The Crypto Market: Navigating the Recent Dip and Its Implications

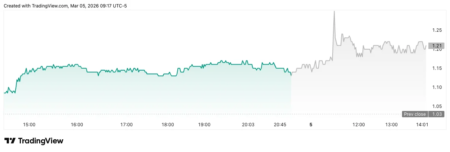

The cryptocurrency market has recently encountered a significant downturn, particularly on Sunday when major international markets opened. This sudden shift contributed to Bitcoin’s fall below the critical $80,000 mark for the first time since early March. Over a quick two-hour period, Bitcoin experienced a decline of more than 3%, culminating in an overall drop of 3.4% within a 24-hour span, as reported by The Block’s Bitcoin Price index. This decline has raised concerns among investors, especially considering that Bitcoin’s largest competitor, Ethereum, faced an even tougher blow, plummeting nearly 8% in the same timeframe. The current ETHBTC ratio now stands at a near five-year low, according to TradingView data.

The overall impact on the cryptocurrency landscape has been notable, with the top 30 cryptocurrencies witnessing an average drop of over 6% in the last day, as detailed by The Block’s GMCI 30 index. This decline is exacerbated by a year-to-date downturn of more than 32% within the index. Amid this sea of red, a few coins, such as Pi Network (PI) and ZCash, have surprisingly shown resilience, with gains of approximately 1.52% and 0.7%, respectively. Such contrasting performances highlight the volatility and unpredictable nature of the crypto market.

The timing of this dramatic dip aligns closely with recent geopolitical events, particularly the actions of U.S. President Trump, who has taken a firm stance on tariffs imposed on various nations. The president’s announcements throughout the weekend did not suggest any potential easing of these tariffs, leading to substantial stock market declines—the worst performances observed since 2020. Investors are rightfully concerned about the potential wider implications for the economy and, by extension, the cryptocurrency market, as these macroeconomic factors tend to ripple through all asset classes.

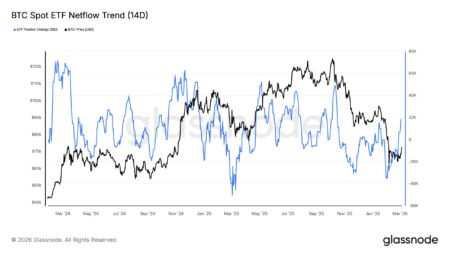

Eric Chen, CEO of Injective, previously discussed with The Block how Bitcoin has exhibited more stable performance relative to altcoins. He attributes this resilience to a fundamental shift in Bitcoin’s market structure following the introduction of Exchange Traded Funds (ETFs). Chen suggests that the increase in demand from retirement accounts, macro funds, and corporate treasuries—like MicroStrategy and GameStop—has fundamentally altered Bitcoin’s market landscape. This evolution may provide Bitcoin with a buffer against volatility, distinguishing it further from its altcoin counterparts, which seem more susceptible to market fluctuations.

Despite these declines, it’s crucial for investors and enthusiasts to remain informed and adaptable in the face of market changes. The crypto sector, while often characterized by significant ups and downs, also offers opportunities for astute investors who can differentiate between transient dips and meaningful trends. Staying abreast of market news, regulatory developments, and macroeconomic indicators will be paramount for anyone engaged in cryptocurrency investment.

As we look ahead, the question remains whether this downward trend will persist or if it signals a potential turning point for the cryptocurrency market at large. While technical indicators and market sentiment lean towards caution in the short term, the resilience shown by certain cryptocurrencies amidst broader declines could indicate a more diversified recovery path. Whether Bitcoin will successfully leverage its changing market dynamics to emerge stronger from this period of uncertainty will be a focal point for investors as they navigate the intricacies of the evolving crypto landscape.