The Future of Tokenized Assets: A $11 Trillion Market by 2030

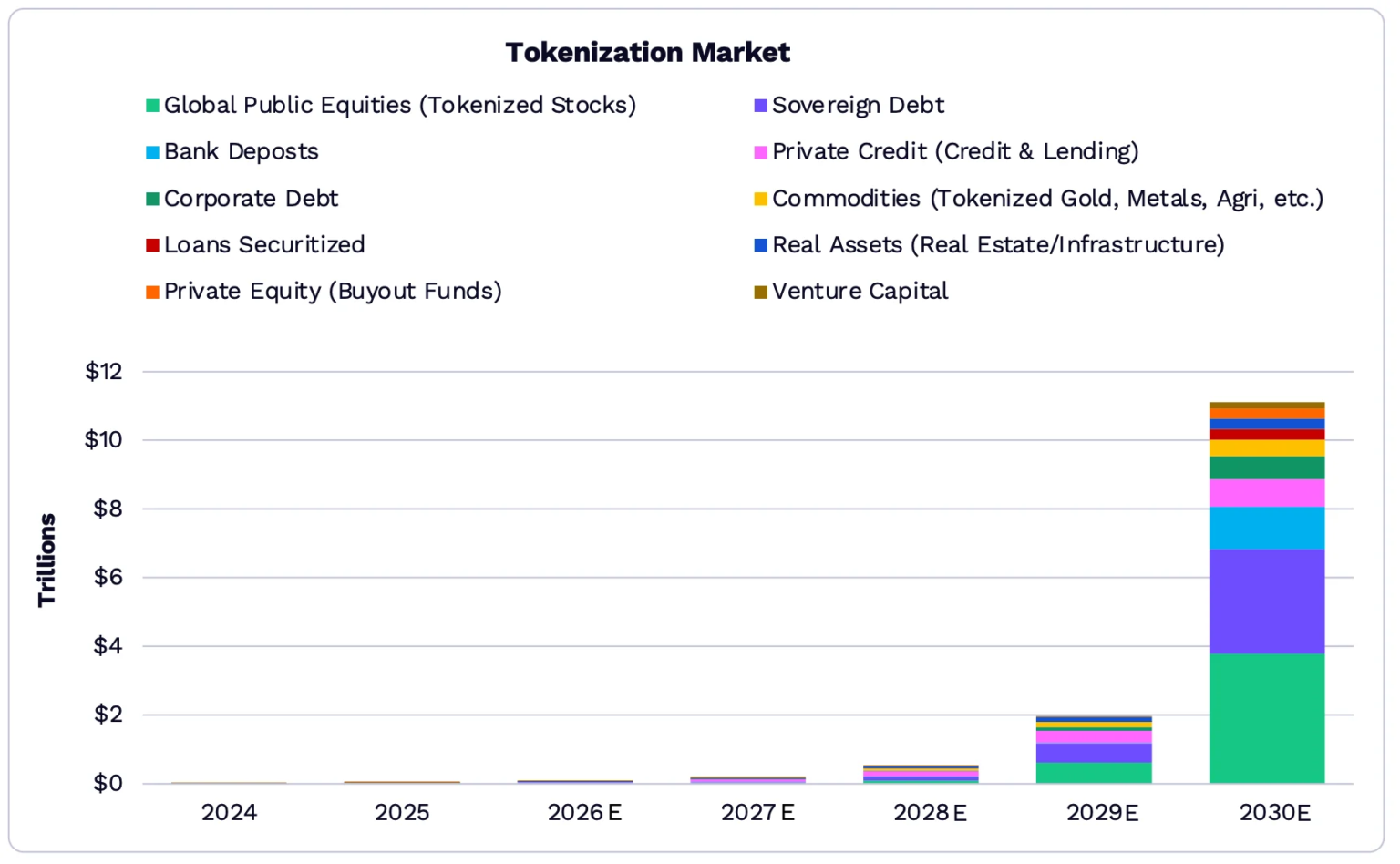

As we move deeper into the digital age, the world of finance is rapidly evolving. Cathie Wood’s Ark Invest has made headlines with its ambitious prediction that the market for tokenized assets could soar beyond $11 trillion by 2030. This projection highlights a staggering increase of approximately 50,000% to 58,000% from the current real-world tokenized asset (RWA) market, estimated to be between $19 billion and $22 billion. This growth is expected to be driven primarily by broad-based adoption of tokenization technology, which will likely coincide with the establishment of regulatory clarity and the development of institutional-grade infrastructure.

Tokenized assets represent a groundbreaking shift in how financial instruments are traded. Unlike traditional assets that operate through conventional brokerages, tokenized assets leverage blockchain technology for trading, providing more transparency and efficiency in financial markets. Advocates argue that tokenization not only reduces costs and settlement times but also enhances liquidity, enables fractional ownership, and increases global accessibility to financial products through 24/7 trading capabilities. As these assets gain traction, we can expect to see a shift in how investments are managed and traded globally.

Institutional Adoption Accelerates

The momentum behind tokenization is not just a theoretical exercise; it is increasingly becoming a reality. Institutions are ramping up their efforts to tokenize assets, reflecting a growing confidence in the technology’s potential. Recent announcements from influential players in the financial sector exemplify this trend. The New York Stock Exchange (NYSE) is building a blockchain-based platform for the 24/7 trading of tokenized stocks and exchange-traded funds (ETFs), with plans for a launch pending regulatory approval. This initiative is expected to provide a more efficient trading environment for both institutional and retail investors.

In addition to the NYSE’s development, F/m Investments has sought approval from U.S. regulators to record existing ETF shares on blockchain. This move comes from a firm managing assets worth approximately $18 billion, indicating that established financial institutions are eager to explore the benefits of tokenization. Moreover, State Street, a prominent custody bank, has announced a digital-asset platform aimed at supporting money-market funds and tokenized deposits. These concerted efforts highlight a noteworthy shift within financial institutions towards adopting blockchain technology and tokenization.

Shifting Landscape of Tokenized Assets

Currently, the realm of tokenized assets is dominated by sovereign debt, particularly U.S. Treasuries. However, Ark Invest anticipates a diversification within the sector, with bank deposits and global public equities poised to play a larger role in the tokenized asset market over the next five years. By 2030, Ark estimates that while the tokenized asset market could reach $11 trillion, it would still only account for about 1.38% of total global financial assets. This statistic underscores the vast untapped potential still present in traditional assets waiting to be tokenized.

Industry predictions from other major institutions also echo this sentiment. For instance, TD Cowen forecasts that on-chain assets could amass values as high as $100 trillion by 2030. Meanwhile, the Boston Consulting Group, in collaboration with Ripple, projects tokenized assets may expand to nearly $19 trillion by 2033. These optimistic forecasts illustrate a growing consensus among experts about tokenization’s transformative impact on financial systems worldwide.

Broader Crypto Market Growth

The positive outlook extends beyond tokenized assets to the broader cryptocurrency marketplace. Ark Invest predicts a significant expansion of crypto assets, forecasting that Bitcoin could reach a market capitalization of around $16 trillion, pushing its price close to $761,900 per BTC based on its capped supply of 21 million coins. With Bitcoin currently trading around $90,000, this anticipation suggests immense growth potential in the crypto market overall.

The projected total crypto market value of approximately $28 trillion by 2030 indicates that crypto assets will play a more substantial role in global finance than many analysts previously anticipated. As institutional interest continues to grow, coupled with increasing regulatory clarity, the landscape for cryptocurrencies seems poised for significant advancements.

The Case for Continued Investment

With the substantial growth potential outlined in Ark Invest’s "Big Ideas 2026" report, the case for tokenized assets cannot be overstated. As traditional asset classes begin to migrate onto blockchain technology, investors should watch closely for both opportunities and challenges. While tokenization can democratize access to financial products and improve operational efficiency, navigating the regulatory landscape will be crucial for success.

Given the rapid pace of change within this sector, stakeholders across the financial industry—from institutional investors to retail participants—should be prepared to adapt to new realities. By embracing the shift toward tokenization, they can position themselves to capitalize on the transformative opportunities it presents.

Conclusion: A Bright Future Ahead

As we head toward 2030, tokenization is likely to redefine financial markets, paving the way for unparalleled growth and efficiency. The combined efforts of institutions, market enthusiasm, and technological innovations are set to create a vibrant landscape for tokenized assets. With Ark Invest and other major firms projecting massive growth, the time to understand and engage with this emerging sector is now. The future of finance is being built today, and the integration of tokenized assets is a vital component of that evolution. As we watch this space, the prospect of realizing a multi-trillion-dollar market for tokenized assets will depend on regulatory advancements and institutional commitment to innovation.