Norges Bank Investment Management Boosts Bitcoin Holdings: An Insight into Q2 Developments

Norges Bank Investment Management (NBIM), known as Norway’s Government Pension Fund Global, is recognized as the world’s largest sovereign wealth fund, amassing approximately $1.7 trillion in assets. In a notable shift during the second quarter of the year, NBIM increased its holdings in bitcoin-linked investments by a staggering 83%. This move has drawn attention from market analysts and investors alike, shedding light on the evolving strategies of sovereign wealth funds in the cryptocurrency space.

Significant Increase in Bitcoin Exposure

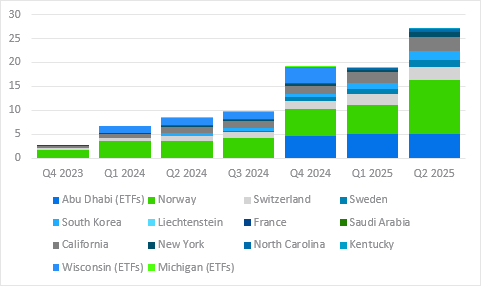

According to Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, the notable increase in bitcoin-related assets was evidenced in the latest 13F filings submitted to the U.S. Securities and Exchange Commission. These filings revealed an increase from 6,200 BTC to an impressive 11,400 BTC in the second quarter—a clear message of NBIM’s proactive strategy towards enhancing its digital asset portfolio. Notably, the bulk of this investment appears to be concentrated in MicroStrategy (ticker MSTR), with a smaller addition of roughly 200 BTC-equivalent attributed to Metaplanet, often referred to as “Japan’s MicroStrategy.”

The Role of MicroStrategy and Metaplanet

MicroStrategy has emerged as a significant player in the corporate bitcoin market, boasting the largest publicly traded reserves with approximately 628,946 BTC valued at nearly $74 billion at current market prices. Meanwhile, Metaplanet stands out as the seventh-largest corporate holder, with around 18,113 BTC worth over $2 billion. Kendrick emphasized that Norges Bank has strategically aligned its investment in MSTR, thereby leveraging this corporate entity as a means to gain substantial exposure to the underlying asset—bitcoin itself.

Sovereign Wealth Funds and Bitcoin Adoption

The increasing interest from sovereign wealth funds in cryptocurrencies has been a subject of discussion among financial analysts. Kendrick previously indicated that sovereigns and government entities were markedly boosting their indirect exposure to bitcoin, primarily through shares of MicroStrategy, as observed in the first quarter. He predicted a broader trend of sovereign wealth funds increasingly embracing digital assets, indicating a pivotal shift in institutional investment strategies towards cryptocurrencies.

Bullish Forecasts for Bitcoin and Other Cryptocurrencies

Kendrick’s outlook on the cryptocurrency market remains optimistically bullish. He recently adjusted his forecast for bitcoin, raising the target price to $135,000 by the end of September and establishing a year-end prediction of $200,000. Looking further ahead, he speculated that bitcoin could potentially reach $500,000 by 2028. Additionally, he has also revised his projections for Ethereum, expecting it to soar to $7,500 by year-end and $25,000 by 2028, demonstrating a comprehensive and favorable analysis of leading cryptocurrencies.

Market Trends and Future Projections

Kendrick’s confidence does not stop with bitcoin and Ethereum; he anticipates further growth for other cryptocurrencies as well, outlining projections for BNB to reach $2,775, Avalanche’s AVAX token to climb to $250, and XRP potentially hitting $12.50 by 2028. This expansive outlook signifies a solidification of cryptocurrencies in the financial landscape, alongside a notable rise in stablecoin adoption that may see the market nearing a valuation of $2 trillion by the end of 2028.

Conclusion: The Evolving Landscape of Institutional Investing in Cryptocurrencies

The recent moves by Norges Bank Investment Management to bolster its bitcoin-linked holdings signal a critical evolution within institutional investing in the cryptocurrency space. As sovereign wealth funds exhibit an increasing appetite for digital assets, analysts like Kendrick provide a roadmap for future developments in the market. As organizations and governments adapt to the growing significance of cryptocurrencies, a trend towards greater stability and adoption is anticipated, transforming the financial landscape for years to come. Investors and market watchers should keep a close eye on this evolving scenario, recognizing the potential implications for both traditional finance and the burgeoning crypto economy.