The Rise of World Liberty Financial’s WLFI Token: Key Developments at the World Liberty Forum

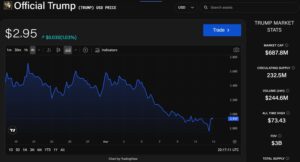

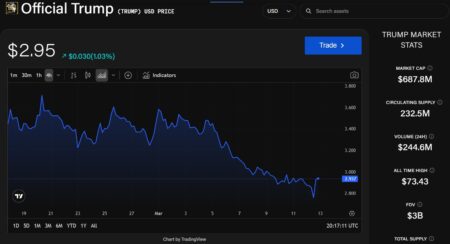

World Liberty Financial’s WLFI token experienced a significant surge, rising approximately 18% on Wednesday, coinciding with the launch of its World Liberty Forum at Mar-a-Lago. This event, associated with the Trump family, highlighted not only the company’s current initiatives but also its plans to enhance its stablecoin infrastructure. The forum served as a platform for unveiling new partnerships, signifying the growing interest and investment in the cryptocurrency sector.

Crypto Adoption in Its Early Stages

Speaking to CNBC’s Sara Eisen, Eric Trump, co-founder of World Liberty, emphasized that the digital asset industry is still in its nascent phases. Despite the volatile nature of cryptocurrencies, he compared the state of crypto adoption to being at the "one-yard line," suggesting there is significant potential for growth. This comment reflects a broader sentiment in the industry, where increased engagement from major financial institutions indicates a shift in market dynamics. Institutions that once steered clear of digital assets are now integrating cryptocurrency into their products and services, recognizing the need to adapt to the evolving financial landscape.

Strategic Partnerships: A Focus on Efficiency

The recent upswing in WLFI’s value is partly attributed to a significant partnership with Apex Group, a financial services firm managing over $3.5 trillion in assets. Apex’s collaboration with World Liberty aims to pilot the use of its USD1 stablecoin within conventional fund workflows. As the fifth-largest dollar-pegged stablecoin, USD1 has over $5 billion in circulation, according to The Block’s data. This partnership is poised to test the effectiveness of using USD1 for transactions linked to tokenized funds, potentially expediting processes like investor subscriptions and redemptions compared to traditional banking systems.

Enhancing Transaction Efficiency with Stablecoins

Donald Trump Jr., alongside Eric Trump during a CNBC appearance, discussed how stablecoins can eliminate inefficiencies inherent in legacy banking systems. He noted that transactions facilitated by stablecoins could settle almost instantaneously, starkly contrasting with traditional banking practices that often result in delays of several days. By leveraging such technology, the World Liberty initiative aims to foster a more efficient and responsive financial ecosystem, which is particularly crucial in fast-paced market environments.

Navigating Regulatory Scrutiny

Despite the potential benefits of its innovations, World Liberty Financial faces scrutiny regarding its political affiliations and potential conflicts of interest. Recently, Senators Elizabeth Warren and Andy Kim requested an investigation from Treasury Secretary Scott Bessent about a reported UAE-linked investment in the firm. World Liberty has reassured stakeholders that neither former President Donald Trump nor any associated individuals participated in this foreign investment transaction. This backdrop highlights the intricate balance the company must maintain between its business aspirations and regulatory considerations.

Positioning USD1 as a Leading Stablecoin

World Liberty is strategically positioning USD1 as a dollar-backed stablecoin aimed at institutional adoption. This focus aligns with the growing trend of institutional investors seeking to diversify their portfolios by incorporating digital assets. As new partnerships develop and substantial financial firms show interest in the stablecoin space, World Liberty’s advancements could redefine how institutional money interacts with cryptocurrencies.

Conclusion

The events at the World Liberty Forum signify a pivotal moment for World Liberty Financial and its WLFI token, highlighting the ongoing evolution of the cryptocurrency landscape. With increasing institutional investment, strategic partnerships, and a commitment to enhancing transaction efficiency, the company is poised for growth despite regulatory challenges. As the digital asset sector continues to mature, World Liberty’s emphasis on stability and transparency could play a crucial role in driving the future of cryptocurrency adoption.