Bitcoin’s Resilience Amid ETF Inflows: Understanding the Current Market Landscape

On Wednesday, Bitcoin demonstrated a commendable hold on its position as tentative ETF inflows suggested stabilizing prospects for the leading cryptocurrency. Reports from The Block highlighted that spot Bitcoin exchange-traded funds (ETFs) recorded net inflows totaling $129 million on November 25. This marked a notable recovery from a series of outflows that had previously pushed Bitcoin to its lowest levels in several months. Alongside Bitcoin, Ethereum and Solana also experienced positive momentum, with inflows of $79 million and $58 million, respectively. Analysts interpreted this trend as a selective but overall constructive shift towards liquid altcoins.

Analyzing Market Dynamics

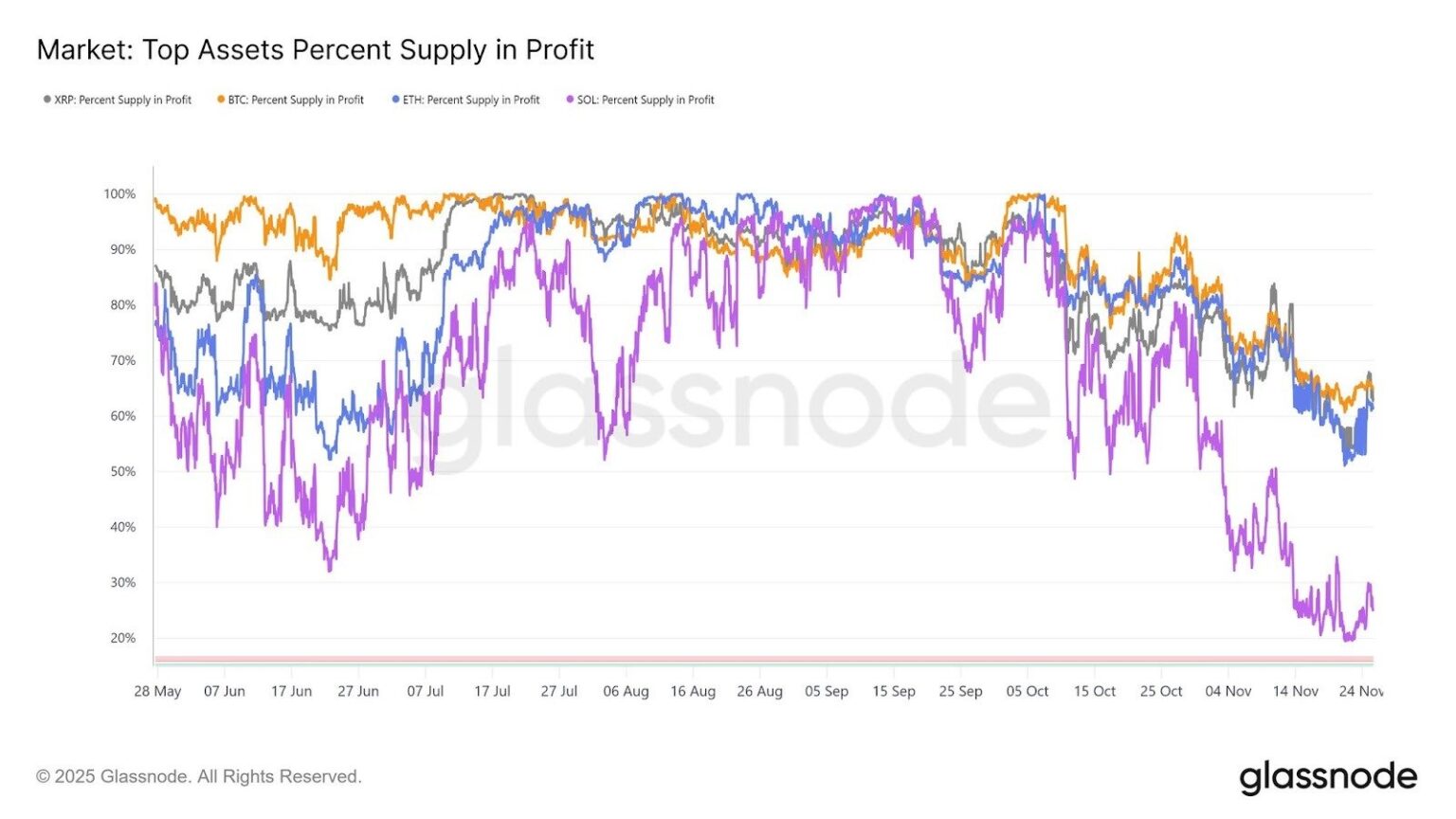

Timothy Misir, head of research at BRN, noted that the recent ETF inflows represented the first significant interest in days, aiding Bitcoin in maintaining its delicate support within the $84,000 to $90,000 accumulation range. While the inflows are a positive signal, Misir cautioned that they are not yet decisive, as on-chain stress indicators remain elevated. Approximately one-third of Bitcoin’s total supply is currently underwater, and the market appears to be witnessing a divide: long-term holders and institutions are selectively accumulating while recent sellers exhibit primarily short-term tendencies.

Mixed Signals and Institutional Observations

In the context of macroeconomic influences, Misir pointed out that mixed signals continue to affect market sentiments, particularly regarding the Federal Reserve’s future actions. With a U.S. Producer Price Index that met expectations, he indicated that this could prolong uncertainty in the Fed’s decisions. Market participants are thus required to prepare for two-way outcomes in the coming days, balancing between aggressive cuts and maintaining a rigid stance.

Gabe Selby, head of research at Kraken-owned CF Benchmarks, described the current scenario as Bitcoin’s "first real institutional stress test." He noted that the ongoing ETF development is broadening access and enhancing price discovery, even amidst downturns. While November 2025 is tracking to be historically poor for ETF flows, Selby viewed much of this activity as profit-taking rather than panic selling, especially following Bitcoin’s price rise from around $60,000 last year to nearly $126,000 earlier this year.

Catalysts for Further Market Recovery

Selby emphasized that Bitcoin’s resilience is heavily reliant on three key catalysts: clarity from the Fed in December, resolution regarding the U.S. government shutdown, and capital allocation cycles post tax season. Institutions are not abandoning the market but are instead biding their time, awaiting the most opportune entry points. Historical patterns suggest that substantial outflows in February 2025 ultimately preceded significant all-time highs for Bitcoin just three months later, illustrating a potential strategic patience among institutional investors.

Shifting Institutional Frameworks

The landscape for institutional involvement in digital assets is also evolving. Keith Grose, CEO of Coinbase UK, highlighted a systematic and regulated approach emerging among institutions across Europe. He noted improved frameworks and infrastructure are being established, with central banks, like the Czech National Bank, launching controlled digital-asset portfolio pilots. Such initiatives indicate that, despite current market volatility, foundational structures for responsible long-term adoption are being constructed.

Risk Factors Ahead

Amid these developments, analysts Misir and Selby have acknowledged several risks that could impact the market this week. A renewed downtrend in ETF flows may put pressure on Bitcoin’s lower support levels around $84,000. Additionally, macroeconomic volatility persists with critical data releases, such as PPI, retail sales, PCE, and jobless claims, all coinciding within a narrow time frame. Such events could sharply alter market expectations regarding interest rates. With thinner holiday trading liquidity, any fluctuations may amplify market movements. Misir noted that indicators such as spikes in exchange inflows or increased long-term holder distribution could jeopardize the fragile stabilization within the mid-$80,000 range.

As of now, Bitcoin trades around $86,900, exhibiting minimal price changes over the past day. The broader sentiment in the crypto market remains subdued, but if Bitcoin can reclaim the $92,000 level or continue to witness sustained inflows across BTC, ETH, and SOL, it may indicate a more substantial recovery on the horizon.

Conclusion

In summary, the current state of Bitcoin reflects a complex interplay between ETF inflows, institutional sentiment, and macroeconomic signals. The cryptocurrency market is carving out a potential bottom, though significant factors will dictate its trajectory in the coming weeks. With institutional frameworks evolving and cautious optimism in the air, Bitcoin’s path forward continues to be watched closely by investors and analysts alike. For those engaged in cryptocurrency markets, understanding these dynamics is crucial for navigating the ongoing volatility and potential opportunities.