LeverageShares Launches Groundbreaking 3x Bitcoin and Ether ETFs in Europe

LeverageShares is making headlines as it prepares to launch the world’s first 3x long and -3x short Exchange-Traded Funds (ETFs) for Bitcoin and Ether in Europe next week. According to a tweet from Bloomberg Intelligence analyst Eric Balchunas, these innovative Exchange-Traded Products (ETPs) will be listed on Switzerland’s SIX Exchange. This move is significant as it expands LeverageShares’ portfolio, which already includes leveraged vehicles linked to various sectors such as semiconductors, artificial intelligence (AI), blue-chip stocks, and individual equities. Leveraged ETFs utilize derivatives and debt to amplify the daily returns of an underlying security, making them appealing to investors seeking to capitalize on short-term market movements.

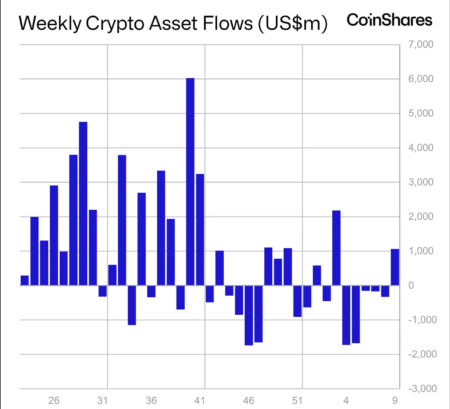

However, the timing of this launch comes amidst a backdrop of fluctuating demand for crypto ETFs. Recent reports indicate that retail investors have pulled approximately $4 billion from spot Bitcoin and Ether ETFs in November alone, surpassing the previous outflow record set in February. According to JPMorgan analysts, Bitcoin’s decline below an estimated production-cost support level of $94,000 has led to intensified selling by non-crypto-native retail holders. This occurs despite signs of stabilization in perpetual futures deleveraging since October, creating a complex scenario for potential investors in the upcoming ETPs.

In juxtaposition to the weakening crypto ETF market, retail investors have channeled around $96 billion into equity ETFs this month, including leveraged stock options. This shift highlights a stark contrast in investor behavior as traditional markets continue to face challenges. The Vanguard S&P 500 ETF (VOO), known as the world’s largest ETF with over $700 billion in assets, recently dipped below $600, marking a 5% decrease from its peak in late October. Meanwhile, the cryptocurrency market has experienced a more severe downturn, with Bitcoin seeing a 35% decrease from its early October all-time high above $126,000 and Ether suffering a more drastic 43% decline over the same period.

As traditional finance and crypto markets diverge, the introduction of leveraged cryptocurrency ETFs could attract investors aiming for higher returns in volatile environments. The leveraged nature of these ETPs allows investors to amplify their market exposure, positioning them well for potential rebounds as the market adjusts to current price levels. This could particularly appeal to experienced traders who understand the inherent risks associated with leveraging financial products and are looking to take advantage of short-term price movements.

It is essential to approach these new investment vehicles with caution. The crypto market is known for its volatility, and while the potential for high returns exists, so do significant risks. Investors should conduct thorough research and risk assessments before committing capital to any leveraged ETF. Market dynamics, investor sentiment, and macroeconomic factors all play a crucial role in the performance of these financial instruments. Moreover, the current climate of increased scrutiny from regulatory bodies toward cryptocurrency investments adds another layer of complexity to the landscape.

In conclusion, LeverageShares’ forthcoming launch of 3x long and -3x short Bitcoin and Ether ETFs is a significant development in both the European capital markets and the broader cryptocurrency space. As the landscape continues to evolve, these new products could redefine how investors engage with crypto assets. Nonetheless, understanding the risks and staying informed about market conditions is imperative for successful investment strategies. The forthcoming weeks will be crucial in determining whether interest in leveraged crypto ETFs can withstand the ongoing fluctuations in the market.