Federal Reserve Holds Interest Rates Steady: Insights and Market Reactions

The U.S. Federal Reserve recently decided to keep interest rates unchanged, maintaining its benchmark federal funds target range at 3.5% to 3.75%. This decision, widely anticipated by the markets, aligns with predictions from the CME FedWatch Tool, which indicated a 97% to 99% probability of maintaining rates ahead of the meeting. The Fed is currently balancing cooling inflation with indications of a softening labor market, reflecting careful economic assessment.

In the post-meeting statement, the Federal Reserve noted that economic activity continues to expand at a "solid pace," but inflation remains "somewhat elevated," leading to ongoing uncertainty regarding the economic outlook. The Fed reiterated its commitment to its dual mandate of achieving maximum employment and maintaining 2% inflation. While the committee broadly supported the decision to keep rates steady, Governors Stephen Miran and Christopher Waller were dissenters, advocating for a 25-basis-point interest rate cut.

Crypto Market Reaction to Fed Decision

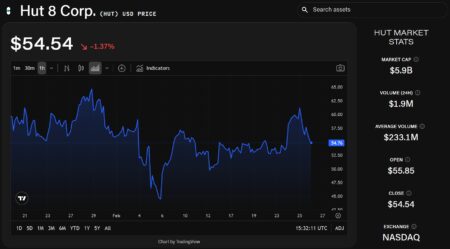

The cryptocurrency market showed a muted reaction to the Fed’s decision. Bitcoin (BTC) experienced a brief decline from approximately $89,600 to $89,000 but managed to recover some losses, last trading near $89,300, according to The Block’s price data. Ethereum (ETH) remained relatively stable around $3,000, while other cryptocurrencies, such as Solana and XRP, hovered near $126 and $1.90, respectively. Despite the Fed’s announcement, the overall sentiment in the crypto market was largely unaffected, indicating a wait-and-see approach among investors.

The Fed’s commitment to maintaining maximum employment and 2% inflation indicates that future policy adjustments will depend on assessing incoming data and the evolving economic landscape. This approach suggests a cautious outlook, which may influence liquidity and investment strategies in the long term.

Focus on Future Fed Actions

Industry experts are closely monitoring the Fed’s rate path as a key variable affecting risk assets, including digital currencies. Andrew Forson, president of DeFi Technologies, noted that the current market environment is characterized by elevated volatility. In periods of uncertainty, investments often rotate first into traditional safe havens, which can delay inflows into riskier assets like Bitcoin.

Forson emphasized that Bitcoin is still treated as a "risk-on," tech-adjacent asset; therefore, market participants are likely to hold back on significant investments until the volatility eases and the Fed’s rate expectations become clearer. The overall market sentiment remains cautious, reflecting uncertainty in monetary policy.

Institutional and Political Signals

Market analysts are shifting their attention beyond immediate rate changes, focusing increasingly on institutional leadership within the Fed. Gabe Selby, head of research at CF Benchmarks, commented that the meeting was unlikely to deliver any surprises that would move the market significantly. Instead, he highlighted that the focus is now on Fed leadership dynamics rather than just near-term rate adjustments.

Betting markets on Polymarket currently favor Rick Rieder as the next Fed chair at approximately 42%, with Kevin Warsh trailing at about 27%. This shift in interest reflects a growing anticipation of potential changes in leadership and its implications for future monetary policy.

Broader Economic Context

The Fed’s decision comes amid a broader economic landscape marked by ongoing inflationary pressures and variability in employment. With inflation still lingering above the desired 2% target, the Fed’s dual mandate remains a critical aspect of its policymaking. Officials are tasked with navigating this complexity while ensuring that employment levels are maximized.

The delicate balance between managing inflation and supporting economic growth highlights the necessity for vigilance and adaptability in monetary policy. As the Fed continues to evaluate incoming data, markets may begin to adjust their strategies in anticipation of future policy shifts that could affect risk appetites in various asset classes.

Conclusion

In summary, the U.S. Federal Reserve’s decision to hold interest rates steady signals a commitment to assessing economic indicators carefully while balancing inflation and employment objectives. The muted reaction from cryptocurrency markets reflects a cautious sentiment among investors as they await clearer signals regarding rate paths and leadership changes within the Fed. As market participants look to the future, ongoing volatility and economic uncertainties will likely continue to shape investment strategies across various asset classes. Investors and analysts alike remain committed to dissecting the complex interplay between Federal Reserve actions and market dynamics in the months to come.