The Future of the U.S. Dollar and Digital Assets: Insights from BlackRock CEO Larry Fink

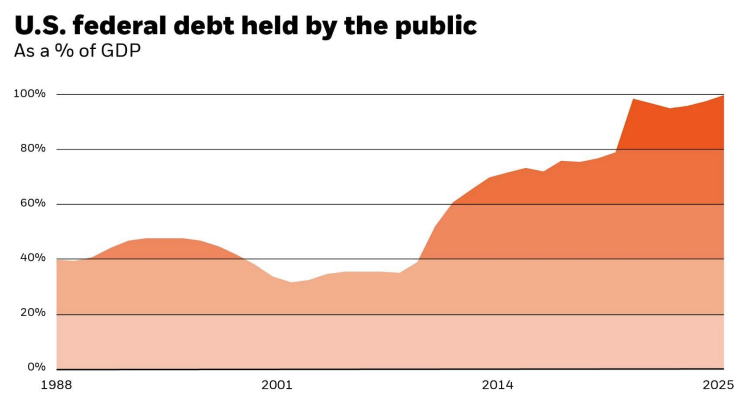

In his recent annual letter to investors, Larry Fink, the CEO of BlackRock, issued a stark warning regarding the future of the U.S. dollar and its global reserve currency status. Fink highlighted that the increasing national debt and expanding fiscal deficits pose real risks, suggesting that unless the U.S. takes considerable steps to rectify its financial situation, it could lose its standing to emerging digital assets like Bitcoin. Historically, the U.S. has enjoyed considerable advantages as the issuer of the world’s reserve currency. However, Fink argues that this privilege is not guaranteed indefinitely, particularly as the national debt has been mounting at an alarming rate—three times faster than the country’s GDP since the debt clock began tracking in 1989.

Fink reported that this fiscal year alone, interest payments on the U.S. government’s debt are expected to reach an astonishing $952 billion, which would surpass the nation’s defense spending. The trajectory of U.S. fiscal policy suggests a grim future: by 2030, mandatory spending and debt service could consume all federal revenues, leading to a chronic deficit scenario. Such alarming statistics reflect the urgent need for policy reform to address spending and fiscal responsibility.

Interestingly, while Fink is not opposed to digital assets, he warns that there’s a dual reality. “Decentralized finance is an extraordinary innovation,” he said, noting how it enhances the speed, affordability, and transparency of markets. However, he cautioned that this very innovation holds the potential to undermine America’s economic advantages if investors perceive Bitcoin as a more reliable store of value than the dollar. This sentiment serves as a clarion call for both policymakers and investors, emphasizing the need for a balanced approach to adopting innovative financial technologies without endangering the established economic framework.

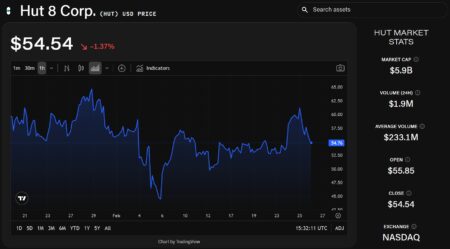

In the context of BlackRock’s recent performances, the establishment of its spot Bitcoin exchange-traded fund (ETF), IBIT, signifies a pivotal moment in the financial landscape. This fund, launched with tremendous success, amassing over $50 billion in assets under management within a year, marks the largest ETF launch in history. Inflows into IBIT exceeded $37.4 billion for 2024 and maintained a striking dominance over competitors, with Fidelity’s FBTC lagging significantly at $11.5 billion. The remarkable demand for IBIT also underscores the shift in market dynamics as more retail investors express interest in Bitcoin and digital asset investment.

Fink’s insights extend beyond Bitcoin alone, emphasizing the transformative potential of tokenization in financial markets. By moving away from outdated trading paradigms reliant on physical transactions, tokenization can enable a seamless transition toward the trading of real-world assets as digital tokens via blockchain technology. Fink compares this shift to the transition from traditional postal services to emails, underlining how tokenization would enable immediate and direct asset transfer. “Every stock, every bond, every fund — every asset — can be tokenized,” he noted, asserting that such advancements could revolutionize investing by ensuring enhanced liquidity and real-time transaction capabilities.

The democratizing effect of tokenization is profound, allowing for fractional ownership and greater accessibility to high-yield investments for a broader range of investors. This paradigm shift could potentially bridge the existing gaps between public and private markets, making investment opportunities accessible not only to wealthy individuals but also to smaller investors. By doing so, Fink believes it will empower a wider demographic, promoting wealth creation and investment participation across economic strata.

While the current economic climate breeds anxiety among investors, Fink’s message is ultimately one of resilience and hope. He acknowledges that economic fluctuations are part of historical cycles and reassures stakeholders that the economy has historically stabilized over time due to human ingenuity and the robust nature of capital markets. Fink’s vision for the future calls for continued innovation and adaptation, ensuring that while the U.S. addresses its fiscal challenges, it also embraces the transformative potential of digital assets and underlying technologies like tokenization to enhance market efficiency and accessibility.

In summary, Larry Fink’s illuminating insights on the future of the U.S. dollar amidst the rise of digital assets serve as a timely reminder for the need for financial reform and adaptability in a rapidly evolving economic landscape. Both investors and policymakers must heed his warnings about the implications of mounting debt, while at the same time exploring the opportunities presented by innovative financial technologies that promise to shape the dynamics of investment in the coming years. By embracing change judiciously and maintaining fiscal responsibility, the U.S. can work towards preserving its economic advantages and security, even as new forms of currency and investment continue to emerge.

1 Comment

How to follow crypto news