Strategy’s Ongoing Bitcoin Acquisitions: Trends, Challenges, and Market Dynamics

Introduction to Strategy’s Bitcoin Strategy

In the evolving landscape of cryptocurrencies, Strategy (formerly MicroStrategy) has maintained its ambitious approach to Bitcoin acquisitions, although the pace has notably softened from its peak in November. Recent insights from K33’s Head of Research, Vetle Lunde, highlight the factors contributing to this trend, including a diminishing premium for Strategy’s Class A common stock (MSTR) relative to its Bitcoin holdings and surging competition from other corporate entities looking to bolster their treasury with Bitcoin. The momentum behind these acquisitions also reflects broader market dynamics and investor sentiment toward cryptocurrency.

Recent Acquisitions and Financial Trends

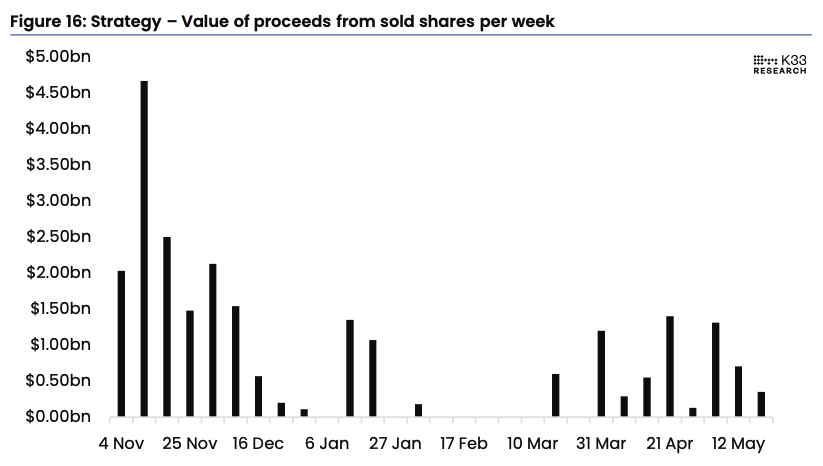

On May 29, Strategy made headlines by acquiring 4,020 Bitcoins for approximately $427.1 million, translating to an average cost of $106,237 per Bitcoin. This acquisition was financed by proceeds from its $21 billion at-the-market (ATM) equity offering, which revealed a significant decrease in capital raised—down from $705.7 million the previous week to $348.7 million for the recent acquisition. The recent pace of ATM usage indicates a stark contrast to the rapid fundraising seen during the latter part of 2023, underscoring a shift in the company’s financial strategy while it navigates a more complex market environment.

Rising Competition in Corporate Treasury Strategy

As Bitcoin continues to attract institutional interest, more companies are entering the treasury accumulation space, competing directly with Strategy’s model. Currently, over 70 companies have incorporated some form of Bitcoin treasury strategy, with newcomers like Trump Media and Technology Group recently announcing their own initiatives. Such entries create additional options for investors interested in equity linked to Bitcoin, potentially undermining demand for MSTR shares. As competition intensifies, investors are faced with a broader range of choices, which may lead to reduced willingness to invest in Strategy’s offerings.

Market Demand and Premium Dynamics

The dynamics surrounding MSTR’s market premium to its Bitcoin holdings have shown signs of fluctuation. Following substantial gains, the premium recently dropped from 185% to 163%, marking significant variability not seen since early April. This decline may reflect the increasing challenges in sustaining a high premium amidst growing Bitcoin adoption by other corporations. As Strategy expands its Bitcoin holdings, the demand from investors must keep pace to retain previous valuation levels, creating pressure on the company’s ATM fundraising strategy to adapt to the evolving landscape.

Bitcoin Holdings and Market Position

Currently, Strategy holds a substantial total of 580,250 BTC, estimated to be worth over $63.3 billion, purchased at an average price of $69,979 per Bitcoin, resulting in paper gains approximating $23 billion. This significant accumulation represents over 2.75% of Bitcoin’s capped supply of 21 million. However, as most corporate treasuries remain relatively small players in the broader Bitcoin market, Lunde emphasizes that, despite the vibrant demand for Bitcoin treasury companies like Strategy, they do not pose a substantial threat to Bitcoin’s overall market momentum.

Future Outlook and Conclusion

As Strategy navigates the fast-paced and competitive environment of Bitcoin acquisitions, it faces a complex interplay of market forces, investor sentiment, and emerging competitors. The company’s ability to adapt its fundraising strategies and respond to fluctuating market demands will be crucial going forward. The evolving landscape calls for a comprehensive understanding of both corporate treasuries and investor preferences, as the future of Bitcoin remains uncertain yet promising. The interplay between demand dynamics, competition, and the strategic moves by leading companies like Strategy will shape the narrative of Bitcoin in the coming months, influencing not only their trajectories but also broader market trends.

In summary, while Strategy has made significant strides in Bitcoin acquisition, it must navigate a slower pace and increased competition to maintain its leading position in the Bitcoin treasury space. The adjustments it makes in response to these challenges will be pivotal in determining its future success amidst the ever-evolving crypto landscape.