Bitcoin’s Surge: Institutional Flows and the “Buy-the-Dip” Sentiment

Bitcoin’s recent rally to $104,000 was significantly fueled by institutional flows and a prevalent "buy-the-dip" sentiment, as noted in a weekly report from Glassnode. Following a drop to $75,000 on April 9, a gradual accumulation phase began, characterized by increased buying activity. Notably, the weekly average net inflows into Wall Street Bitcoin wallets soared to an impressive $389 million per day by April 25, with a peak net inflow of $933 million on April 22—the largest single-day inflow since mid-January. However, despite a cooldown in ETF inflows to about $58 million daily, institutional interest in Bitcoin remains robust, signaling a continuing bullish outlook.

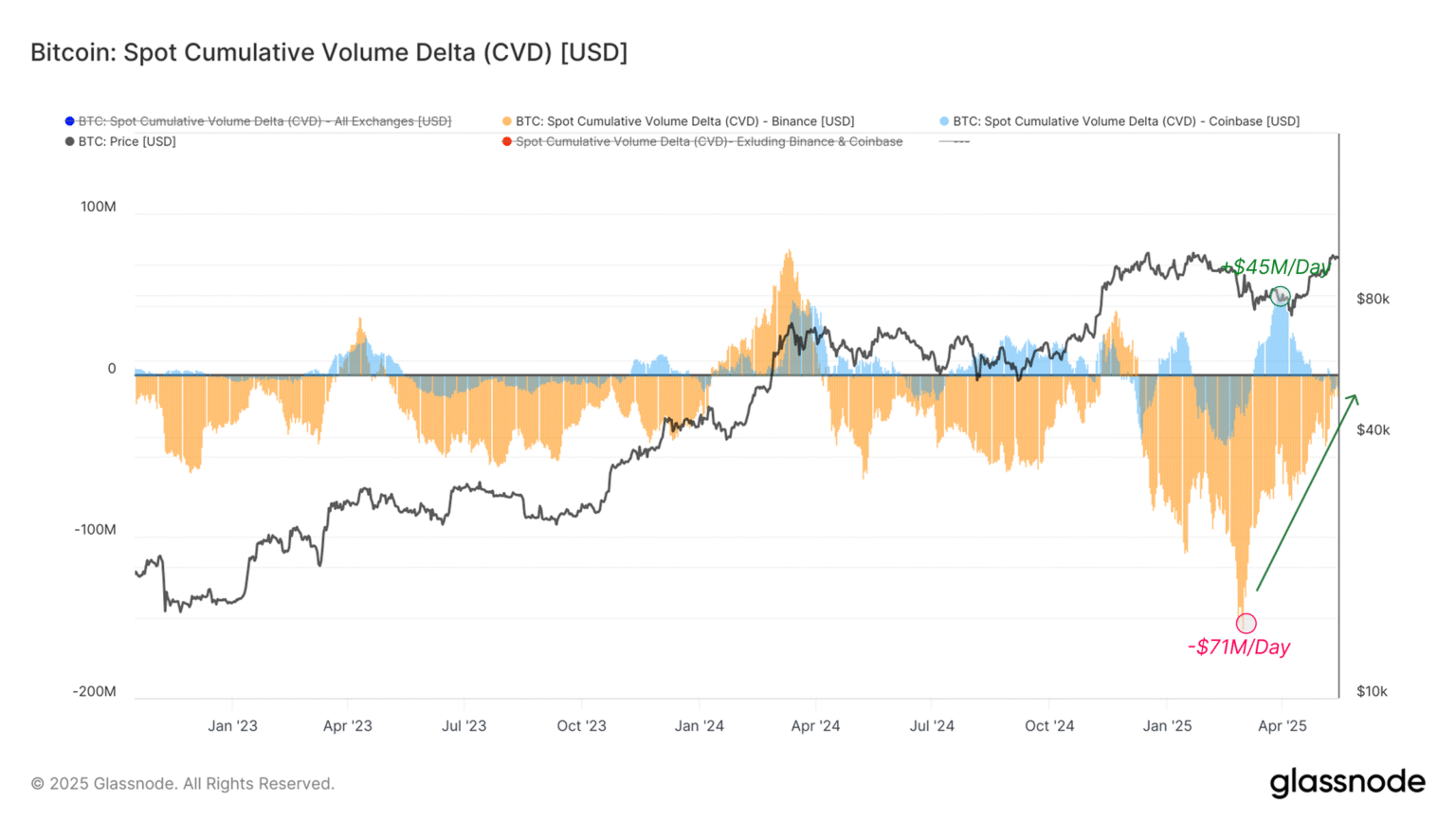

Exchange Activity and Market Dynamics

The report from Glassnode highlighted how the recent institutional capital flows coincided with heightened buying pressure on Coinbase, contrasted with diminished sell orders on Binance. The Spot Cumulative Volume Delta (CVD)—a metric that tracks net buys versus sells on spot order books—indicated that Coinbase traders were allocating as much as $54 million per day toward Bitcoin purchases of late. Conversely, daily sell-offs on Binance decreased sharply from approximately $71 million to around $9 million, indicating a significant shift in market behavior and investor sentiment. This emerging confluence of demand from spot BTC ETFs and crypto exchange traders created a “stair-stepping” accumulation trend, wherein the dwindling supply inventory at specific price points acted as a catalyst for upward price movements.

Short-Term Holder Dynamics

Among those entering the Bitcoin market in the last 155 days, a substantial number of short-term holders acquired assets between $93,000 and $95,000, making the recent surge to $104,000 quite significant. This move increased the Short-Term Holder (STH) Supply in Profit/Loss Ratio to 9.0, meaning around 90% of these holders were experiencing profits. Analysts at Glassnode indicated that this wave of unrealized gains may provoke profit-taking behaviors among short-term holders, contributing to Bitcoin’s recent price fluctuations between $102,000 and $103,700. The dynamic nature of the market, underscored by profit-taking, raises questions about short-term sustainability and potential corrections.

Technical Indicators and Market Sentiment

Valentin Fournier, a lead research analyst at BRN, commented on the technical indicators, suggesting a "mild sell signal" ahead of the weekend. While the market appears overbought, there are no strong reversal signals currently evident. Given that institutional activity often wanes over weekends, there’s a heightened risk of a price drift lower in the absence of sustained buying pressure. Regardless, Glassnode analysts propose that the $93,000 to $95,000 range may provide a robust support level against significant price declines, representing a demand zone where buying interest could reignite.

The Future Outlook for Bitcoin

With the current market dynamics and substantial institutional interest, many are keenly observing how Bitcoin will respond to potential corrective pressures. The prevailing "buy-the-dip" sentiment continues to motivate both new and existing investors, fostering an environment where opportunistic buying could set the stage for future price increases. The interplay between short-term holders recognizing profits and the sustained accumulation from institutions suggests a complex market landscape that could be pivotal in shaping Bitcoin’s trajectory in the near term.

Conclusion: Navigating Volatility in the Bitcoin Market

In summary, Bitcoin’s ascent to $104,000 illustrates the intricate relationship between institutional flows and market sentiment, particularly among short-term holders. While current indicators suggest that caution may be warranted due to market overextensions, the established support zones and institutional backing could buffer against severe downturns. As the crypto landscape continues to evolve, remaining vigilant and adaptable amid market changes will be crucial for investors looking to navigate the inherent volatility that characterizes Bitcoin trading.

By understanding the forces at play, from institutional interest to individual trading behaviors, investors can make informed decisions that position them favorably within this dynamic marketplace.