The Recent Crypto Market Downturn: What It Means for 2026

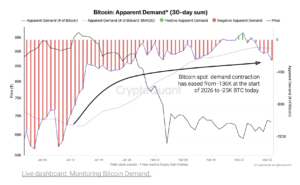

January has come to a close, leaving a significant reality check for the crypto market as we look towards 2026. The initial optimism of sideways movement over the past eight weeks has been abruptly disrupted by a sudden 7% drawdown, leading to an astonishing loss of approximately $200 billion in total market capitalization. This situation has sent the crypto landscape into a risk-off mode, triggering the largest liquidation cascade of 2026, amounting to around $1.8 billion. To put it into perspective, a staggering 95% of these liquidations derived from long positions, illustrating a widespread shift in sentiment towards bearishness.

While the crypto market has taken a substantial hit, it’s crucial to note that this downturn is not isolated. The broader U.S. market has also felt the effects, with over $5 trillion wiped off the value of metals, cryptocurrencies, and equities. Analysts are referring to this event as a “once-in-a-decade” shakeup, raising questions about whether this was merely a coincidence or a coordinated effort to shake out weaker investors. This divergence is noteworthy; back in October, the total crypto market experienced a loss of $1 trillion, while gold rose by 7%. The current situation reveals a wider network of selling, highlighting the interconnectedness of these financial instruments.

As we analyze the recent downturn, it’s essential to understand the broader context. Just as the crypto market appeared to be building towards a bullish scenario—with significant developments such as the passage of the crypto market structure bill and the resolution of government shutdown fears—the sudden sell-off raises eyebrows. The anticipation surrounding potential U.S. Federal Reserve Chair appointments has added to the volatility. With President Trump hinting at Kevin Warsh’s candidacy, market sentiment has been particularly sensitive, emphasizing changes that could shape future financial landscapes.

Despite a seemingly supportive macro backdrop, the crypto market faced significant challenges. These sudden pullbacks, even during strong market conditions, are often indicative of deeper market dynamics. Many observers speculate that this may not just be a random sell-off but rather a calculated maneuver designed to flush out weak hands or attract dip-buyers. This increasingly coordinated liquidation event, which has resulted in dramatic losses across multiple asset classes, suggests a more complex narrative than one simply revolving around fundamental shifts.

This $200 billion drop in the crypto market signals something more significant—a macro-driven risk reset that cuts across various financial markets. With such a large amount of wealth disappearing in a short time frame, it’s vital to consider whether these loss events reflect organic market behavior or engineered circumstances aimed at repositioning investors. The rapid sell-off and subsequent liquidation suggest a potential strategy to unsettle market participants, emphasizing the fragility of current market sentiment.

As we digest these developments, it is essential to maintain a vigilant perspective. The alignment of numerous factors contributing to the recent downturn makes it crucial to stay informed about the broader economic climate. While some might argue these recent movements are mere adjustments, the substantial capital lost reflects greater market sentiment trends. So, as we move into the rest of 2026, the implications of this moment could echo significantly through the coming months, making it important for investors to navigate carefully amid these turbulent waters.

In conclusion, the recent $200 billion drawdown in the crypto market represents not just a localized event but signals a significant, broader market-wide concern as $5 trillion evaporated across multiple asset classes. With a robust macro backdrop, the rapid plunge feels orchestrated rather than a response to shifts in fundamentals. As we evaluate these changes, it remains critical for investors to stay on the lookout for potential opportunities in this evolving landscape while acknowledging the risks inherent in such a volatile atmosphere.