U.S. Spot Bitcoin ETFs See Record Inflows, Sparking Investor Interest Amid Market Volatility

U.S. spot Bitcoin exchange-traded funds (ETFs) recently demonstrated a remarkable resurgence, with net inflows totaling $524 million on one notable Tuesday. This figure represents the highest daily inflow since the cryptocurrency reached its all-time peak of approximately $126,000 on October 6. The leading player in this growth was BlackRock’s iShares Bitcoin ETF (IBIT), which contributed $224.2 million. Notably, other significant contributors included Fidelity’s Bitcoin ETF (FBTC) at $165.9 million, Ark Invest’s ARK Bitcoin ETF (ARKB) at $102.5 million, followed by Grayscale and Bitwise, which brought in $24.1 million and $7.3 million, respectively. These inflows have occurred despite Bitcoin experiencing a price drop of around 3% on that day, highlighting a distinct investor interest in these ETFs during market fluctuations.

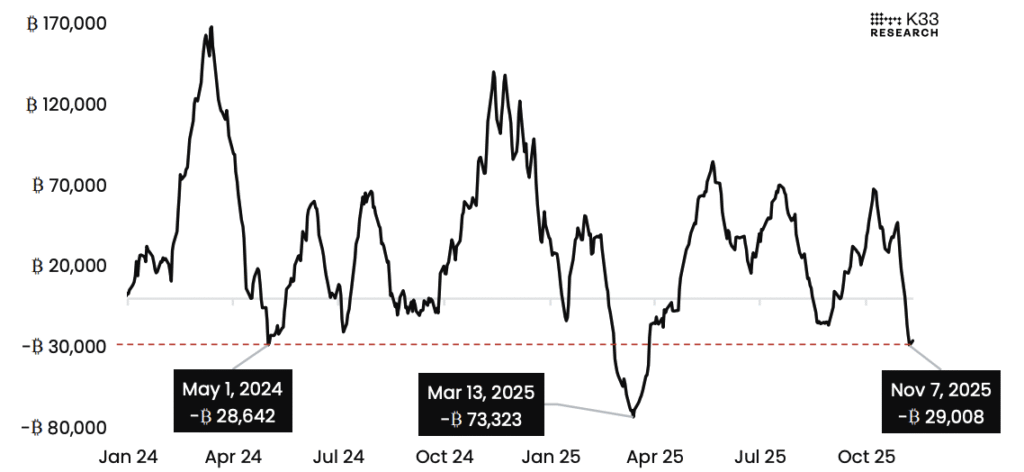

Since their launch in January 2024, Bitcoin ETFs have accrued substantial total net inflows of $60.8 billion, with cumulative trading volume nearing the $1.5 trillion mark. This data underscores the significant role these financial products play in the overall cryptocurrency ecosystem, reflecting growing confidence among investors. Following a period of cooling demand, especially in the wake of a major deleveraging event, analysts are observing a shift in investor sentiment. The 30-day inflow figures have dipped to -29,008 BTC, marking the lowest flows observed since March 2025. However, experts like K33’s Head of Research Vetle Lunde are confident that this trend is likely a temporary blip, suggesting that net inflows will recover as market conditions stabilize.

The recent inflows into Bitcoin ETFs signify a cautious optimism among investors, with many betting on future gains despite the current price corrections. Market analysts note that while current inflow periods may be episodic, they believe that sustained demand will drive Bitcoin prices toward the critical $108,000-$110,000 range. Timothy Misir, BRN’s Head of Research, indicated that crossing this battleground requires not just sporadic investments but consistent and robust inflows. Thus, the current inflow surge is pivotal in shaping investor outlook as they look ahead to potential price recoveries and market stability.

In contrast to the upbeat figures for Bitcoin ETFs, U.S. Ethereum ETFs have faced challenges, reporting net outflows totaling $107.1 million on the same Tuesday. Grayscale’s Ethereum product led these outflows with a substantial $75.7 million, contributing to a negative trend for the month that has seen nearly $615 million in total outflows. This stark contrast highlights the differing investor sentiments towards Bitcoin compared to Ethereum, emphasizing Bitcoin’s status as a more preferred asset at this moment.

Amid the ups and downs in Bitcoin and Ethereum, the newly launched U.S. spot Solana ETFs have noted a positive performance, bringing in $8 million on Tuesday. Grayscale’s GSOL surpassed Bitwise’s BSOL for the first time, with inflows of $5.9 million and $2.1 million, respectively. The cumulative inflows since their launch on October 28 now stand at approximately $350.5 million. This growth portrays Solana as a notable contender in the cryptocurrency market, demonstrating resilience and attracting investor interest despite broader market trends.

Lastly, the recently launched U.S. spot ETFs for HBAR and Litecoin had a quieter day, recording zero inflows. Cumulatively, these ETFs have managed modest inflows of $71.1 million and $4.5 million, respectively, since their debut on October 28. This slow uptake could signify investor caution or a divergence in interest towards different cryptocurrencies at present. Overall, the divergent trends within the cryptocurrency ETF landscape illustrate the dynamic nature of the market, where investor sentiment can shift rapidly based on broader economic conditions and perceptions of various assets.

In conclusion, the resurgence in Bitcoin ETF inflows marks a pivotal moment in the cryptocurrency investment landscape. Despite early hurdles and a sharply fluctuating market, investor confidence seems to be rallying around Bitcoin, while the performance of Ethereum and newer assets remains lukewarm in comparison. As market dynamics continue to evolve, staying updated on trends and flows in the cryptocurrency ETF space will be essential for investors seeking opportunities for growth in an increasingly complex financial environment.