Unveiling Early $PUMP Distribution: Insights from Bubblemaps

Blockchain analytics has emerged as a critical tool for understanding the nuances of cryptocurrency markets, especially amidst the growing complexity in token distribution. Recent findings from Bubblemaps have shed light on a significant early distribution of the $PUMP token, tying various Solana wallets, notably those associated with Hayden Davis, to this distribution. These insights provide a clearer picture of the dynamics at play just after the token’s launch and raise pertinent questions about the nature of early investor activities in volatile ecosystems.

On February 19, 2026, Bubblemaps revealed the depth of its analysis, tracing transactions across several interconnected Solana wallets. One notable wallet, which made a staggering investment of approximately $50 million USDC into Pump.fun, received an allocation of 12.5 billion $PUMP tokens at launch. This substantial allocation was valued at around $73 million, positioning this wallet as the second-largest private sale participant for the project. Such significant early investments not only spotlight investor confidence but also hint at the future trajectory of token supply and market activity.

The Flow of Early $PUMP Transfers

Bubblemaps’ investigations have uncovered that around 80% of the tokens held by this wallet were swiftly sent to centralized exchanges merely days after the token’s launch. This rapid transfer serves as a critical benchmark, demonstrating how fast liquidity can enter the market. The remaining tokens were subsequently routed through a constellation of secondary wallets, which each sold portions of the supply over an extended timeframe. From on-chain transaction histories, Bubblemaps estimated that these sales culminated in realized profits of approximately $15 million. While it remains unclear whether Pump.fun had prior knowledge of the wallet ownership during this period, the blockchain connections between the addresses linked to Hayden Davis were described as “clear and connected in multiple ways,” lending credibility to the findings.

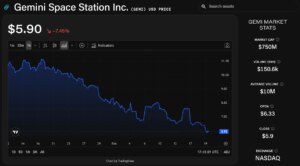

Diverging Trends: Holder Growth vs. Price Action

An intriguing aspect of this situation is the diverging trends in the ownership and price of $PUMP. According to data from Santiment, the total count of $PUMP holders experienced consistent growth, rising from mid-2025 through February 2026 and surpassing 320,000 addresses. However, the price action tells a markedly different story. Data from TradingView indicates that while $PUMP experienced an initial peak shortly after launch, it soon fell into a prolonged downtrend punctuated by repeated sell-offs and lower highs. This entrenching divergence between the expanding holder base and the diminishing price levels often signifies an ongoing distribution phase, where early investors capitalize on incoming demand rather than accumulate additional holdings.

Implications of Early Distribution Patterns

The observations made by Bubblemaps highlight the implications of early distribution strategies, particularly in high-velocity markets like meme tokens and launchpad projects. The significant transfer of tokens from early investors to centralized exchanges raises critical questions about price manipulation and market volatility. It may indicate a pattern where early holders take profits at the expense of newer investors entering the market, which can result in substantial price fluctuations and diminish overall market confidence. For potential newcomers, the data emphasizes the necessity for diligence when entering such speculative environments, especially where early holders may be less inclined to retain their positions.

Transparency in the Blockchain Ecosystem

Bubblemaps is careful to note that its findings are centered on the analysis of wallet behavior and transaction flows, rather than casting accusations of wrongdoing. This emphasis underscores the importance of transparency regarding early token movements, particularly as they relate to strategies of distribution and selling pressure within the cryptocurrency market. The firm’s research highlights a growing trend seen across Solana-based launches, potentially amplifying volatility for later market participants and emphasizing the need for clear communication around distribution practices. The findings reinforce the idea that understanding tokenomics and wallet behaviors is essential for participants navigating the increasingly complex cryptocurrency ecosystem.

Conclusion: Navigating the Cryptocurrency Landscape

As the cryptocurrency landscape continues to evolve, the recent findings surrounding $PUMP distribution serve as a poignant reminder of the intricacies involved in tokenomics. Relationships between investor activities, token distribution, and market dynamics play a crucial role in shaping outcomes for all participants. With over 320,000 holders as the token’s price faces challenging conditions, the tension between ownership growth and market value illustrates the nuanced realities that can shape an asset’s lifespan in speculative markets. As the community awaits potential responses from Hayden Davis and Pump.fun regarding these findings, stakeholders must remain vigilant in exploring the behaviors that underpin their investment decisions in an ever-changing world of digital assets.