Node Capital Launches Liquid Fund Amid Bearish Crypto Market Conditions

Node Capital, a prominent crypto venture firm, has recently unveiled a liquid fund aimed at investing in listed tokens, viewing the current bearish market conditions as an opportune entry point. Amos Meiri, the founding partner of Node Capital, believes that this market phase presents notable prospects for liquid tokens due to their current valuations when compared to early-stage projects that are still in the pre-launch phase. Meiri states, “The bear market is the best time to invest in liquid tokens that we refer to as ‘pre-ETF [pre-exchange traded fund] assets.’” This launch signifies Node Capital’s commitment to leveraging market conditions for strategic investments.

This inaugural liquid fund stands out due to its open-ended structure, allowing for the acceptance of new capital on a quarterly basis. Meiri emphasized the firm’s ongoing fundraising efforts, adding that this is a private fund restricted to specific types of investors based on regulatory guidelines. Although he withheld further details regarding the fund’s financial specifics, the initiative emerges against a backdrop of significant volatility in the crypto space, with fluctuating investor sentiment and challenges such as U.S. tariffs affecting the sector.

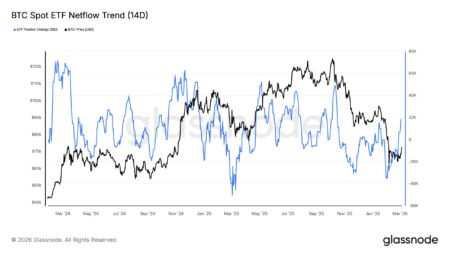

As of late 2023, Bitcoin has experienced a decline of over 15% year-to-date, hovering around $79,000, while the total crypto market capitalization has contracted by more than 25%, amounting to approximately $2.6 trillion. In light of these downturns, Meiri posits that now is an ideal time to invest in liquid tokens, which typically entail more active investment strategies focused on generating near-to-mid-term returns. This diverges from traditional venture funds, which tend to support early-stage startups with a longer investment horizon. Meanwhile, hybrid funds integrate elements from both models to capitalize on diverse opportunities.

Since its inception in 2021, Node Capital has progressively expanded its focus, starting with a hybrid fund, continuing with a second venture fund, and now introducing the liquidity-focused strategy. The firm currently manages assets worth $50 million and successfully raised $20 million for its second venture fund, although overall fundraising details have not been publicly disclosed. Diverse projects in Node Capital’s portfolio include noteworthy names like Ether.fi, Fhenix, and Axelar, with limited partners comprising founders from leading Layer 1 blockchain projects and general partners from both crypto-centric and traditional investment firms.

In order to navigate the increasingly volatile market environment, Node Capital has developed proprietary risk management tools, indicating a strategic approach toward investment rather than day trading. Meiri stressed their focus on longer holding periods, ranging from two to five years, while emphasizing their analytical methods in assessing potential investments. The firm places particular importance on identifying discrepancies related to a project’s runway, growth trajectory, on-chain data, and valuations, with a significant focus on infrastructure and decentralized applications (dApps) in the current market landscape.

In addition to the liquid fund, Node Capital operates three other entities: Node Monster, Node Security, and Node Link. Launched in 2023, Node Monster serves as the group’s validator arm, recently surpassing $1 billion in assets under management (AUM) across more than 20 blockchain networks, positioning it as one of the largest Ethereum validators. Concurrently, Node Security offers essential services including security audits and vulnerability assessments, while Node Link aims to bolster community growth and engagement for Node Capital’s portfolio companies. With these developments, Node Capital continues to enhance its footprint in the crypto venture landscape, showcasing its adaptability and commitment to leveraging market opportunities effectively.

This innovative approach underscores Node Capital’s strategic positioning in the rapidly evolving crypto space, where timely investments and risk management can significantly influence outcomes. As the market navigates through uncertainties, Node Capital’s initiatives highlight the potential for growth and innovation even amidst challenging conditions, reinforcing the firm’s dedication to fostering promising ventures in the blockchain ecosystem.