Title: A Comprehensive Analysis of Recent Trends in Global Crypto Investment Products

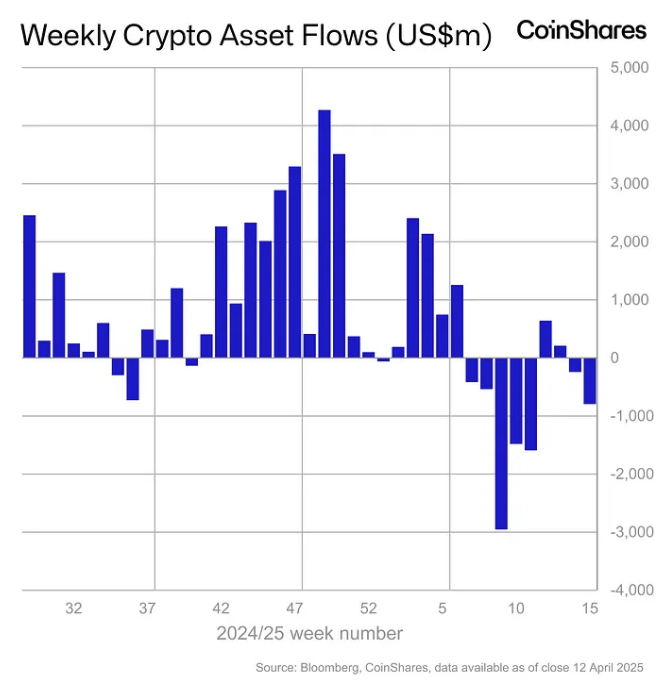

In a recent development within the cryptocurrency landscape, asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares have experienced notable net outflows from their global crypto investment products. According to updated data from CoinShares, the industry has seen net withdrawals amounting to $795 million in just one week. These figures reflect a broader trend initially triggered by concerns over tariff policies under President Trump, which have dampened sentiment towards cryptocurrencies. James Butterfill, CoinShares Head of Research, highlighted that total outflows since early February have now reached a staggering $7.2 billion, effectively overshadowing any year-to-date inflows, which now sit at a meager $165 million.

Amidst these turbulent times, a late-week price rebound provided some much-needed relief. Following President Trump’s temporary reversal of tariffs, the total assets under management rebounded from their lowest levels since November 2024, climbing to $130 billion—an 8% increase. This surge came despite Bitcoin initially dipping below the $75,000 mark earlier in the week, only to recover above $84,000 by Friday. Concurrently, the GMCI 30 index—which tracks leading cryptocurrencies—showed a notable 13% increase in value over the past week, hinting at a possible shift in market dynamics.

The predominant trend in net outflows is largely linked to U.S. investors, who led withdrawals with a staggering $763 million leaving crypto funds in the country last week. Internationally, investment products based in Switzerland, Hong Kong, Sweden, and Germany collectively saw significant outflows of $34.3 million. Interestingly, while the U.S. faced substantial declines, funds located in Canada, Brazil, and Australia reported modest net inflows totaling $2.7 million. This dichotomy underscores the varying sentiment and investor confidence level across different geographical regions.

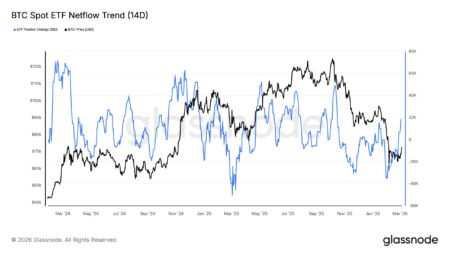

Diving deeper into specific asset classes, Bitcoin-based investment products faced the largest outflows globally, with a staggering $751 million departing in the previous week, although year-to-date inflows remain promising at about $545 million. Short-Bitcoin products also faced minor setbacks with net outflows of $4.6 million. Notably, U.S. spot Bitcoin exchange-traded funds were hit particularly hard, accounting for almost the entirety of these withdrawals, with negative flows reported each day of the week.

Following Bitcoin’s substantial outflows, Ethereum-based investment products also suffered, registering second-largest net outflows at $37.6 million. Despite international funds making attempts to recuperate losses, they could not compensate for the $82.5 million in outflows experienced from the U.S. spot Ethereum ETFs. Other cryptocurrencies such as Solana, Aave, and Sui saw slight outflows, while funds focused on XRP, Ondo, Algorand, and Avalanche managed to gain minor inflows, suggesting a subtle shift in investor preferences.

On a more optimistic note, the macroeconomic environment appears to be undergoing a transformation, potentially easing tensions that have weighed heavily on investor sentiment. China’s counter-move of imposing 125% tariffs on U.S. goods raised eyebrows, initially escalating trade tensions. However, potential concessions on electronics and semiconductors might hint at a willingness to negotiate and acknowledge the economic ties between the two nations, providing investors with a renewed sense of assurance. Analysts from BRN, including Valentin Fournier, suggest that easing inflation, expectations for rate cuts, and diminishing geopolitical stress could create a favorable environment for digital assets. They predict an upward trend for risk assets, with Bitcoin possibly retesting the $90,000 resistance level in the near future.

Conclusion

In summary, the landscape of global cryptocurrency investment products is currently navigating through turbulent waters marked by significant outflows primarily led by U.S. investors. Despite the unfavorable tariff developments and recent withdrawals, market sentiments have shown signs of recovery, aided by price rebounds and helpful macroeconomic indicators. As investors recalibrate their strategies, it is essential to closely monitor forthcoming trends and data, which could provide insight into the future trajectory of digital assets. The crypto investment space remains dynamic, and with emerging opportunities, there is still potential for recovery and growth in the near term.

In light of this ongoing situation, it is crucial for stakeholders and investors alike to remain informed and agile in their approach. As the crypto market continues to evolve, being adaptable will be key in effectively navigating the complexities and seizing upcoming opportunities.