Bitcoin Mining Difficulty Surges Amid Seasonal Strain: What This Means for the Crypto Market

In a significant recent adjustment, Bitcoin mining difficulty surged by 14.7%, reaching 144.4 trillion. This marked the largest absolute increase recorded in the network’s history. The shift occurred during block height 937,440, as the Bitcoin network’s hashrate rebounded following extensive equipment curtailments due to harsh winter weather across the United States. The latest adjustment effectively reversed an earlier drastic decline in mining difficulty of 11%, showcasing the volatility that can occur in the crypto-mining landscape.

Understanding Bitcoin Mining Difficulty and Hashrate

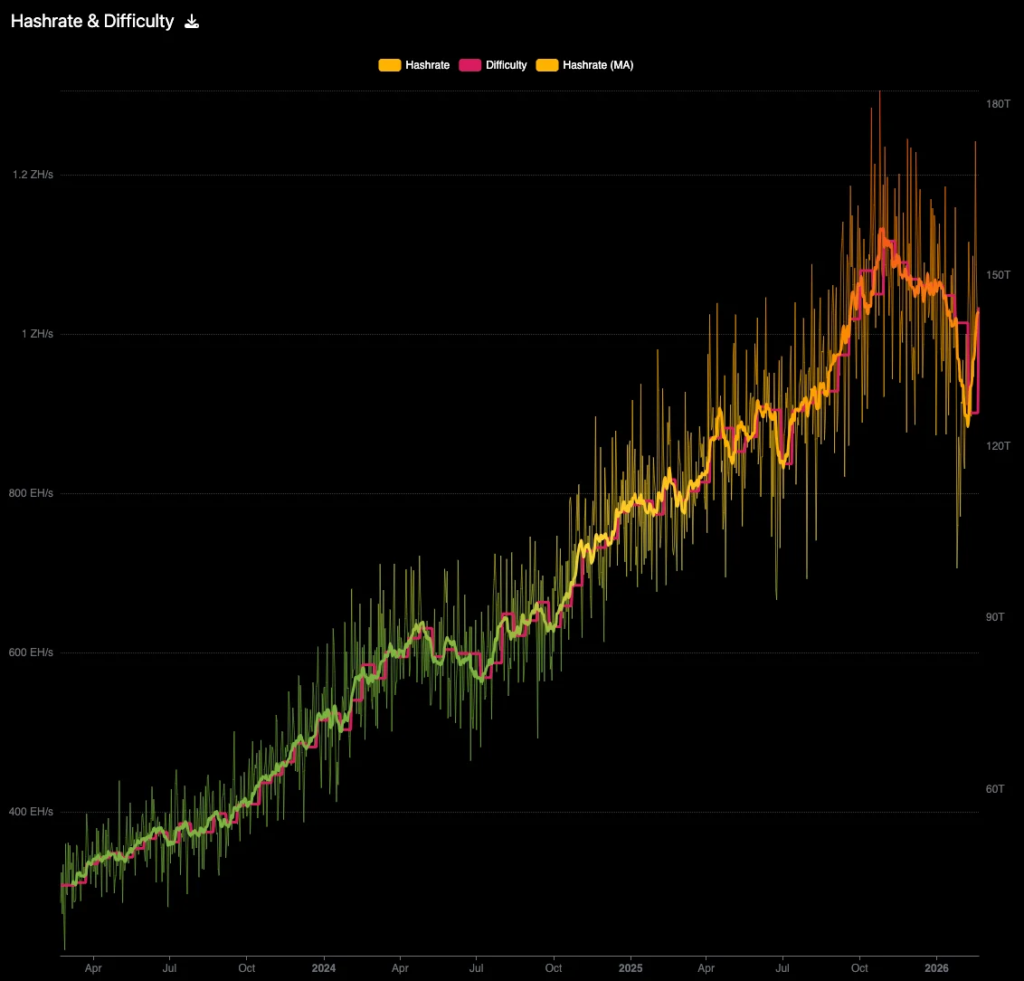

Bitcoin mining difficulty represents how challenging it is to mine a new block relative to the easiest it could ever be. This metric adjusts every 2016 blocks, or approximately every two weeks, ensuring the network maintains an average block discovery rate of 10 minutes. During the latest epoch, blocks were found at an accelerated average rate of approximately 8 minutes and 47 seconds, considerably faster than the target. As the overall network hashrate—essentially the collective computing power securing and processing transactions on the Bitcoin network—rose from around 884 exahashes per second to 1,030 exahashes per second, the automated mining difficulty adjustment was triggered.

The Influence of the Recent U.S. Winter Storm

The latest adjustment came in the wake of a severe winter storm in the U.S. that forced many Bitcoin miners to temporarily disconnect their operations to alleviate stress on local power grids. During this period, it was estimated that around 200 exahashes per second (EH/s) of mining capacity went offline, with notable declines reported among major mining pools such as Foundry USA, which saw a roughly 60% decrease in connected hashrate. This disruption pushed average block production times beyond 12 minutes, triggering a downward adjustment in mining difficulty that set the stage for the subsequent recovery.

Miners as Flexible Resources

Bitcoin miners often act as flexible loads during extreme weather events, drawing on demand-response programs that allow them to temporarily shut down their rigs and either sell power back to the grid or refrain from operations during peak pricing periods. Such practices not only help stabilize the electrical grid but also underline how external environmental factors influence mining operations. With improved weather conditions, miners have successfully restored their equipment, culminating in a rapid recovery of the network’s hashrate and a reversal of the slowdown in block production.

Historic Context and Previous Adjustments

While the 14.7% spike in mining difficulty is noteworthy, it’s essential to view it against a historical backdrop. Even though this adjustment marks the largest absolute gain recorded, it is relatively modest compared to some of the largest percentage increases seen in Bitcoin’s early years. For instance, back in July 2011, the network experienced a staggering increase of 31.5%. However, considering the Bitcoin network’s evolving landscape and growing complexities, the latest adjustment signals a maturing infrastructure that can adapt to changing conditions.

Looking Ahead: Implications for the Bitcoin Market

The current rise in mining difficulty serves as an essential marker for the state of the Bitcoin network and its miners. Industry experts suggest that this recovery is more indicative of external weather conditions rather than a shift in the fundamental economics of mining or concerns over technological advancements like quantum computing. As miners return to operations following the winter storm, it could pave the way for new investments and innovations in mining technologies, further enhancing the resilience and efficiency of the Bitcoin ecosystem.

As the Bitcoin network continues to navigate challenges and adapt to external pressures, the recent difficulty adjustment reflects both the ecosystem’s inherent volatility and its remarkable capacity for recovery. Keeping a close eye on these changes will be crucial for stakeholders and enthusiasts alike, establishing a clearer understanding of Bitcoin’s evolving operational landscape.