Bitcoin and Ethereum Market Analysis: A Deep Dive into Recent Trends

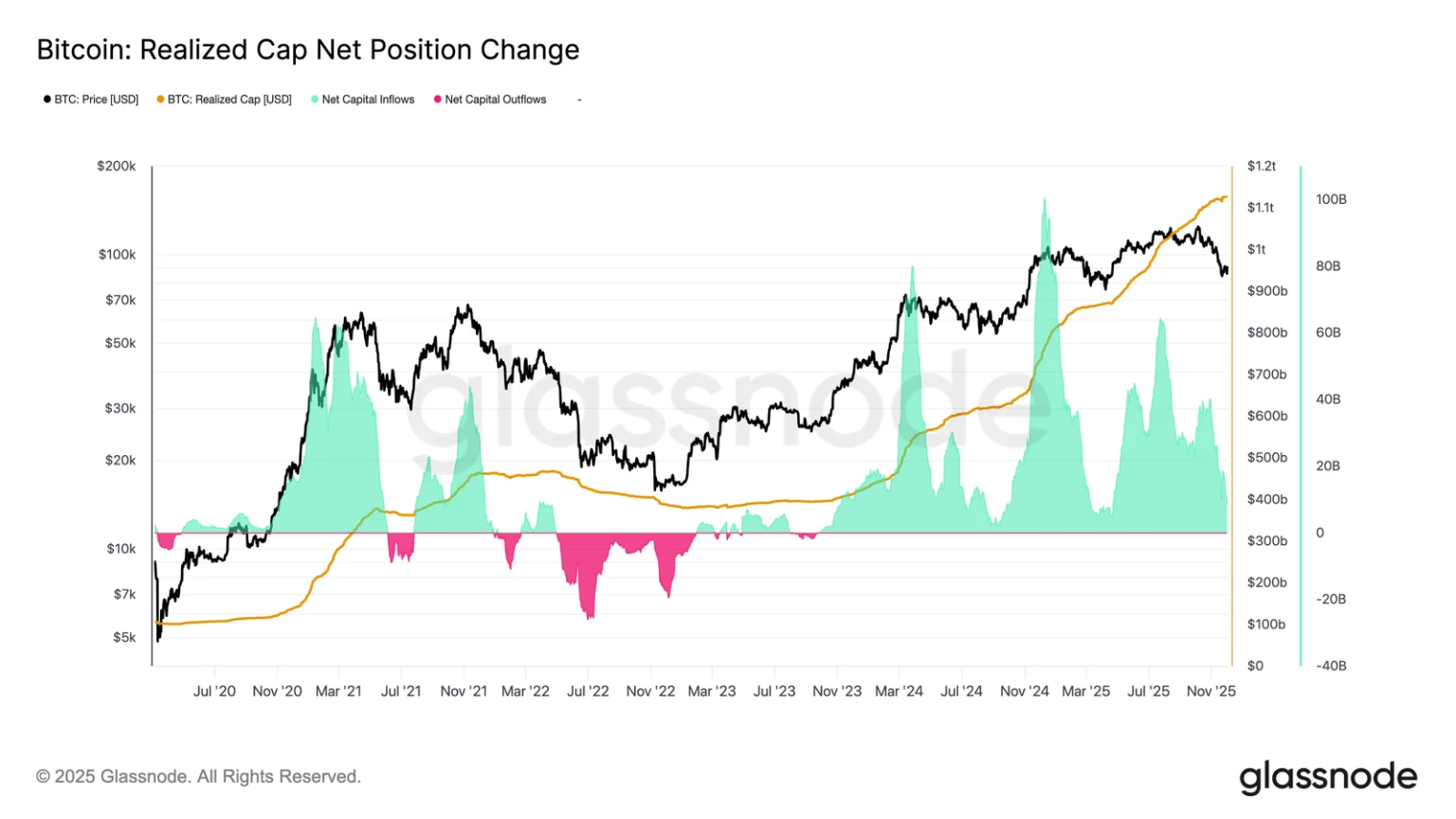

Bitcoin held its ground above $93,000 on Thursday, as on-chain data revealed a persistent trend of supply moving away from centralized exchanges. This stabilization comes after a week marked by notable volatility and liquidations in the crypto market. According to analysts at BRN Research, the underlying structure of Bitcoin continues to strengthen, despite a general lack of momentum in spot trading. Timothy Misir, the head of research at BRN, highlighted that Bitcoin exchange balances have plummeted to around 1.8 million BTC, the lowest since 2017. This decline indicates that fresh capital is entering the market even as the broader trading range tightens. Misir emphasized the need for a decisive break into the $96,000 to $106,000 range to trigger further bullish momentum.

Ethereum Outpacing Bitcoin: A Look at Network Activity

Ethereum has shown remarkable strength, outperforming Bitcoin for the second consecutive session. Misir pointed to significant accumulation by "shark" wallets—those holding between 1,000 and 10,000 ETH. The daily network growth for Ethereum surged, nearing 190,000 new addresses after the recent Fusaka upgrade. This spike in network activity reflects genuine organic expansion, which is a strong signal for Ethereum’s future performance. While Solana and BNB displayed mixed but stable trading patterns, the overall cryptocurrency market capitalization remains close to $3.2 trillion, showcasing a solid foundation for growth across the sector.

Mixed ETF Flows: A Pause for Bitcoin, Attraction for Ether

The ETF landscape presented a mixed scenario, as Bitcoin experienced a slight net outflow of $14.9 million on December 3, breaking a five-day streak of inflows. Despite this, BlackRock’s IBIT ETF emerged as a strong performer, attracting $42.24 million. Conversely, Ethereum’s spot ETFs saw robust demand, raking in $140 million in net inflows. This contrasting performance indicates that while Bitcoin may be facing short-term resistance, investors are gravitating towards Ethereum as a favorable investment option.

Easing Liquidations: Market Normalization After Volatility

Following substantial volatility earlier in the week, overall liquidations have eased significantly. Data from CoinGlass reported over $312 million in liquidations over the last 24 hours, a far cry from the billion-dollar spikes seen previously. Of the liquidated positions, about $202 million involved short sellers while approximately $110 million stemmed from long positions. This shift illustrates a more cautious stance among traders as Bitcoin consolidates beneath resistance levels. However, it is important to note that exchanges release liquidation data in a staggered manner, meaning actual figures could be higher than reported.

Supportive Macro Backdrop: An Optimistic Outlook

The macroeconomic environment is gradually becoming more supportive for cryptocurrency markets. This week, the U.S. Treasury executed a record $13.5 billion debt buyback, contributing to an incrementally positive liquidity profile. Delphi Digital posited that the Federal Reserve is likely to implement another 25 basis-point rate cut in December, thereby lowering the fed funds rate to a range of 3.50%–3.75%. Prediction tools like the CME FedWatch and Polymarket indicate a 90% likelihood for this adjustment. Additionally, the conclusion of quantitative tightening on December 1, along with a reduced Treasury General Account and a depleted RRP facility, create the first net-positive liquidity backdrop for the crypto market since early 2022.

Sector Implications: Favorable Conditions for Large Caps

Market analysts are observing a shift in policy from a headwind to a mild tailwind, favoring larger market capitalization assets, gold, and digital assets with structural demand. With these supportive conditions, investors may find renewed confidence in the cryptocurrency market, particularly in major players like Bitcoin and Ethereum. The current trends suggest that as liquidity improves, both assets could see further appreciation.

As the market stabilizes and key indicators reinforce positive sentiment, it is crucial for investors to keep an eye on significant resistance levels and emerging trends in exchanges, network activity, and macroeconomic variables. Now is an opportune time to assess entry points and strategies in both Bitcoin and Ethereum, as the landscape appears poised for a potential breakout in the coming weeks.

In conclusion, Bitcoin’s consistent performance above $93,000, Ethereum’s network growth, and the easing of liquidations present a multifaceted view of the current cryptocurrency market that combines both short-term fluctuations and long-term strategic investments. Understanding these elements will be vital for navigating the evolving landscape.