The Impact of Regulatory Uncertainty on Crypto Asset Investment Products

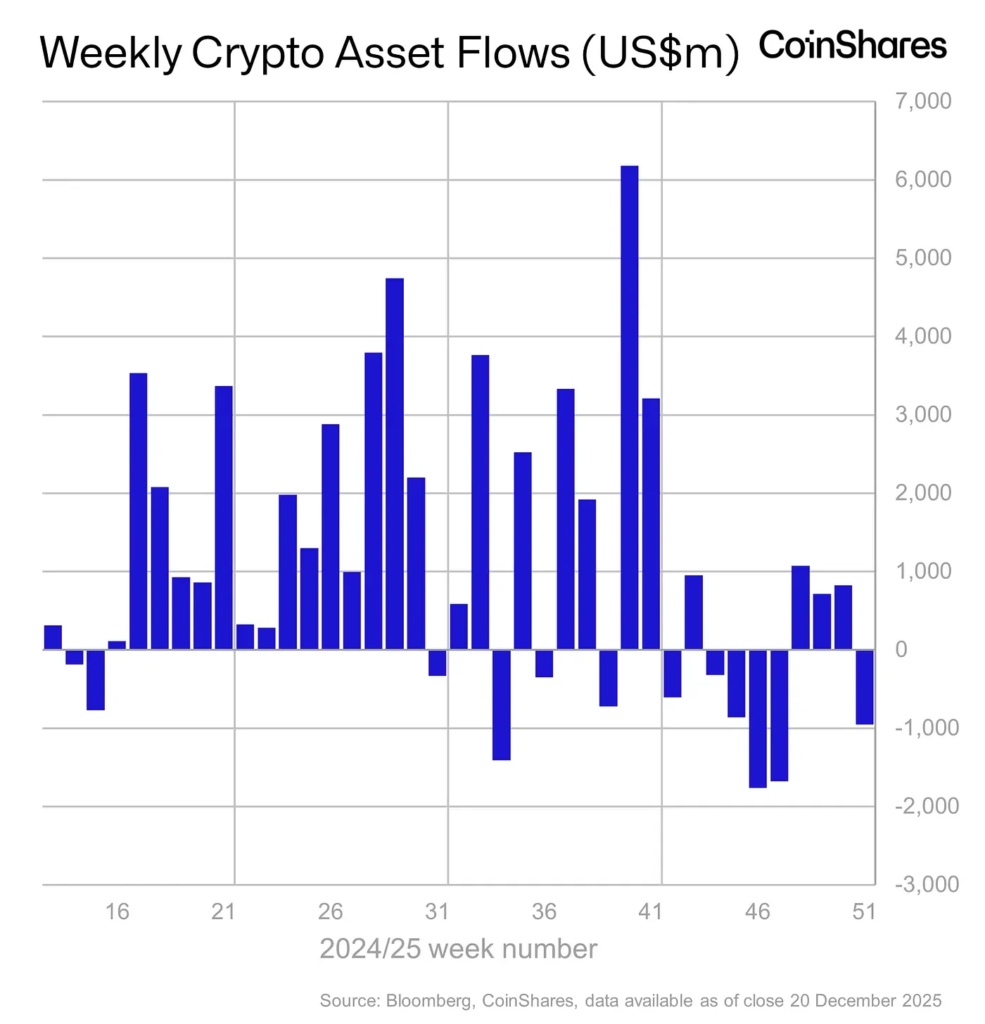

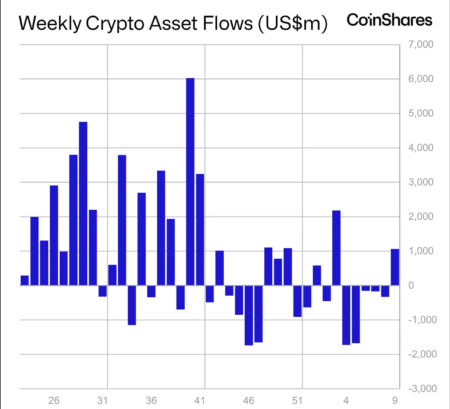

In a notable reversal, crypto asset investment products from major issuers like BlackRock, Bitwise, Ark 21Shares, and Grayscale experienced $952 million in outflows last week. This disruption has effectively overturned the previous three weeks of inflows, predominantly attributed to the delayed U.S. Clarity Act, which has rekindled fears of regulatory ambiguity and potential whale-led selling pressure. CoinShares Head of Research, James Butterfill, emphasized that this is the largest monthly outflow recorded, indicating a significant negative market reaction to the stagnant legislative advancements in Washington, D.C.

The U.S. Clarity Act aims to establish clearer regulations within the digital asset sector and was anticipated to progress before this year concludes. However, the confirmation from U.S. crypto czar David Sacks regarding the bill’s markup slated for January has only extended the uncertainty surrounding asset classification, oversight of exchanges, and obligations for issuers. This ambiguity has notably dampened market sentiment for U.S.-listed Exchange-Traded Products (ETPs) and has become a focal point in discussions among investors.

Dissecting the Outflows: U.S. vs. Global Perspectives

A staggering majority of the outflows—$990 million—were concentrated in the United States, highlighting the unique regulatory challenges faced by American investors. In contrast, Canada and Germany exhibited relatively resilient market sentiments, attracting modest inflows of $46.2 million and $15.6 million, respectively. This divergence indicates that while U.S. investors are facing uncertainty and selling pressure, international markets are still showing some optimism toward crypto assets, suggesting a potential decoupling of market sentiments on a global scale.

Ethereum emerged as the most affected asset within this bearish trend, witnessing outflows totaling $555 million. CoinShares’ analysis suggests that Ethereum could significantly gain or suffer based on the Clarity Act’s outcomes, given its central role in discussions about asset classification and the broader market structure. Despite these recent setbacks, Ethereum has garnered inflows of $12.7 billion year-to-date—substantially higher than the $5.3 billion registered in 2022—indicating that underlying demand remains resilient.

Bitcoin’s Performance: A Cooling Demand

Meanwhile, Bitcoin investment products also registered notable outflows, amounting to $460 million. While Bitcoin still holds an impressive year-to-date inflow of $27.2 billion, this figure falls short of the $41.6 billion seen in the previous cycle. This decline in demand from U.S. institutional investors, who drove significant inflows last year, raises concerns about the sustainability of market momentum moving forward.

Investors appear to be discerning in their allocations, with some major assets like Solana and XRP continuing to garner interest. Solana attracted $48.5 million in inflows, while XRP secured $62.9 million. This trend illustrates that despite broader selling pressures on flagship assets like Bitcoin and Ethereum, select cryptocurrencies are maintaining investor support based on comparative performance and market dynamics.

Projections for Future Flows and Market Sentiment

Reflecting on the current inflow figures, CoinShares projects that it is becoming increasingly improbable for this year’s total inflows to surpass last year’s record. James Butterfill remarked that the total assets under management stand at $46.7 billion, compared to $48.7 billion in the previous year. This sentiment underscores the challenges facing the crypto market due to ongoing regulatory uncertainties and market fluctuation.

Despite the bearish sentiment, Bitcoin has shown a slight uptick of nearly 2% last week and is presently trading around $89,700. Ethereum, however, has displayed more subdued price action, hovering close to the $3,000 mark. This minor recovery underscores the ongoing volatility that characterizes the crypto market, where investor sentiment remains a crucial driver for price movements.

Conclusion: Navigating the Future of Crypto Investments

As the crypto space continues to evolve in response to regulatory challenges and investor sentiment, the outcomes of pending legislation like the Clarity Act will be crucial for future market dynamics. The current outflows and variable performance among major assets indicate a period of consolidation for investors who may be re-evaluating their strategies amid shifting market conditions. The ongoing developments in regulatory clarity will likely play a pivotal role in shaping the future trajectory of crypto asset investments, particularly within the U.S. market.

For investors and enthusiasts alike, staying informed about market trends, legislative changes, and evolving investment products will be essential to navigating this increasingly complex landscape. As crypto markets seek stability and clarity, understanding the broader implications of these outflows and legislative developments will be key in identifying potential opportunities and risks within the evolving digital asset ecosystem.