Strategy Expands Bitcoin Treasury Amid Market Corrections

Strategy, once known as MicroStrategy, has made headlines again with its latest acquisition of Bitcoin (BTC) as it further cements its position as the largest company holding Bitcoin in its treasury. This move comes during a challenging period, as both the cryptocurrency market and Strategy’s stock, MSTR, experience notable corrections.

Major Bitcoin Acquisition Details

In a recent press release, Strategy revealed it has acquired 430 BTC for a substantial $51.4 million, averaging out at approximately $119,666 per Bitcoin. This new addition brings the company’s total Bitcoin holding to an impressive 629,376 BTC, which were accumulated at an average cost of $73,320 per coin. The company’s BTC yield stands at an encouraging 25.1% year-to-date (YTD), showcasing its ongoing commitment to Bitcoin as a key asset.

The acquisition was funded through proceeds from the sale of shares in three different offerings: STRK, STRF, and STRD. Strategy raised $19.3 million, $19 million, and $12.1 million from these sales, indicating a structured approach to finance its Bitcoin purchases. Notably, this marks the third consecutive week where Strategy has increased its Bitcoin holdings, following a purchase of 155 BTC for $18 million just a week earlier.

Market Challenges and Timely Acquisitions

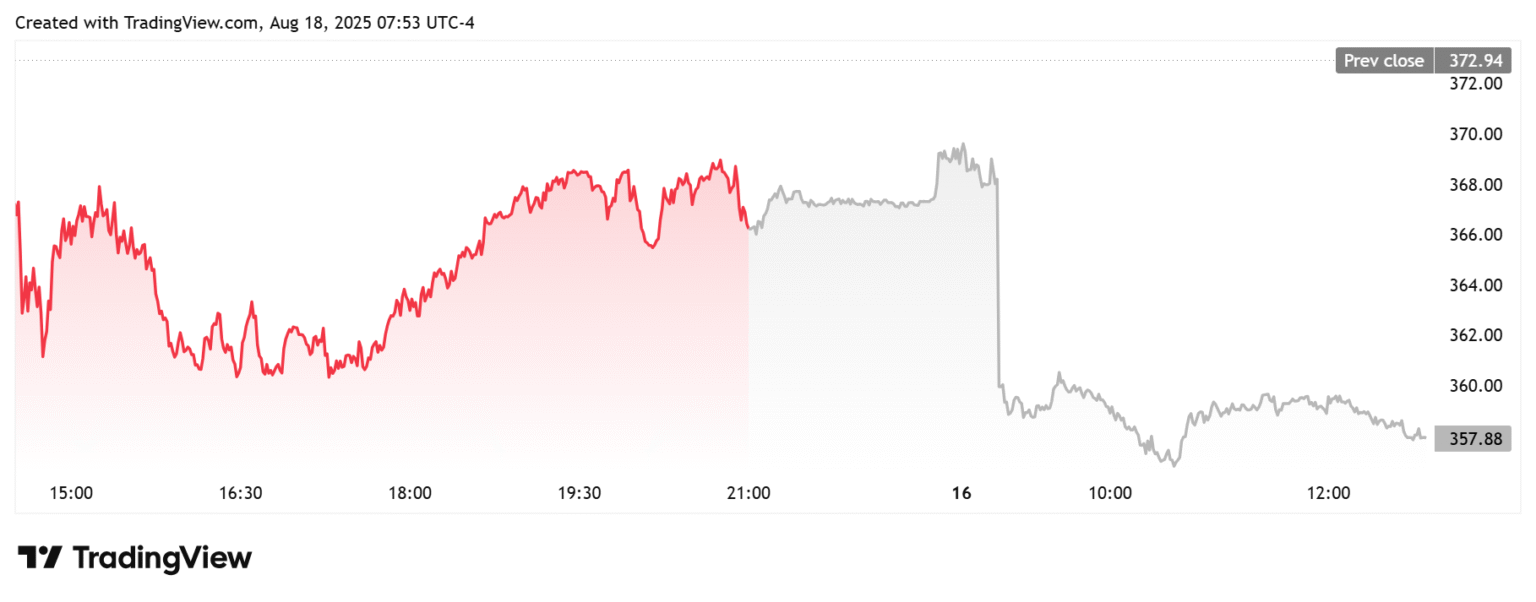

Strategy’s recent investment comes at a time when both Bitcoin prices and MSTR stock are undergoing fluctuations. Bitcoin has declined nearly 5% in just the last week, dipping below the critical psychological level of $115,000. Concurrently, Strategy’s stock price has retraced over 8% within the same timeframe, trading around $358 after a drop from the previous week’s close of $366.

These market corrections are significant, as they often lead to performance impacts on companies heavily invested in cryptocurrencies. Strategy’s stock, known to correlate closely with Bitcoin’s values, typically sees declines whenever Bitcoin experiences a downturn. This has led to an air of bearish sentiment, further compounded by reports that significant asset management firms like Vanguard have cut their stakes in the company by about 10%.

Year-to-Date Performance Insights

Despite these recent setbacks, Strategy’s stock is still performing relatively well overall. It has seen a remarkable increase of over 22% YTD and an astonishing 174% rise over the past year. This positive trajectory is emphasized even further when assessing Bitcoin’s performance, which is also up almost 22% since the beginning of the year. Such statistics indicate robustness, especially in the fast-evolving cryptocurrency landscape.

The resilience of both Strategy’s stock and the value of Bitcoin can prompt discussions about investor sentiment and market cycles. While short-term corrections are vital, the long-term outlook can often reveal growth and opportunities in the crypto market.

The Role of Leadership and Strategic Insights

Underlying Strategy’s consistent Bitcoin strategies is the leadership of co-founder Michael Saylor, whose influence on the company’s direction has been significant. Recently, Saylor hinted at the company’s desire to acquire more BTC, encapsulated in his recent post on X, previously Twitter, where he referenced the need for "Insufficient Orange" — a cryptic nod to further Bitcoin purchases.

Saylor’s commitment to Bitcoin as a primary asset is not just a business decision but also a reflection of his personal beliefs about the cryptocurrency’s potential. His proactive communication with stakeholders and the market continues to play a crucial role in maintaining investor confidence during corrections or downturns.

Conclusion

As Strategy navigates through fluctuating market conditions, its robust strategy for Bitcoin accumulation continues to set it apart. The latest purchase of 430 BTC underscores its commitment to capitalizing on the long-term value that Bitcoin can provide. With an impressive year-to-date performance, both for its stock and Bitcoin holdings, Strategy remains a noteworthy player in the cryptocurrency market.

Investors and market analysts will be keen to observe how Strategy’s strategy unfolds, particularly as it responds to ongoing market dynamics. With Saylor at the helm and a focus on Bitcoin as an essential asset, the company is poised for potential recovery and growth even amid current corrections.

In an evolving landscape, Strategy’s actions suggest a forward-looking approach that may set benchmarks for other companies in the digital asset space. As the market rebounds, those who remain invested in leading firms like Strategy may find themselves well-positioned to harness the benefits of a burgeoning Bitcoin economy.