The Growth of Decentralized Finance in Q4 2025: A Deep Dive

Decentralized finance (DeFi) continued to solidify its position as a pivotal layer for trading and settlement within the cryptocurrency landscape in Q4 2025. This trend was detailed in a recent report by ARK Invest, which highlighted the adaptations and shifts in activity across diverse networks and products following a significant October volatility shock. Although the overall stablecoin supply reached over $300 billion by the end of the year, growth has largely stagnated since the tumultuous October events that shook yield strategies and caused a notable decline in the USDe supply.

Stablecoin Dynamics Post-October Volatility

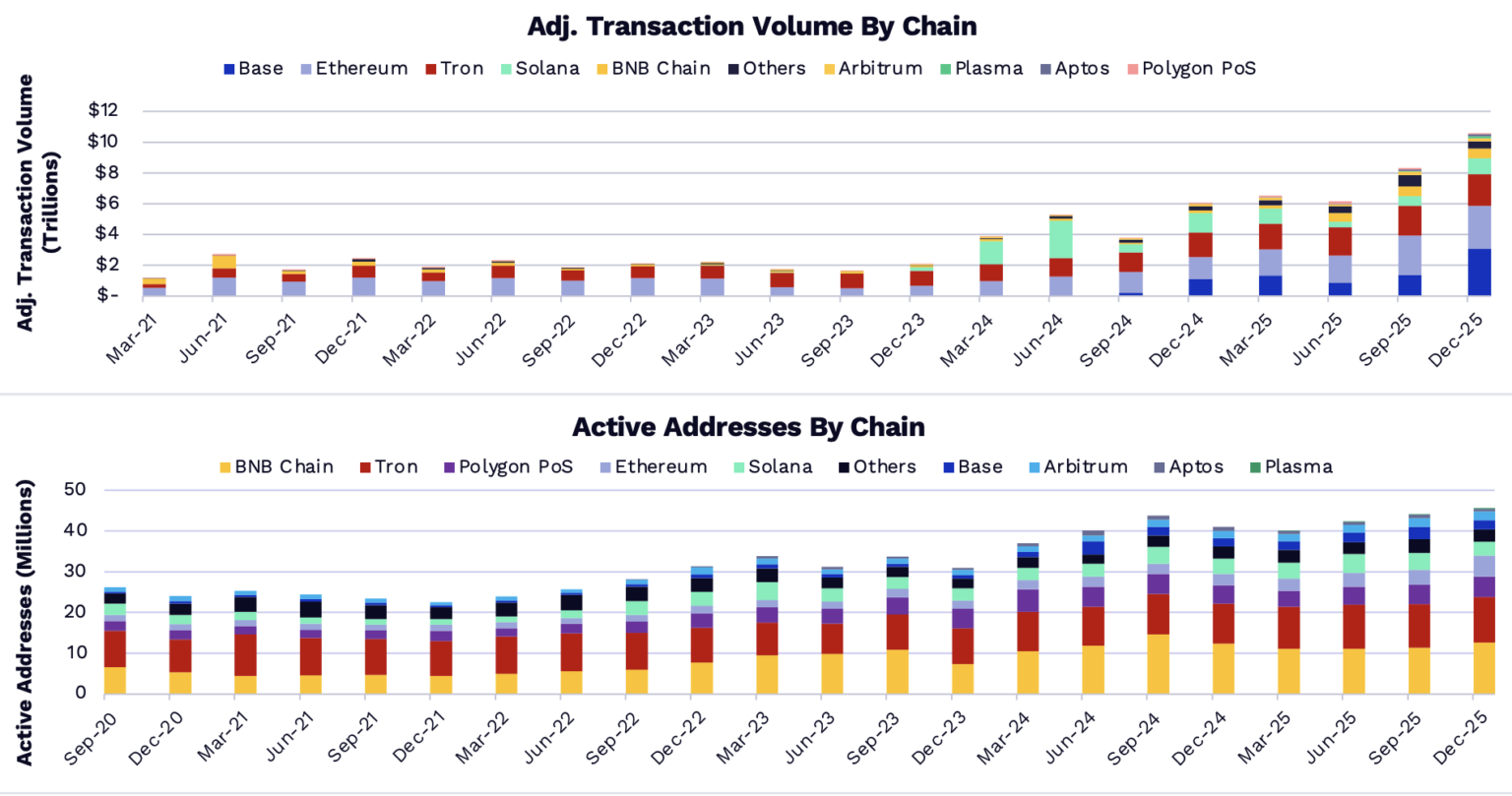

Stablecoins play a crucial role in DeFi, and their demand remained resilient even amidst the fluctuations in the market. ARK reported that Coinbase’s Base platform saw an impressive 121% quarter-over-quarter increase in stablecoin transaction volume, surpassing traditional giants like Ethereum and Tron. This surge reflects a dynamic shift in the stablecoin landscape, wherein Base emerged as a leader, while Ethereum and its Layer 2 solutions continued to be recognized as primary hubs for stablecoin activity, commanding 58% of the total volume—a 1,300 basis points rise from the previous quarter. Notably, USDC gained traction as a transactional stablecoin, accounting for over 60% of adjusted transaction volume despite only constituting 25% of the stablecoin supply.

Tokenized Real-World Assets (RWAs) Gain Momentum

The integration of tokenized real-world assets (RWAs) into the DeFi ecosystem marked a significant trend in Q4 2025. The total value of tokenized assets reportedly reached around $19 billion, demonstrating a quarter-over-quarter increase of 14.8%. Commodities, particularly tokenized gold products such as Tether’s XAUT and Paxos’ PAXG, were noteworthy drivers of this growth, with a remarkable 64% rise. Additionally, private credit continued its upward trajectory, with Maple Finance reporting substantial growth in their offerings. The distribution of RWAs also evolved, with Ethereum and its Layer 2 networks holding approximately 70% of the total RWA value on public blockchains, while BNB Chain’s share notably increased due to the growth of Circle’s USYC money-market product.

Surge in Decentralized Exchange Trading

Trading activities on decentralized exchanges (DEXs) soared in Q4, with spot DEX volume hitting around $1.1 trillion. This marks the fifth consecutive quarter that volume has crossed the trillion-dollar threshold. A significant portion of this activity—about 55%—was attributed to stablecoin flows, reflecting a continued trend towards stablecoin-to-native and stablecoin-to-stablecoin trading pairs. Notably, trading in tokenized assets emerged as the fastest-growing category, with a staggering 202% quarter-over-quarter growth. However, interest in memecoins and liquid staking token swaps waned, experiencing declines of approximately 37% in trading volume.

Impact of October’s Market Shock on DeFi Revenue

The report also underscored a decrease in DeFi revenues as the market grappled with the aftermath of October’s volatility. ARK highlighted a 27% quarter-over-quarter decline in network “real economic value,” which settled at around $473 million, while total application revenue reached approximately $656 million by quarter’s end. Ethereum regained its position as the leading revenue-generating blockchain, surpassing Solana for the first time since Q3 2024, with reported revenues of $111 million compared to Solana’s $90 million. Lending activities also faced headwinds, with total deposits across protocols dropping roughly 21% to about $92 billion, although the number of active loans rose by about 48% throughout 2025.

Evolving Payment Dynamics in the Crypto Ecosystem

As DeFi continues to mature, payment processing has shown significant developments. ARK’s dataset revealed that crypto card spending exceeded $100 million in December alone, escalating to about $262 million for the quarter. Visa emerged as the dominant payment processor, handling approximately 76% of transaction volume, followed by Mastercard at 24%. This shift towards crypto adoption in everyday transactions signals a pivotal evolution in the perception and utilization of cryptocurrencies in daily financial exchanges.

Conclusion: Navigating the Future of Crypto with DeFi

The data from Q4 2025 encapsulates the evolving landscape of decentralized finance, showcasing resilience amidst volatility and the advent of new trends, particularly in stablecoins and tokenized assets. As DeFi continues to expand its influence across various networks, the foundational role of stablecoins and the potential of RWAs in diversifying asset classes are set to define the future of this burgeoning sector. The surge in DEX trading alongside evolving payment mechanisms heralds a more integrated and user-friendly approach to financial services in the crypto space, making it imperative for stakeholders to stay informed and adaptive in this rapidly changing environment.