The Dynamics of Bitcoin Trading: Recent Short Positions and Market Implications

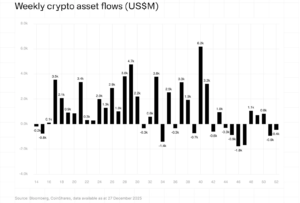

In a striking development within the cryptocurrency trading landscape, a major trader has significantly expanded their short positions, investing around $119 million across Bitcoin and other leading digital assets on December 29. The move has raised eyebrows in the community, particularly as more than $250 million has been funneled into leveraged bearish positions. This strategic positioning comes at a time when the U.S. spot market is exhibiting a lack of demand to absorb increasing sell pressure.

Understanding Short Positions and Market Dynamics

The notable trading activity, flagged by on-chain analytics firm Lookonchain, highlighted that the trader has also opened substantial short positions amounting to $106 million in Ethereum and $43 million in Solana in a mere five-hour window. Such trades were executed via perpetual futures, underscoring a derivatives-led strategy instead of outright spot selling. This shift indicates a keen awareness among traders regarding market sentiment and the underlying demand dynamics influencing cryptocurrency prices.

As the U.S. spot market continues to grapple with weakened demand, the implications of these leveraged trades grow more pronounced. The Coinbase Bitcoin Premium Index, which tracks the difference in Bitcoin’s price on Coinbase versus offshore exchanges, has remained negative at -0.086. This negative premium serves as an indicator of subdued interest among U.S.-based investors, affecting price stability and overall market sentiment.

The State of U.S. Spot Market Demand

Historically, a negative premium implies that U.S. investors, including institutional players, are retreating from conventional regulated spot venues. Consequently, the sell pressure introduced through derivatives markets finds limited absorption from spot buyers, thereby creating a riskier trading environment. In essence, this disconnect amplifies potential volatility, as the absence of active buyers leaves the market vulnerable to continued downward trends.

Despite the significant size of the trader’s short positions, Bitcoin’s price movements have displayed a surprising resilience, trading around $87,540 with only slight fluctuations. This stability suggests a market characterized by controlled de-risking rather than widespread capitulation, indicating that while leverage is increasing, the potential for forced liquidations has remained low.

Market Behavior: Controlled De-risking vs. Panic Selling

The lack of panic-driven selling fundamentally alters the dynamics at play within the market. While leveraged positions can continue to exert downward pressure, the absence of a sweeping demand surge prevents any abrupt price dislocations. This creates a unique scenario where large short positions can endure longer in a market perceived to be weak in demand.

The controlled environment allows expert traders and investors to adjust their positions strategically, rather than reacting impulsively to market fluctuations. Instead of signaling an impending crash, the data suggests a tactical bearish sentiment rooted in the prevailing weaknesses within the U.S. spot market.

Implications for Bitcoin’s Future Valuations

The fundamental question facing traders and investors is what this extensive positioning indicates for Bitcoin’s future. With no immediate resurgence in spot demand, typically indicated through a sustained positive Coinbase premium, the current leveraged positions are poised to continue asserting influence over near-term price movements. This presents a complex challenge for market analysts and traders alike, especially those navigating the evolving landscape of cryptocurrency investments.

The general consensus indicates that any potential recovery would hinge on renewed buying interest from U.S. spot traders, capable of absorbing the amplified sell pressure and challenging existing bearish sentiments. Until then, the balance of evidence denotes that downside pressures, primarily expressed through derivatives, will persist, rendering spot markets largely passive.

Conclusion: The Evolving Landscape of Cryptocurrency Trading

In summary, significant leveraged short positions can remain prolific in environments where spot demand is weak, allowing derivatives markets to dominate immediate price actions. The crypto trading sphere is constantly shifting, with both opportunities and risks perpetually evolving. As large traders adjust their strategies to navigate these complexities, it is crucial for smaller investors to stay informed about market dynamics and potential future alterations in investor sentiment.

Ultimately, a sustained recovery in the cryptocurrency market will likely necessitate renewed buying engagements from U.S. spot investors, which can effectively absorb sell pressures and initiate a challenge to these bearish positions. Therefore, keeping an eye on market indices and trading behaviors will be critical for understanding where Bitcoin—and the broader cryptocurrency market—will head next as 2024 unfolds.

![Zcash [ZEC] Faces Pressure as $4.12 Million Leaves Kraken – Is a Squeeze Developing?](https://icoinmarket.com/wp-content/uploads/2025/12/Erastus-86-1000x600-450x270.jpg)