Recent Trends in Crypto Investment Products: A Deep Dive

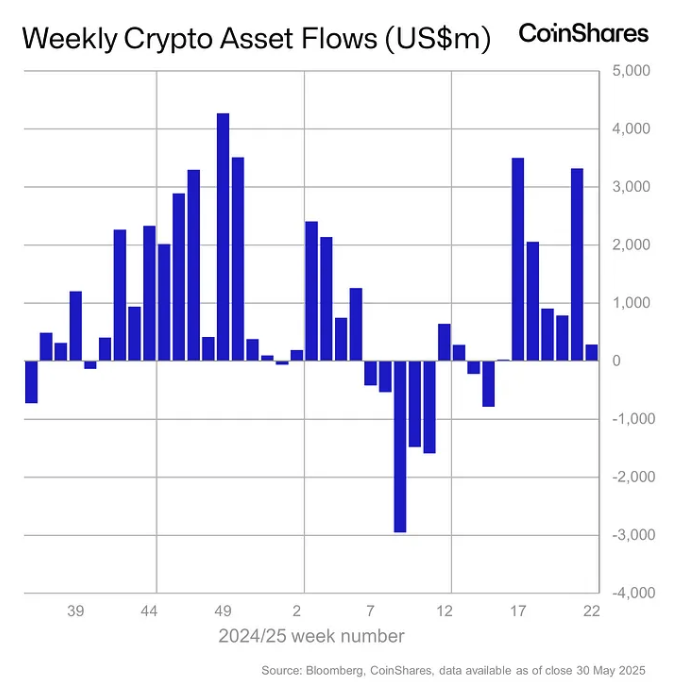

In the evolving landscape of cryptocurrency investment, notable asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares have reported substantial net inflows. According to recent data from CoinShares, these investment products accumulated $286 million globally over the past week. Interestingly, this surge comes amidst a notable performance from Ethereum-based funds, compensating for the observed outflows from Bitcoin products. This influx marks the seventh consecutive week of gains, culminating in a remarkable total of $10.9 billion over this period.

Ethereum Outshines Amidst Market Volatility

Ethereum investment products have showcased exceptional performance recently, contributing an impressive $321 million to a six-week running total of $1.2 billion—marking their strongest run since December 2024. CoinShares Head of Research, James Butterfill, attributes this success to an enhanced market sentiment around Ethereum. Notably, U.S. spot Ethereum exchange-traded funds (ETFs) accounted for a significant portion, with $285.8 million in weekly inflows, as reported by The Block.

In contrast, Bitcoin investment products, which usually dominate the market, encountered a sharp downturn following a midweek reversal. After an encouraging start, the funds experienced net outflows of $8 million by Friday. This downturn ended a substantial $9.6 billion influx over a six-week period, highlighting the unpredictability of the cryptocurrency market amid rising volatility, particularly influenced by ongoing uncertainties surrounding U.S. tariffs.

A Break in Bitcoin’s Dominance

While Bitcoin-based funds initially seemed to carry momentum, the pressures of market volatility led to disappointing performance. Despite previously enjoying a streak of inflows, the recent announcement regarding legal disputes over U.S. tariffs sparked investor caution. Thus, these funds suffered, effectively halting what was a robust period characterized by a striking $9.4 billion influx in just 34 days. This trend underscores the vulnerability of Bitcoin’s standing amidst regulatory developments and broader market fluctuations.

The situation is further complicated by continued outflows from XRP-based investment products, which reported losses totaling $28.2 million. This consistent outflow trend for XRP raises questions about the future potential of such digital assets within an investment portfolio. As investors seek more stable opportunities, the focus and sentiment surrounding various cryptocurrencies continue to shift.

Regional Investment Dynamics

Regionally, the landscape of crypto investment is also experiencing a shift. While the U.S. market remains the largest contributor with $199 million in net inflows, other regions are beginning to make their mark. For instance, Hong Kong emerged as a notable player, reporting its best weekly inflows since its exchange-traded products launched in April 2024, totaling $54.8 million. Additionally, Germany and Australia noted inflows of $42.9 million and $21.5 million, respectively, signaling a growing interest in crypto investments outside of the U.S. sphere.

However, not all regions are seeing positive movements. Swiss products faced the largest outflows, amounting to $32.8 million, suggesting a potential decline in confidence among investors within that market. This divergence illustrates the complex and varied nature of global investor sentiment towards cryptocurrencies, influenced by local regulatory environments and market dynamics.

Market Performance and Outlook

While recent inflows highlight renewed investor interest in cryptocurrency, market performance has shown signs of volatility. Over the week, Ethereum witnessed a modest decline of 2.7%, bringing its price to $2,488. Similarly, Bitcoin experienced a drop of 4%, while the GMCI 30 index, encompassing leading cryptocurrencies, fell by 6%. These fluctuations, tied to broader economic conditions and regulatory developments, warrant careful observation from investors.

The overall decline in total assets under management from an all-time high of $187 billion to $177 billion reflects the ongoing market adjustment amid these fluctuations. Investors are increasingly wary, emphasizing the importance of remaining informed in such a rapidly changing environment.

Concluding Thoughts

The current landscape of crypto investment products indicates a trajectory characterized by both opportunity and caution. While Ethereum has demonstrated significant strength and commitment from investors, Bitcoin’s recent setbacks illustrate the increasingly unpredictable nature of this market. Regional variances in inflows further amplify the complexity of navigating crypto investments, highlighting differing investor sentiments globally.

As the crypto market experiences rising volatility—largely influenced by regulatory developments—investors must stay vigilant and informed. Engaging with reliable data and expert insights will remain crucial for navigating the intricacies of crypto investments. As we move forward, the interplay between market performance, sentiment, and regulatory factors will inevitably shape the future of investment strategies within this dynamic environment.