Ethereum’s Declining Transaction Fees: A Structural Shift in Usage

Ethereum, one of the leading blockchain networks, has recently seen its base-layer transaction fees drop to their lowest levels of the year. Despite this decline, data from platforms like Glassnode and DeFiLlama indicates that the total value locked (TVL) in the Ethereum ecosystem remains relatively stable. This trend points to a significant structural shift in how users are interacting with the network, and it’s essential to understand the implications for both Ethereum’s future and the broader DeFi landscape.

Understanding the Fee Decline

Recent data illustrates a consistent downward trend in Ethereum’s fee revenue over the past several months, indicating a potential shift in user behavior rather than a drop in engagement. The 90-day moving average for total transaction fees has plummeted since early 2025, suggesting that while fees are lower, user activity has not necessarily decreased. Historically, lower transaction fees often indicated weakened demand for block space. However, in this current scenario, Ethereum’s TVL remains robust, suggesting users are still active but opting for more cost-effective transaction options.

The Impact of Upgrades on Transaction Fees

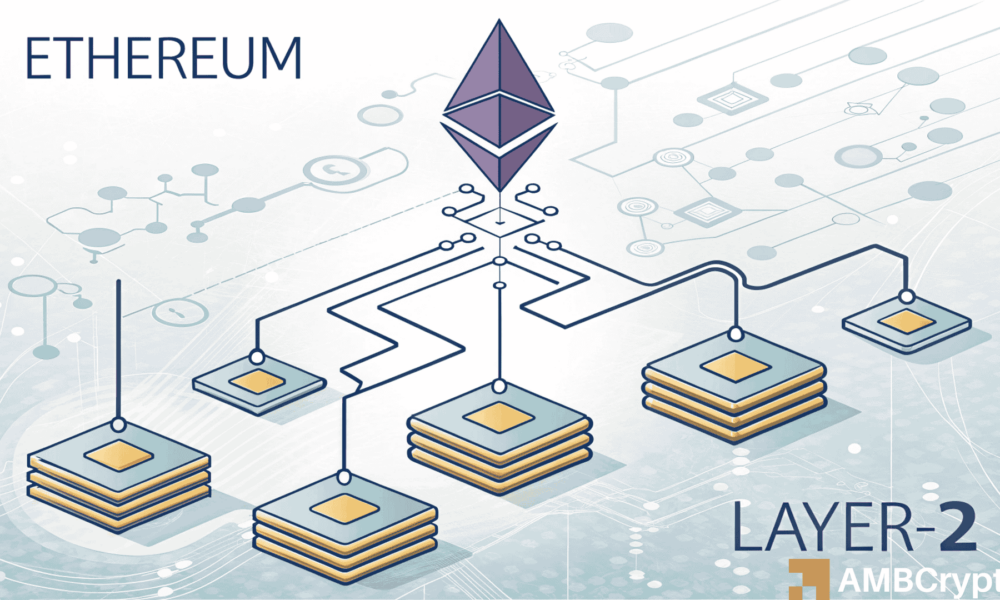

The decline in transaction fees can be attributed in part to the Ethereum Fusaka upgrade, which has enhanced data capacity and throughput on the network. Data from Glassnode highlights that fees fell sharply between January and May 2025, dropping from over 1,800 ETH to approximately 389 ETH, and currently resting around 289 ETH. This change allows for increased efficiency in Layer-2 (L2) networks and rollups, thereby reducing the reliance on costly mainnet transactions. Such upgrades position the Ethereum network as a more scalable ecosystem, encouraging users to engage with L2 solutions for a more efficient transaction experience.

Layer-2 Solutions and Revenue Changes

The trend of declining chain revenue and application revenue underscores the notion that value is migrating to various execution layers within Ethereum, rather than simply disappearing. The shift toward cheaper L2s means that while revenue on the main chain may be dwindling, user engagement hasn’t faltered. As of now, chain revenue stands at approximately $8.5 million, while application revenue is around $6.6 million. This redistribution of activity allows for a more optimized use of Ethereum’s resources and caters to a growing demand for lower transaction costs.

Stable Total Value Locked (TVL)

Despite the drop in transaction fees, Ethereum’s TVL remains more than $70.5 billion, reflecting the resilience of capital tied up in smart contracts. This stability indicates ongoing interest in decentralized finance (DeFi) services and staking opportunities, even with reduced fees. Fluctuations in ETH price have not drastically affected liquidity, pointing to a sustained demand for the ecosystem’s offerings. As users adapt to the changing landscape of fees, the strong TVL emphasizes that Ethereum remains a cornerstone of DeFi engagement.

Corralling Price Adjustments and Fundamentals

As Ethereum’s price corrects from recent highs, it is crucial to understand that this decline in transaction fees is primarily tied to structural changes within the network. At present, ETH is trading around $3,127. The potential for continued Layer-2 adoption, coupled with further upgrades to expand network capacity, suggests that Ethereum’s base-layer fee revenue may stabilize at a lower level, without necessarily reflecting a decline in the underlying strength of the network. This evolution in fee structures could welcome new users and projects as the ecosystem becomes increasingly adaptable.

Conclusion: The Future of Ethereum

In summary, the falling transaction fees on Ethereum signify a transformative shift toward Layer-2 utilization following significant upgrades. With a stable TVL and continuous liquidity within the ecosystem, network activity remains strong, even in the face of declining base-layer revenue. As Ethereum continues to evolve and scale, it is poised to maintain its position as a leading platform for developers and users alike, keeping the fabric of decentralized services resilient and robust.

These changes provide a glimpse into Ethereum’s future, showcasing its adaptability and commitment to improving user experience while maintaining strong engagement across multiple layers of execution.