Bitcoin’s Recent Rally: Navigating the Crypto Landscape Amid Economic Uncertainty

Bitcoin has recently rebounded, reaching around $88,000 as the cryptocurrency market cautiously recovers in anticipation of a series of delayed U.S. macroeconomic data releases. The trend signals a commitment among investors to explore potential bottom formations and market stability.

Market Performance and Recovery

In this latest trading week, Bitcoin fluctuated between $85,000 and $89,150, reflecting a notable weekend recovery that lifted total crypto market capitalization to approximately $3.07 trillion. Ethereum remained steady near $2,900, while Solana saw a nearly 6% increase, trading around $136. This upsurge was largely fueled by ongoing investments into spot ETFs, highlighting a temporary relief among larger market caps despite ongoing struggles within mid-cap tokens.

Divergent ETF Flows

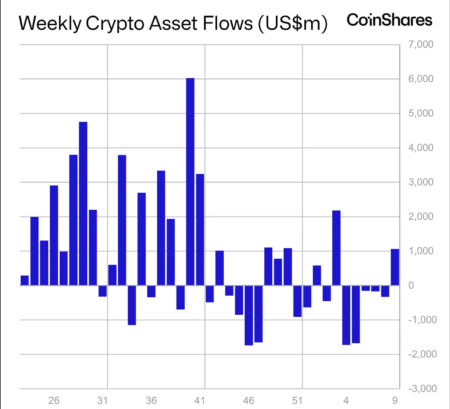

In a striking development, weekly ETF flows painted a contrasting picture. Bitcoin ETFs recorded $151 million in net outflows, continuing a prolonged trend of de-risking. Simultaneously, Ethereum and Solana ETFs drew in $97 million and $58 million, respectively, indicating a shift in institutional investor preferences. Interestingly, Solana ETFs have experienced 20 consecutive days of net inflows since their inception, suggesting strong institutional endorsement despite broader market hesitation. Conversely, the crypto-fund sector faced substantial redemptions, with global crypto ETPs experiencing $1.9 billion in outflows last week—one of the most significant declines since 2018.

Signs of Market Bottom Formation

Despite the ongoing stress on on-chain metrics, market analysts believe signals for a potential bottom are emerging. Timothy Misir from BRN Research notes that the market is transitioning from aggressive selling to a more organized unwinding phase. While many key on-chain activity metrics have notably declined, this typically points to late-stage corrections where participants retreat rather than capitulate. Even though profitability metrics remain strained, historical patterns indicate that spikes in unrealized losses may precede stabilization.

The momentum for Bitcoin’s short-term performance has improved, as key indicators rebound from oversold conditions. Market specialists observe that while options markets remain defensive, institutional activity is starting to shift positively, as seen with record daily volumes on BTC futures contracts reported by the CME. Misir suggests that the market is consolidating within an $84,000–$90,000 accumulation range, indicating the potential for volatility but also the formation of conditions conducive to a bottom.

Fed Rate Adjustments and Their Impact

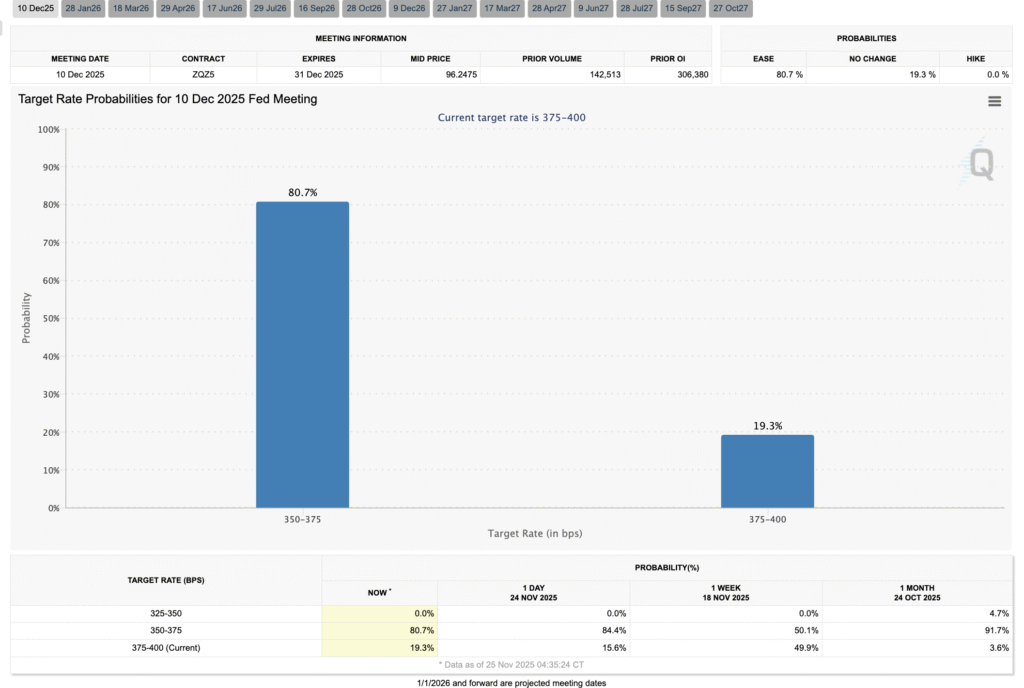

Tactical support for Bitcoin came in the wake of dovish comments from New York Fed President John Williams, who hinted at the possibility of near-term rate cuts. This shift increased the likelihood of a 25 basis point cut in December to approximately 80%, offering Bitcoin a respite despite its recent bearish trend, characterized by a decline of over 30%. A close examination of options positioning reveals that traders are hedging for potential upward movements, as seen in the open interest for December call options, which outweigh their put counterparts.

However, analysts warn that weekend price rises have often been unreliable and that critical macroeconomic data released mid-week will be key to determining whether these gains are sustainable.

Broader Macro Context

In the current landscape, macroeconomic factors are proving to be dominant drivers compared to crypto-specific influences. According to Ruslan Lienkha of YouHodler, the corrective phase in U.S. equities significantly impacts Bitcoin’s short-term outlook. Institutional investors have largely scaled down their exposure while retail investors exhibit increased levels of fear and uncertainty. This cautious sentiment suggests that while brief rallies for Bitcoin may occur, the cryptocurrency remains vulnerable should equity markets continue to decline.

Conclusion: Navigating Uncertainty

As we observe Bitcoin’s recovery and the broader market dynamics unfold, it’s crucial to remain aware of imminent macroeconomic indicators that can heavily influence this volatile ecosystem. Notably, sustained fluctuations in ETF flows, potential rate cuts, and investor sentiment will all play pivotal roles in how Bitcoin and the overall crypto market behave in the coming weeks. The resilience shown thus far during this tentative recovery may lay the groundwork for a more stable market, but participants must tread carefully amid ongoing uncertainty.

This article aims to provide insights into the current state of Bitcoin, integrating relevant SEO strategies to optimize for search visibility while effectively conveying the essential updates and investor implications.