Bitcoin Market Update: Analyzing the January Volatility and Future Prospects

Bitcoin (BTC) experienced a notable breakout attempt in early January 2024, aiming to surpass the $90,000 mark. However, this effort has faltered, with prices retreating back below this critical threshold. Analysts indicate that this setback stems from a dense band of overhead supply that has emerged as a key structural constraint. After displaying signs of seller exhaustion at the year’s inception, Bitcoin managed a bounce towards its multi-month range, momentarily trading close to $98,000. Yet, this upward momentum stalled around key cost levels, revealing that many investors were prepared to capitalize on the rise by selling into strength.

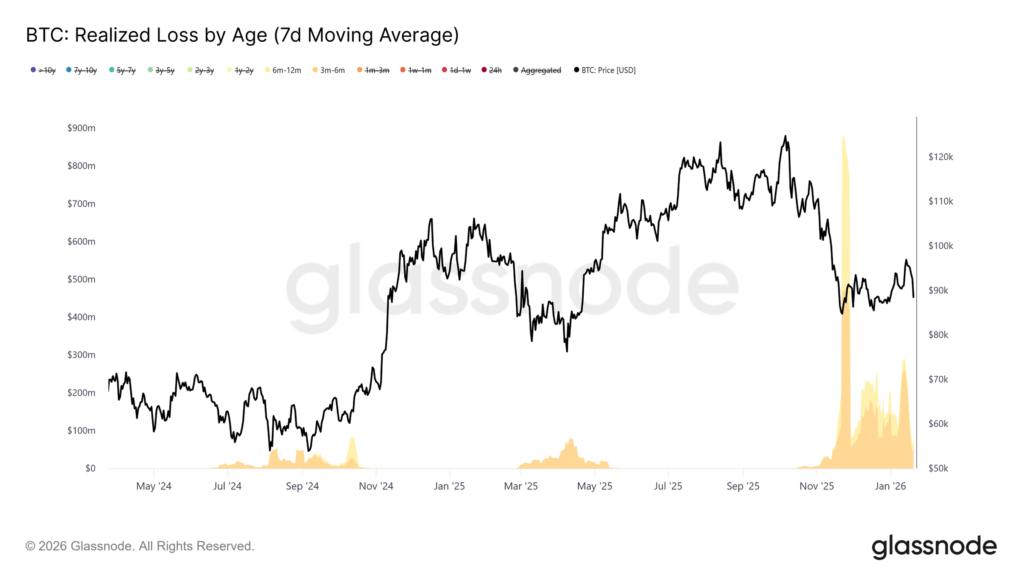

According to on-chain analytics firm Glassnode, the recent rejection of Bitcoin near the short-term holder cost basis of approximately $98,000 mirrors similar market behaviors observed in early 2022. During that period, repeated failures to reclaim breakeven levels prolonged market consolidation. Glassnode emphasized that an ongoing "supply overhang" exists, as recent buyers continue to face significant resistance, thereby constraining any potential upward momentum. This repetitive pattern indicates that any rallies may remain vulnerable to distribution until the overhead supply loosens.

Recent on-chain data has revealed that selling pressure predominantly originates from investors who had accumulated Bitcoin between early and mid-2025. These investors are now starting to exit their positions as prices drift back into their original entry ranges. Glassnode points out that loss realization characterizes the actions of holders in the three-to-six-month category. In contrast, profit-taking predominantly reflects traders locking in modest gains rather than pursuing longer-term bullish trends. This dynamic is typical of transitional markets, characterized by low conviction and cautious behavior.

Despite this cautious atmosphere, conditions in the spot market have shown modest improvement. Analysts have observed a decrease in sell-side pressure across major exchanges, suggesting a shift towards more buy-dominant conditions. The cumulative volume delta has turned positive, and the selling activities led by Coinbase have slowed down after a lengthy period of distribution. Nevertheless, Glassnode maintains a cautious outlook, noting that accumulation remains selective. This lack of aggressive demand fails to align with the sustained upward momentum generally associated with more robust market trends.

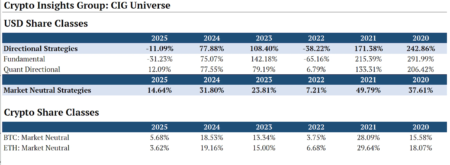

Moreover, institutional and corporate interest in Bitcoin has shown uneven patterns. While corporate treasury activity has remained quite sporadic, derivatives participation has witnessed minimal engagement, with futures volumes compressed and leverage utilization subdued. Options markets exhibit similar hesitance, with volatility primarily concentrated at the front end of the curve. This cautious sentiment emphasizes the prevailing uncertainty, as investors appear reluctant to make significant commitments in the current landscape.

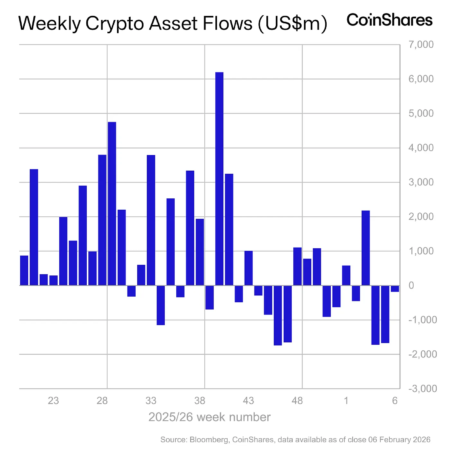

The recent failed breakout has coincided with renewed macroeconomic pressures, particularly as Bitcoin dropped below the $90,000 mark amidst global market volatility. Factors such as turmoil in Japanese government bonds and rising geopolitical tensions have resulted in over $1 billion in liquidations. Furthermore, recent reports indicate that U.S. spot Bitcoin and ether exchange-traded funds (ETFs) experienced nearly $1 billion in combined outflows, reversing last week’s positive inflows. This trend highlights fragile sentiment among institutional investors, raising concerns about market stability.

Nevertheless, the analysts have cautioned against interpreting this pullback as a definitive breakdown of market structure. Instead, Glassnode characterizes the current phase as a necessary pause, driven more by limited participation than by aggressive selling. The firm suggests that the market is quietly building a base, indicating that consolidation is in progress as traders anticipate a clearer catalyst to absorb the overhead supply that has been constraining Bitcoin’s growth. As of the latest reports, Bitcoin trades near $89,900, signaling a critical juncture for the cryptocurrency as it awaits signals conducive to renewed demand.

In conclusion, while Bitcoin’s recent attempts to break above the $90,000 level have faced notable challenges, the broader market dynamics reflect a complex interplay of cautious participation and macroeconomic influences. Investors must remain vigilant as Bitcoin navigates this intricate phase, with analysts suggesting that the foundation for future growth could be quietly forming beneath the surface. Understanding these nuances will be vital for stakeholders looking to capitalize on the evolving landscape of Bitcoin and the wider cryptocurrency market in 2024 and beyond.