The Current Crypto Landscape: Exciting Developments and Untapped Potential

As Bitcoin (BTC) and Ethereum (ETH) hover near all-time highs, the cryptocurrency market is experiencing a wave of bullish enthusiasm. Industry leaders, like Bitwise CIO Matt Hougan, emphasize that while many developments are factored into current valuations, several significant trends remain underestimated. This article explores these key developments that could further propel the crypto market toward new heights by the end of 2025.

Positive Momentum in Regulation and Adoption

According to Hougan, a positive shift is happening in global regulations and legislation impacting the cryptocurrency sector. Regulatory advancements are increasingly favorable for enhancing market stability and institutional adoption. Stablecoins are also gaining traction, offering a viable alternative to traditional currencies, which paves the way for broader crypto acceptance. Growing corporate interest is substantial, with major companies incorporating cryptocurrencies into their treasury strategies, thus invigorating market confidence. Institutions, too, are gradually increasing their allocations into cryptocurrencies via Exchange-Traded Funds (ETFs), indicating a more pronounced acceptance of digital assets in traditional finance.

The “Three Horsemen” of Bitcoin Demand

A significant factor impacting Bitcoin’s future performance is the potential for increased government adoption. Hougan mentions what he terms the “Three Horsemen of Bitcoin Demand”: ETFs, corporations, and governments. While ETFs have amassed a staggering amount of Bitcoin—surpassing 183,126 BTC valued at approximately $22 billion—corporate treasuries are also contributing significantly by acquiring 354,744 BTC, valued at about $43 billion. However, government engagement has yet to reach the expected levels. Notable exceptions include minor initiatives by countries like Pakistan and Abu Dhabi, but interest from central banks, such as the Czech Republic, is quietly building. The realization of even a few government announcements could serve as a powerful catalyst for sustained price growth.

Interest Rates and Bitcoin’s Stability

Another intriguing aspect is Bitcoin’s resilience at near all-time highs in the face of historically high interest rates. While the market anticipates potential rate cuts by the year’s end, Hougan believes larger shifts are on the horizon. Recent signals from the Trump administration suggest a desire for a weaker dollar and a more dovish stance from the Federal Reserve. The appointment of Stephen Miran to the Fed’s Board of Governors aligns with the thoughts of more aggressive monetary policy adjustments than the market currently prices in. A shift toward significantly lower rates could bolster Bitcoin’s attractiveness, presenting unique investment opportunities amidst economic fluctuations.

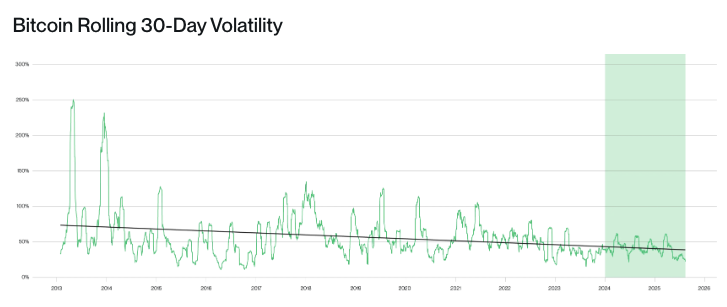

Volatility Trends Encouraging Institutional Investment

Since the launch of spot Bitcoin ETFs in early 2024, the volatility of Bitcoin has significantly decreased, positioning it similarly to high-volatility technology stocks like Nvidia. This reduced volatility has prompted institutional investors to reconsider their portfolios, with many starting to allocate 5% or more toward Bitcoin. Increased ETF inflows of $5.6 billion since July illustrate this growing interest, and with expectations for that trend to continue, we may witness even larger institutional investments in the coming months.

Potential for an ICO Revival

Amid a backdrop of evolving regulations, Initial Coin Offerings (ICOs) might be set for a resurgence. Despite a tumultuous past, SEC Chair Paul Atkins’ "Project Crypto" initiative is proposing clearer regulations and safe harbors for ICOs and related ventures. This could lead to the emergence of a "ICO 2.0" landscape, ultimately allowing for more transparent market participation and unlocking new streams of capital and resources for the crypto sector.

Conclusion: Oversights in Bull Market Potential

In conclusion, while the crypto market is already in a favorable position, it seems to be underappreciating the scale of ongoing bullish developments. Hougan reminds investors that markets respond positively not just to good news, but to news that hasn’t yet been fully accounted for in pricing. With several catalysts poised to influence the crypto market significantly, from government adoption and institutional investment to regulatory advancements, the future for cryptocurrencies looks promising. Investors and market participants should stay vigilant, as these developments could herald substantial price movements in the crypto space.

Disclaimer

This article provides informational content and should not be considered as financial, legal, or investment advice. As always, it is prudent to conduct thorough research and consult with a financial advisor before engaging in cryptocurrency investments.