Is a New Crypto Winter Looming? Insights from Coinbase Institutional

In recent weeks, multiple signals have emerged that suggest the cryptocurrency market might be entering a new "crypto winter," as highlighted in a report from Coinbase Institutional. This speculation follows significant negative sentiment, particularly stemming from the turbulence surrounding tariff policies initiated by former President Trump. The state of the cryptocurrency market is concerning, with the total market capitalization (excluding Bitcoin) now resting at $950 billion, a stark 41% drop from its peak of $1.6 trillion in December 2024. This decline is also 17% lower than the same period last year, marking a downturn that surpasses most of the period from August 2021 to April 2022. In contrast, Bitcoin, while still hit by the bearish trends, has demonstrated relative resilience, with its price falling by less than 20%, signifying its growing dominance in the broader crypto market.

While there was a slight uptick in venture funding during the first quarter of this year, it is still down between 50% and 60% compared to the high levels seen during the 2021-2022 cycle. This steep decline in venture capital significantly hampers the inflow of new investments, particularly impacting altcoins that are generally more volatile and speculative. The reduction in market activity coupled with a tightening of financial resources fosters an environment that could propel the crypto market further into a bearish phase.

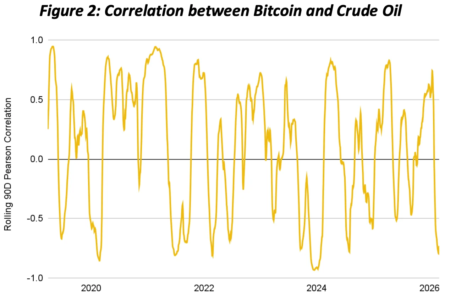

Understanding the concept of crypto winter is crucial for navigating the current market landscape. This term generally refers to an extended period characterized by depressed cryptocurrency prices and diminishing market activity, akin to a bear market in traditional finance. Unlike stock markets, where a 20% move is often viewed as a turning point, the high volatility of cryptocurrencies complicates this metric. Daily fluctuations are common, making it challenging to discern true trend shifts. David Duong from Coinbase suggests leaning toward risk-adjusted performance metrics and long-term moving averages rather than relying on conventional measures. By evaluating Bitcoin’s sharp decline in relation to its historical performance over the past year, Duong points out that Bitcoin’s significant drop had parallels within the S&P 500, indicating a correlation between broader market trends and cryptocurrency performance.

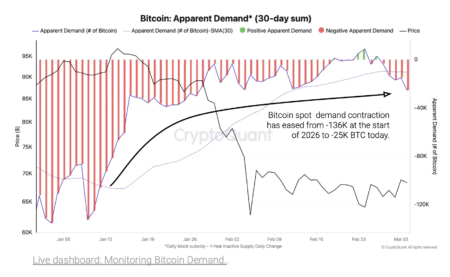

An essential tool for assessing market trends is the 200-day moving average (200DMA), which helps to smooth out short-term price noise and reveal overall market directions. A persistent trading pattern above the 200DMA indicates bullish momentum, while repeated trading below it suggests bearish conditions. While Bitcoin’s 200DMA model indicates the start of a bear market cycle as of late March 2025, analyses of the broader COIN50 index, which tracks the top 50 cryptocurrencies, reveal a more severe downturn, qualifying it as trading in bear market territory since February.

This divergence in performance between Bitcoin and the broader cryptocurrency market raises the question: Is the crypto winter upon us? Recent indications show that both Bitcoin and the COIN50 index have dipped below their respective 200DMAs, which could signify long-term bearish trends. Coupled with a reduction in total market capitalization and venture capital funding, these conditions present clear red flags for market participants. Duong notes that the uncertainties permeating the macroeconomic landscape — including fiscal tightening and disruptive tariff policies — further exacerbate the challenges in crypto investment and recovery.

Despite these headwinds, Duong advocates for a cautious yet optimistic outlook. He suggests that while the market is currently under structural stress, it may reach a bottom by mid to late Q2 2025, potentially paving the way for recovery in Q3. Should the sentiment eventually shift, changes in market dynamics could occur swiftly, leading to renewed positive action in the second half of 2025. Thus, while the current landscape seems alarming for cryptocurrencies, it is important to stay informed and agile as these markets evolve.

As the cryptocurrency market faces significant external pressures, it is crucial for investors to remain vigilant. Understanding market signals and underlying economic factors can provide critical insights into navigating this tumultuous period. Coinbase’s analysis underscores the importance of approaching the crypto market with a blend of caution and strategic optimism, highlighting the potential for recovery amidst lingering uncertainty.