Crypto Market Update: Major Shifts Amid Continued Sell-off

As this week wraps up, the crypto market remains in a turbulent state, predominantly driven by recent economic data and heightened investor panic. Bitcoin’s price has reached alarming lows, while significant outflows from ETFs signal shifting investor sentiment. In this article, we’ll explore the latest trends and analyses affecting cryptocurrencies as the market grapples with volatility.

Bitcoin’s Rollercoaster Ride

Bitcoin has recently been hovering around $84,000 after plunging to approximately $80,500 earlier this Friday. This dramatic drop was triggered by stronger-than-expected U.S. jobs data, which revealed 119,000 new jobs added—surpassing estimates of 50,000. The report has intensified inflation concerns and diminished hopes for a Federal Reserve rate cut in December, as highlighted by Kronos Research CIO Vincent Liu. The crypto market’s current state of extreme fear, reflected in a Fear & Greed Index of 11, echoes the lows experienced during the 2022 bear market. Despite this pessimism, some analysts believe this correction indicates a healthy market adjustment, hinting at possible capitulation nearing completion.

Retail Selling Impacts the Market

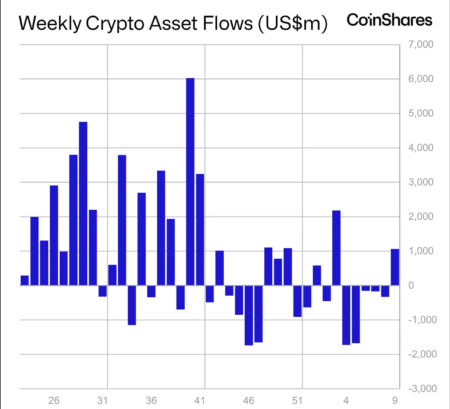

Analysts from JPMorgan recently reported that the current crypto correction is mostly driven by retail investor selling from Bitcoin and Ethereum spot ETFs, which saw approximately $4 billion in outflows this November. This trend comes alongside a substantial inflow of $96 billion into equity ETFs, suggesting that the crypto sell-off does not correlate with a broader risk aversion. Retail investors are liquidating their crypto positions in ETFs while simultaneously investing in traditional equities, indicating a strategic shift rather than an outright bearish sentiment towards risk assets.

ETF Trends and Market Sentiment

Continuing on the ETF front, U.S. spot Bitcoin ETFs recorded significant outflows of $903 million on Thursday—a notable decline that reflects a sentiment shift. This activity constitutes the second-largest daily drawdown for the ETFs, driven largely by concerns around tech giant Nvidia. Despite these short-term withdrawals, cumulative inflows into these funds remain favorable at $57.4 billion, indicating that traders are merely adjusting their exposure rather than abandoning Bitcoin altogether. Overall, a notable trend has emerged in the altcoin sector, as newly launched altcoin ETFs have attracted strong inflows, signifying a diversified interest within the investor community.

Liquidation Wave Hits Crypto Markets

Over the past 24 hours, more than $2 billion in leveraged crypto positions were liquidated amid Bitcoin’s price plunge. This wave of forced selling affected around 400,000 traders, marking one of the year’s most significant liquidation events. Analysts suggest that Bitcoin may be entering a capitulation phase, with short-term holders experiencing significant losses. With Bitcoin’s price unable to reclaim levels between $88,000 and $90,000, concerns arise regarding the possibility of a further decline towards the $78,000 mark.

Treasury Firms Facing Challenges

Digital asset treasury firms are feeling the strain from the ongoing market decline. Their combined market cap has halved from a peak of $176 billion in July to about $99 billion today. The value of crypto holdings among these firms has also seen a notable decline. Amid the downturn, firms like Strategy and Bitmine have experienced significant stock drawdowns. However, prominent figures, such as Michael Saylor, insist on their unwavering conviction in Bitcoin as a long-term investment.

Upcoming Events to Watch

Looking ahead, several economic indicators are set to impact the crypto market next week, including U.S. PPI data and jobless claims. Additionally, major crypto projects like Tornado Cash and Euler are set for token unlocks. Events such as Devconnect in Buenos Aires and the Australian Crypto Convention will also draw attention to the evolving crypto landscape. As we navigate these turbulent waters, it’s clear that the crypto ecosystem remains dynamic, ready to absorb shifts in market sentiments and economic landscapes.

In summary, although the crypto market is experiencing significant volatility, with pronounced effects on Bitcoin and ETFs, there exist structural factors that could favor a potential rebound as market participants recalibrate their strategies. The broader investment community appears cautious yet strategic, demonstrating resilience amidst uncertainty. Stay informed by subscribing to reliable resources for ongoing insights into the ever-changing world of cryptocurrencies.