Title: Standard Chartered Predicts Major Price Surge for XRP By 2028

Standard Chartered has recently launched coverage on XRP, the digital asset created by Ripple, with a bullish price forecast signaling a potential surge of over 500% from its current value. According to Geoffrey Kendrick, the global head of digital assets research at Standard Chartered, XRP could reach as high as $12.50 by 2028. This optimistic outlook stems from the anticipated growth in digital asset use cases, including payments and tokenization, along with shifts in regulatory landscapes that favor cryptocurrencies.

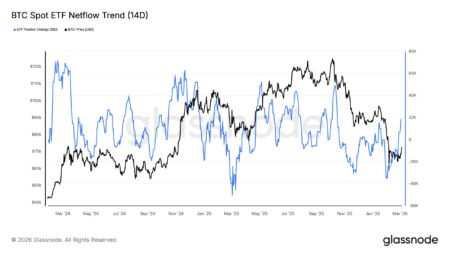

Kendrick’s report stresses the imminent market dynamics surrounding XRP, especially with expectations that its market cap will surpass Ethereum’s by the end of 2028. He stated in correspondence with The Block that the conclusion of current regulatory challenges, often referred to as the “tariff mess,” could lead to a significant upward movement in not just XRP but the broader cryptocurrency market as well. According to Kendrick, the recent performance of Bitcoin amidst ongoing challenges indicates potential growth for the entire asset class.

Several key factors contribute to Kendrick’s positive outlook for XRP, marking it as a digital asset ripe for growth. Significant regulatory developments, particularly the recent decision by the U.S. Securities and Exchange Commission (SEC) to appeal no longer in the SEC case against XRP, provide a more favorable operating environment for the digital asset. Additionally, Kendrick expects the SEC to approve XRP spot exchange-traded funds (ETFs) by Q3 2025, possibly attracting between $4 billion and $8 billion in initial inflows during the first year.

Kendrick highlights the primary function of XRP as an enabler of cross-border payments, crucial for its growth given the rising demand for digital asset transactions. The increasing popularity of stablecoins has seen transaction volumes escalate by 50% annually, with projections indicating that this growth may amplify tenfold in the coming four years. Moreover, Ripple’s expansion plans into tokenization—exemplified by initiatives involving tokenized U.S. Treasury bill funds and the USD-pegged stablecoin RLUSD—further bolster the potential for XRP to capture additional market share.

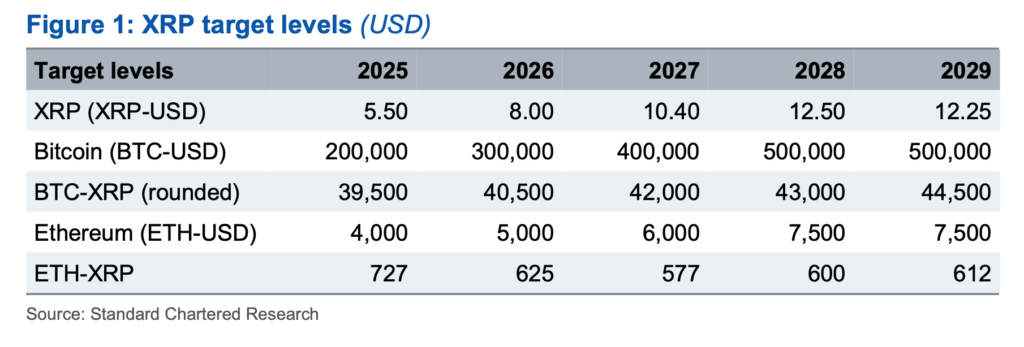

In the report, Kendrick forecasts a structured price trajectory for XRP, predicting it will climb to $5.50 by the end of 2023, rise to approximately $8.00 in 2026, and peak at $12.50 by the close of 2028. This upward trend appears sustainable, especially with Bitcoin expected to reach a price of $500,000 within the same timeframe, suggesting that XRP will perform well even amid inflationary pressures. However, it is noteworthy that XRP encounters challenges, including a comparatively small developer ecosystem and a low-fee framework that limits its valuation capacity. Despite these barriers, Kendrick believes that favorable regulatory and market trends can mitigate these drawbacks.

In addition to XRP, Kendrick’s projections extend to Bitcoin and Avalanche (AVAX), both of which he categorizes as “identified winners” in the crypto landscape. His bullish stance on Bitcoin includes a target price of $500,000 by the end of 2028. Conversely, his perspectives on Ethereum have soured; Kendrick recently revised his Ethereum price target downward by 60%, reflecting skepticism about ETH’s future performance. Ultimately, his analysis positions XRP as a cryptocurrency likely to thrive amidst evolving regulatory frameworks and growing use cases, placing it in a competitive position against Ethereum and other digital assets.

In conclusion, Standard Chartered’s bullish forecast for XRP represents a significant development in the cryptocurrency market, underscoring the impact of regulatory clarity and increasing adoption trends. As XRP adapts to meet the demands of cross-border payments and tokenization, its trajectory appears set for substantial growth within the next few years. With several market catalysts on the horizon, including potential SEC approvals and expanding use cases, XRP could emerge as a leading digital asset, challenging Ethereum and assuming a prominent position in the broader cryptocurrency landscape by 2028. As always, investors should conduct thorough research and consider market dynamics before engaging with digital assets.