Bitcoin’s Recent Fluctuations: Navigating Market Dynamics

Bitcoin has shown signs of recovery, edging higher as crypto markets seek stabilization after recent volatility characterized by ETF redemptions and heightened retail selling. As of Thursday, Bitcoin has surged approximately 2.7%, reaching around $93,000—an encouraging rebound from lows below $90,000. However, despite this uptick, the cryptocurrency remains below critical structural levels observed by onchain analysts, highlighting the ongoing tension in the market.

Diverging Trends in Investor Behavior

Timothy Misir, head of research at BRN, has shared insights into the current onchain conditions. He noted that Bitcoin has fallen below the 0.75 cost-basis quantile, a boundary that typically distinguishes minor pullbacks from more significant trend reversals. Misir emphasized that Bitcoin is now "pressuring the Active Investors zone," a pivotal area that will determine the next direction of the asset. Interestingly, larger wallets holding over 1,000 BTC have increased their holdings by 2.2%, marking the highest growth seen in four months, while smaller retail wallets have been reducing their positions. Misir commented that the current gains could be interpreted more as stabilization following capitulation rather than the onset of a new bullish momentum.

Market Cap and Performance of Altcoins

The total cryptocurrency market capitalization has bounced back above $3.2 trillion, albeit with thin market depth following last week’s deleveraging. While Bitcoin has gained traction, other cryptocurrencies are also displaying notable performance. Ether managed to retain its position around the $3,000 mark after a tumultuous week, while Solana stood out with a commendable 3% rise to approximately $142. The market’s mixed performance indicates a complex landscape, with different cryptocurrencies navigating distinct trajectories amidst overarching market trends.

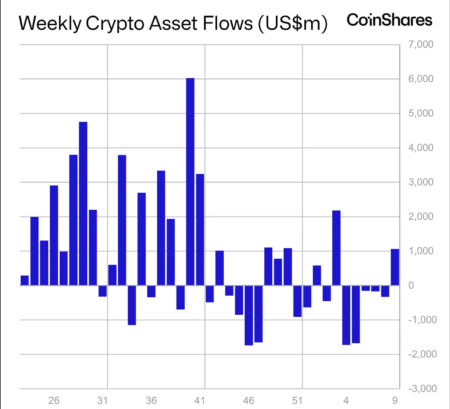

ETF Dynamics: A Temporary Cushion for Bitcoin

The fluctuation in exchange-traded funds (ETFs) seems to have provided a temporary cushion for Bitcoin’s price increase. Recent data reveals that U.S. spot Bitcoin ETFs recorded $75 million in net inflows—the first positive day after four consecutive days of significant outflows. Conversely, ether ETFs have not fared as well, showing $37 million in net outflows, marking a continued decline over the last week. However, Solana ETF products continued to attract attention, recording an impressive $55 million in inflows.

This backdrop—coupled with optimistic sentiment following Nvidia’s strong earnings report—has also played a role in influencing market movement. While Bitcoin has shown resilience, broader market confidence remains subdued. The condition of open interest in derivatives has been diminishing, funding rates are neutral, and The Block’s Fear & Greed Index reflects a landscape of extreme fear. Currently, Bitcoin’s year-to-date performance indicates a near 2% decline, underscoring the market’s recent selloff that has erased earlier gains.

Federal Reserve’s Conditional Stance

Adding complexity to the market dynamics, the Federal Reserve’s latest meeting minutes failed to provide clarity for traders who were hoping for imminent rate cuts. While there are signs of improving inflation, policymakers have emphasized the necessity for "confirmation before cuts." This cautious language signals that while easing is a potential future outcome, it is not guaranteed, dampening broader risk sentiment. The conditional messaging from the Fed appears to have restrained market movements, preventing the formation of any strong, directional trading strategies centered around anticipated policy support.

The Dual Influence of Technology and Bitcoin Sentiment

As market observers note, Nvidia’s recent earnings report had the effect of elevating sentiment in the tech sector, offering temporary relief to risk markets. The chipmaker announced fiscal third-quarter revenue of around $57 billion, alongside optimistic guidance of approximately $65 billion for the next quarter. This positive news has helped stabilize risk assets, especially after a period marked by notable downward shifts led by cryptocurrencies.

According to Nic Puckrin, co-founder of The Coin Bureau, Bitcoin has exhibited varied behavior in recent days, influenced by conflicting news sources. He highlights that if the favorable mood in the tech industry endures into the weekend, Bitcoin might follow suit. Notably, Bitcoin has experienced a prolonged downturn, with today’s upward movement possibly indicating a turning point in its trajectory.

Conclusion: Navigating the Future of Bitcoin

Looking ahead, resistance levels become increasingly relevant. Puckrin identifies $107,500 as a key resistance point should upward momentum become established, while $75,000 stands as a significant support level amid potential macroeconomic uncertainties. As traders and investors navigate this complex landscape, the interplay between technological advancements, regulatory news, and market sentiment will remain essential in shaping the future of Bitcoin and the broader cryptocurrency market.

In these rapidly changing times, staying informed and mindful of market signals will be crucial for participants in the crypto space. It’s clear that while Bitcoin has shown signs of recovery, the road ahead will be defined by volatility and the ongoing tug-of-war between bullish and bearish forces in the market.