The Impact of Trump’s Statements on Bitcoin and U.S.-China Relations: An Analytical Overview

In recent remarks, U.S. President Donald Trump has thrown uncertainty into the anticipated meeting with Chinese President Xi Jinping, raising questions about the future of U.S.-China trade relations. These developments have not only influenced the political landscape but also fueled volatility in the cryptocurrency market, particularly the price of Bitcoin. This article delves into the nuances of Trump’s statements and their repercussions on Bitcoin, exploring the broader implications for investors and the financial market.

Trump Hints at Uncertainty with China

During a recent address at the Rose Garden Club Lunch, President Trump suggested that his meeting with President Xi Jinping might not occur as planned. Despite having confirmed the meeting for October 31 at the APEC summit in South Korea, Trump’s latest comments cast a shadow over the anticipated dialogue. He emphasized the importance of reaching a “good deal” with China, indicating that while negotiations are still desired, they may not come to fruition as soon as hoped. The potential lack of a meeting is a pivotal point, as it could affect the ongoing trade negotiations between the two global superpowers.

Tariffs Intensify Tensions

Trump’s stance has been further complicated by his threats to impose a staggering 155% tariff on Chinese goods if a trade agreement isn’t reached before November 1. This follows his previous announcement of a 100% tariff, designed to take effect on the same date. Such aggressive trade measures heighten tensions and create an atmosphere of economic instability, which can ripple through global markets. Investors closely watching these developments are experiencing increased anxiety, as trade disputes can lead to unpredictable economic consequences.

Bitcoin: A Volatile Reaction

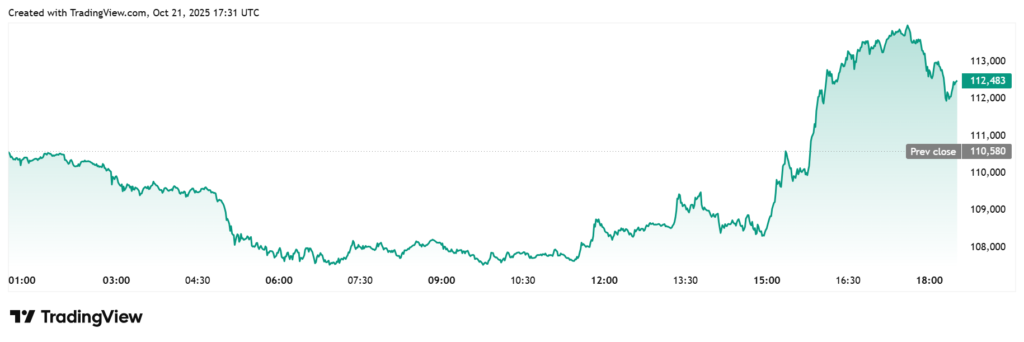

As President Trump voiced uncertainty regarding the U.S.-China meeting, Bitcoin’s price witnessed a dramatic decline. It tumbled from approximately $113,000 to an intraday low of about $108,000. Although the cryptocurrency initially surged to $114,000, Trump’s statements triggered a significant pullback. Following this dip, Bitcoin has shown signs of recovery, demonstrating resilience in the face of uncertainty. As it seeks to reclaim the $113,000 level, many traders speculate whether the bullish sentiment observed earlier in the day will persist, indicating the possibility of a renewed bull market.

Shifts in Investor Sentiment

Amidst this turmoil, Bitcoin’s performance takes on added significance, especially when juxtaposed against gold, which recently experienced its largest daily decline since 2013. This drop in gold prices could suggest a shift in investor sentiment, where investors pivot from traditional safe-haven assets like gold to cryptocurrencies like Bitcoin. Following an impressive rally that saw gold reach an all-time high above $4,300, the decline may prompt a reallocation of assets as investors weigh their options in an uncertain market.

Broader Market Implications

From an economic perspective, the ongoing U.S.-China trade tensions and their ramifications on Bitcoin underscore the intricate relationship between traditional finance and cryptocurrency. With both the stock market and cryptocurrencies reacting to geopolitical events, investors must be vigilant about developments that could shift their strategies. The interplay between tariff announcements, trade meetings, and asset price movements is becoming increasingly apparent, highlighting the need for real-time monitoring of global events impacting financial markets.

Conclusion: Future Outlook

In conclusion, President Trump’s recent comments regarding the uncertain nature of his upcoming meeting with President Xi Jinping have reverberated across both the trade landscape and the cryptocurrency market. As Bitcoin strives to regain lost ground, investors must weigh the potential for continued volatility against the backdrop of U.S.-China negotiations. With tariffs looming and global economic conditions shifting, the market remains on edge, awaiting clarity on trade dealings and their broader implications for financial assets. Investors who remain informed and responsive to these developments will be better positioned to navigate the complexities of today’s financial ecosystem.