Satsuma Technology Secures £163.6 Million to Expand Bitcoin Treasury Operations

Satsuma Technology, a notable Bitcoin treasury firm and decentralised AI company based in London, has successfully raised £163.6 million (approximately $217.6 million) through a secured convertible note round led by ParaFi Capital. This impressive funding round saw participation from prominent investors such as Pantera Capital, DCG, Kraken, Arrington Capital, BTC Opportunity Fund, and Borderless Capital, among others. The fundraising effort, which began on June 24 and concluded on July 28, exceeded its minimum target of £100 million by an impressive 63.7%.

The convertible loan notes will convert to ordinary shares priced at £0.01 each, contingent upon receiving shareholder approval and publishing a prospectus. Satsuma plans to convene a general meeting in the near future, with a draft prospectus already submitted to the Financial Conduct Authority. The capital raised will primarily be allocated towards expanding operational capabilities, maintaining a minimum of three months’ cash working capital, and bolstering its Bitcoin treasury through its Singapore subsidiary, Satsuma Pte.

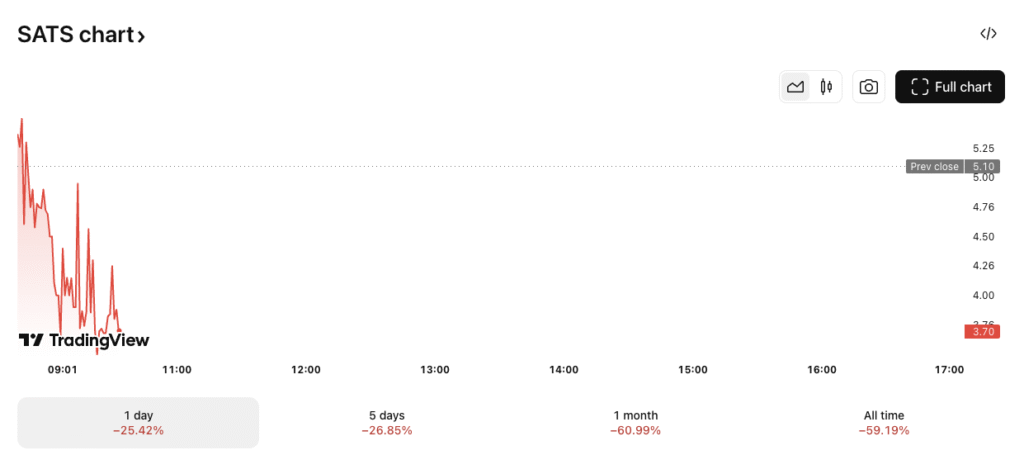

Despite the successful funding round, Satsuma’s stock (ticker: SATS) experienced a sharp decline of over 25% on the day of the announcement, reflecting investor concerns. This follows a troubling trend for Satsuma shares, which have plummeted by over 50% since the company revealed its commitment to a Bitcoin treasury policy in June. Presently, the shares are trading around £3.70, indicating a significant departure from earlier valuations.

Notably, a substantial portion of the investment was made in Bitcoin, with Satsuma accepting 1,097.29 BTC as part of the funding, equivalent to £96,875,000 in cash. The decision to facilitate Bitcoin subscriptions was geared towards aligning with their treasury strategy, using a fixed daily rate over a 24-hour window to determine the Bitcoin contribution. This strategy continues to signal Satsuma’s commitment to Bitcoin, following a prior acquisition of 28.56 BTC for $3.4 million on July 13.

Henry K. Elder, Satsuma Technology’s CEO, emphasised the significance of this funding milestone, calling it a "landmark validation" of the company’s vision to merge a Bitcoin-native treasury with decentralised AI. Elder remarked that achieving such an oversubscribed fundraising round represents a strong vote of confidence from investors. The CEO further expressed that the ability to accept Bitcoin for the first time in London demonstrates the company’s innovative approach and potential to redefine corporate value creation within the tech landscape.

The rise of Bitcoin treasury firms is becoming increasingly evident in the UK, where Satsuma Technology is making strides as a publicly listed entity on the London Stock Exchange while planning to allocate a significant portion of its reserves to Bitcoin. However, competition is growing, with The Smarter Web Company leading the UK public Bitcoin treasury race with 2,050 BTC valued at approximately $235 million. The Smarter Web Company has also announced a recent raise of $21 million via a Bitcoin-denominated convertible bond.

Additionally, the UK cryptocurrency landscape faces scrutiny amid allegations of conflict within the investing community, especially regarding The Smarter Web Company’s backing of Satsuma Technology. Critics have raised concerns over market control and investor perception, especially related to UTXO’s interests in supporting multiple Bitcoin treasury initiatives. Following these developments, firms such as Phoenix Digital Assets and Coinsilium have also emerged, reinforcing the competitive environment for Bitcoin treasury firms within the sector.

In summary, Satsuma Technology’s recent fundraising underscores an optimistic outlook for Bitcoin treasure firms in the UK, marking a new chapter for corporate treasury strategies that intersect with the burgeoning field of decentralised AI. As the firm integrates its Bitcoin treasury with innovative AI applications, it positions itself as a potential leader in a rapidly evolving market. The future will be telling as Satsuma advances its goals amid challenges and opportunities in the cryptocurrency landscape.