices, primarily due to pervasive bearish sentiment. This time, Houston points out, we are witnessing high levels of fear, as reflected in the Crypto Fear and Greed Index, despite some potential bullish narratives, like the new Fed chair being a bitcoin enthusiast. The overarching sentiment remains grim, echoing the struggles faced in earlier market phases.

Historical Context and Market Patterns

Historically, crypto winters have lasted around 13 months. However, the current downturn’s onset may have been misjudged. While Bitcoin peaked in late 2025, Hougan notes that weaknesses became apparent as early as January 2025, masked by strong inflows into exchange-traded funds (ETFs) and digital asset treasury vehicles. This phase of excess leverage and profit-taking among early investors has resulted in pronounced declines, further aggravated by an environment devoid of sufficient institutional support for many tokens.

Institutional Investment Impact

The Bitwise 10 Large Cap Crypto Index not only tracks the success of major cryptocurrencies but also provides insights into the influence of institutional investment. During previous downturns, assets like Bitcoin, Ether, and XRP saw declines of 10% to 20%, while tokens that had garnered ETF approval dropped much more dramatically. Tokens lacking institutional backing collapsed by over 60%. Such trends indicate that ETFs and treasury purchases have played a key role in cushioning the impact of the downturn, as institutional demand has provided critical support for certain assets.

Navigating the Current Downturn

Despite the ongoing challenges, Hougan notes that structural advancements persist in the broader crypto landscape. Improvements in regulation, growing institutional adoption, and the development of stablecoins and tokenization suggest a foundation for future recovery. He reminds investors that crypto winters often conclude with exhaustion rather than exuberance. The prevailing feelings of despair and malaise among investors could signal that we are nearing the bottom of this cycle.

Looking Towards Recovery

While the exact timeline for a market recovery remains uncertain, Hougan believes the crypto ecosystem is gradually moving closer to a turnaround. The winter has already stretched beyond a year, and potential catalysts like robust economic growth, positive developments like the Clarity Act, and a shift toward sovereign adoption of bitcoin could serve as sparks for recovery. As Hougan aptly puts it, "It’s always darkest before the dawn."

In summary, while current market conditions are challenging, they may be paving the way for future growth and resilience in the cryptocurrency sector. By analyzing key trends and maintaining a broader perspective, investors can better navigate this complex and evolving landscape.