YZi Labs and CEA Industries: A Governance Clash in the BNB Ecosystem

In a developing saga within the cryptocurrency space, YZi Labs, a venture capital firm associated with Binance founder Changpeng "CZ" Zhao, has publicly escalated disputes with CEA Industries, listed as BNBC on NASDAQ. The month-long disagreement centers around a pivotal governance issue, as YZi Labs accused CEA of “poisoning the pill” by deviating from its commitment to a BNB-centric digital asset treasury (DAT). Their recent statements suggest a growing discontent with CEA’s strategic direction, raising concerns about shareholder rights, transparency, and fiduciary responsibilities.

YZi Labs articulated their grievances through a vocal campaign, framing their actions as a defense of shareholder democracy. They’ve initiated a consent solicitation aimed at expanding CEA’s board, countering what they deem as CEA’s defensive maneuvers that entrench current management and hinder investors’ voices. As this governance battle unfolds, the stakeholders involved must carefully navigate the complex landscape of digital assets while keeping investor interests balanced against managerial decisions.

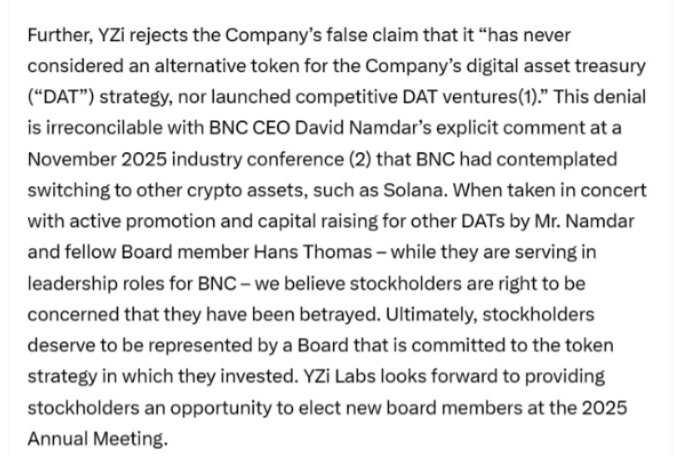

The root of the conflict lies in CEA’s shifting token strategy. YZi alleges that CEO David Namdar’s comments at the Cantor conference in November, along with other managerial activities, indicated a consideration for other tokens beyond BNB, such as Solana. This new direction contradicts CEA’s previously established commitment to a BNB-focused DAT, instilling doubt among investors regarding the company’s long-term vision. Such a pivot could signal a larger trend within the digital asset space as companies evaluate the viability of their treasury strategies amidst market volatility.

This strategic pivot reportedly took shape following a successful $500 million private placement in August 2025 aimed at establishing CEA as a BNB-focused treasury. Backed by 10X Capital and other investors, including YZi Labs, this endeavor marked a significant investment in the BNB ecosystem. However, amidst the fallout, YZi has raised alarms about CEA’s adoption of a poison pill strategy, a defensive mechanism designed to thwart hostile takeovers. This move, coupled with bylaw amendments that limit shareholders’ ability to act by written consent, has further fueled tensions between the two entities.

With CEA holding approximately 515,554 BNB tokens in its digital asset treasury, it stands as one of the largest publicly disclosed corporate BNB treasuries globally. This prominence places CEA at a crucial intersection of investor sentiment and market dynamics. As digital asset treasury models continue to attract scrutiny, corporations like CEA find themselves at the forefront of evolving discussions around sustainability and governance in the space. Other DATs such as Strategy and Metplanet are highlighting the ongoing debate about the profitability of businesses that lean heavily on digital assets.

As the situation unfolds, the implications for BNB and its stakeholders could be considerable. CEA’s actions regarding its treasury strategy not only impact its corporate governance but also resonate throughout the broader cryptocurrency ecosystem. Investors are likely to keep a close eye on CEA’s management decisions, especially in light of evolving market conditions and competitors’ performance.

In conclusion, the governance dispute between YZi Labs and CEA Industries exemplifies the complexities that arise in the rapidly changing world of digital assets. As both parties vie for control over CEA’s strategic direction, their battle underscores the importance of shareholder rights and transparency in a sector still grappling with its legitimacy and future potential. Investors and stakeholders must remain vigilant and informed as developments unfold in this significant governance clash.