Title: Bitcoin and Ether ETFs Face Outflows Amid Investor Caution

Introduction

In recent weeks, the cryptocurrency market has experienced significant volatility, leading to notable fluctuations in exchange-traded funds (ETFs) related to Bitcoin and Ether. After enjoying a brief period of growth, Bitcoin ETFs have now reversed course, experiencing a $173 million outflow. Meanwhile, Ether ETFs have faced continued pressure, culminating in nearly $50 million in net outflows, marking the sixth consecutive week for Ether funds to report losses. This article delves into the underlying factors driving these trends and what investors can expect moving forward.

Bitcoin ETFs: A Brief Respite Followed by Decline

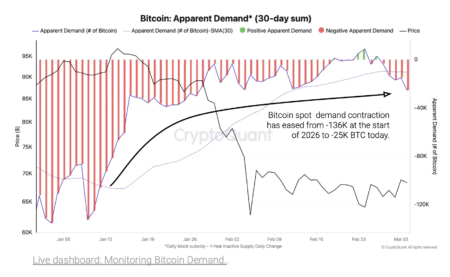

For a few weeks prior, Bitcoin ETFs had been on a winning streak, showcasing the resilience and adaptability of the cryptocurrency as an asset class. However, the recent outflow of $173 million signifies a shift in investor sentiment. Factors such as increasing regulatory scrutiny, macroeconomic pressures, and volatile Bitcoin prices have contributed to an environment of caution among investors. The reversal highlights the unpredictable nature of cryptocurrency investments and raises questions about the sustainability of earlier gains.

Ether ETFs Struggle Amid Continued Outflows

In contrast to Bitcoin, Ether ETFs have struggled significantly over the past six weeks. With nearly $50 million in outflows this week alone, the decline in interest reflects broader trends in the Ethereum ecosystem. Investors may be reacting to several market dynamics, including ongoing concerns about network congestion, scalability issues, and competition from other blockchain projects. As Ether continues to face challenges, ETFs linked to this cryptocurrency are likely to remain under pressure unless bullish trends emerge.

Market Sentiment and Economic Trends

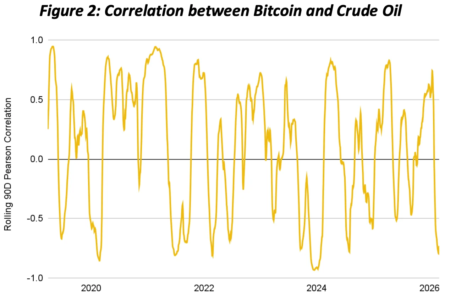

The recent outflows from Bitcoin and Ether ETFs can also be understood within the context of prevailing market sentiment. Amidst concerns about inflation, rising interest rates, and global economic uncertainty, more conservative investors may be opting to reassess their exposure to cryptocurrencies. This sentiment shift can lead to greater volatility in the crypto market, resulting in fluctuations in ETF performance as investors seek safety in more traditional assets. Understanding these macroeconomic factors is crucial for anyone looking to navigate the evolving landscape of cryptocurrencies.

Regulatory Scrutiny and Its Impact

Another significant factor influencing ETF flows is the increasing regulatory scrutiny surrounding cryptocurrencies. Regulatory bodies worldwide are assessing how to best govern this rapidly evolving space, impacting investor confidence. Uncertainty surrounding potential regulations can lead to heightened caution among investors, prompting them to withdraw funds from ETFs. Continuous developments in this area may play a pivotal role in shaping the future of Bitcoin and Ether ETFs as investors look for clarity on compliance and legality.

Looking Ahead: Potential for Recovery?

Despite the recent declines, the future of Bitcoin and Ether ETFs may not be entirely bleak. The crypto market has historically shown resilience, and there are indicators that suggest potential recovery could be on the horizon. Innovations in blockchain technology, shifts in market demand, and the possibility of new institutional investments could reignite interest in cryptocurrency ETFs. For investors, understanding these indicators and analyzing market trends will be crucial for making informed decisions in a landscape that remains highly dynamic.

Conclusion

As Bitcoin and Ether ETFs face significant outflows amidst growing investor caution, it is evident that the cryptocurrency market is experiencing a period of adjustment. Factors such as macroeconomic pressures, regulatory scrutiny, and evolving market sentiments continue to shape the behaviors of investors. While challenges persist, the potential for recovery remains, making it essential for investors to stay informed and agile as they navigate this rapidly changing environment. Understanding the interplay between external factors and market dynamics will be critical for anyone looking to invest in cryptocurrency ETFs in the coming months.