Kraken-Linked KRAKacquisition Corp Closes $345 Million IPO: A New Era for Crypto Firms

Kraken-affiliated special purpose acquisition company (SPAC), KRAKacquisition Corp, has successfully completed a significant upsized initial public offering (IPO), raising an impressive $345 million. This development marks a pivotal moment in the cryptocurrency sector, especially amid evolving regulatory landscapes and financial market conditions in the United States. The IPO reflects the increasing interest that crypto companies are garnering in public markets, showcasing a shift toward new opportunities for capital influx.

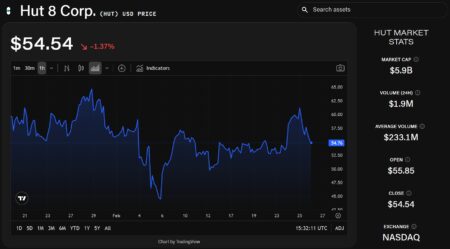

The offering included 34.5 million units, each priced at $10, with 4.5 million units sold following the underwriter’s exercise of its overallotment option. The total gross proceeds amounted to $345 million before deducting any fees and expenses, a noteworthy achievement that signals investor confidence in the crypto space. Following the debut on Friday, KRAKacquisition’s units began trading on the Nasdaq Global Market under the ticker symbol KRAQU, catching the attention of market watchers eager to explore the evolving landscape of crypto investment opportunities.

A Closer Look at KRAKacquisition Corp’s Structure

Upon its launch, each unit of KRAKacquisition consists of one Class A ordinary share and a quarter of a redeemable warrant. These warrants provide investors with potential additional value, as each full warrant is exercisable at a price of $11.50 per share. This financial structure is designed to attract a diverse array of investors aiming to capitalize on future opportunities in the evolving cryptocurrency sector. Once the units separate, the shares and warrants will trade under the ticker symbols KRAQ and KRAQW, respectively, allowing for more straightforward transactions in upcoming financial endeavors.

The underwriter for this significant offering is Santander US Capital Markets, a trusted name in the financial services industry. A registration statement for the IPO was made effective on January 27, which preceded the actual trading of KRAKacquisition’s units. This organizational setup not only provides transparency for investors but also illustrates the envisioned strategic choices the company plans to pursue.

The Sponsorship and Future Aspirations

KRAKacquisition Corp is sponsored by an affiliate of the well-established cryptocurrency exchange Kraken, along with support from Natural Capital and Tribe Capital. Such backing lends credibility to the SPAC as it seeks to navigate the complexities of the public market. The company has been formed with ambitions to engage in a future merger or acquisition, a mechanism commonly used by SPACs to provide capital and growth opportunities for emerging companies.

Importantly, KRAKacquisition has not yet identified any specific targets for acquisition and is currently in the preliminary stages of discussions. This means the firm is positioned to evaluate various prospects, keeping an open mind as the crypto industry evolves. This flexibility allows them to adapt to market conditions and emerging technologies that are reshaping the financial landscape.

Market Context and Regulatory Environment

KRAKacquisition’s IPO comes at a time when cryptocurrency-linked firms are increasingly exploring public market avenues. The changing regulatory environment in the U.S. has led many companies to rethink their strategies, prompting SPACs like KRAKacquisition to step in as an alternative route for capital raising. Unlike traditional IPOs, SPACs offer businesses quicker access to the public markets while providing investors with the chance to engage in promising ventures before they become established.

Moreover, the SEC’s evolving stance on cryptocurrencies has created an atmosphere of caution and potential opportunity. Companies that remain adaptable within this regulatory framework are likely to secure a competitive edge in the burgeoning crypto market. KRAKacquisition’s strategic positioning aims to capitalize on these shifts, providing investors with exciting possibilities.

Implications for the Crypto Investment Landscape

As KRAKacquisition begins its journey within the Nasdaq, the implications extend beyond its immediate financial success. The launch of this SPAC could herald a new wave of crypto investments, inspiring other firms within the industry to follow suit. With significant backing and a clear focus on potential acquisitions, KRAKacquisition is poised to set a benchmark for future crypto SPACs.

Investors are likely watching closely, as the performance of KRAKacquisition will serve as a litmus test for how the market responds to cryptocurrency-centric SPACs. The outcomes of this venture could influence subsequent funding strategies for other organizations in the ecosystem, encouraging more crypto startups to leverage public markets for growth.

Conclusion: A Forward-Looking Perspective

In summary, KRAKacquisition Corp’s $345 million IPO marks a landmark initiative for cryptocurrency firms, providing them with an innovative pathway to engage with investors and the public capital markets. As the company embarks on its mission, stakeholders are keen to witness the next steps in their journey, from potential acquisitions to market positioning. The successful launch of this SPAC demonstrates the continued evolution and maturation of the cryptocurrency sector, representing an era of growth and opportunity for investors and businesses alike.

As the cryptocurrency market continues to experience fluctuations due to regulatory changes and technological advancements, KRAKacquisition’s activities may shed light on the strategic avenues crypto entities can pursue. This SPAC serves as a key player in reshaping perceptions and investment strategies within the industry, inviting further exploration into the exciting world of cryptocurrencies.